Green Dot 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Green Dot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

2012

Table of contents

-

Page 1

2012 ANNUAL REPORT -

Page 2

-

Page 3

2012 ANNUAL REPORT -

Page 4

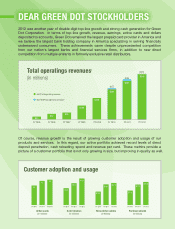

... Green Dot Corporation. In terms of top-line growth, revenue, earnings, active cards and dollars deposited to accounts, Green Dot remained the largest prepaid card provider in America and we believe the largest bank holding company in America specializing in serving financially underserved consumers... -

Page 5

..., but are not limited to, the factors discussed in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available on Green Dot's investor relations website at ir.greendot.com and on the SEC website at www.sec.gov . All information provided in this letter speaks only as of the... -

Page 6

-

Page 7

...business day of the registrant's most recently completed second fiscal quarter, was approximately $694.7 million (based on the closing sale price of the registrant's common stock on that date as reported on the New York Stock Exchange). There were 31,801,422 shares of Class A common stock, par value... -

Page 8

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 9

GREEN DOT CORPORATION TABLE OF CONTENTS Page PART I. Business ...Risk Factors ...Unresolved Staff Comments ...Properties ...Legal Proceedings ...Mine Safety Disclosures ...PART II. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...... -

Page 10

...reason. In this report, unless otherwise specified or the context otherwise requires, "Green Dot," "we," "us," and "our" refer to Green Dot Corporation and its consolidated subsidiaries, the term "GPR cards" refers to general purpose reloadable prepaid debit cards, the term "prepaid cards" refers to... -

Page 11

... States and that our Green Dot Network is the leading reload network for prepaid cards in the United States. Other products and services include GoBank, an innovative checking account developed for distribution and use via mobile phones, which is expected to be available to U.S. consumers generally... -

Page 12

...these agreements, Green Dot designs and delivers the Walmart MoneyCard product and provides all ongoing program support, including network IT, regulatory and legal compliance, website functionality, customer service and loss management. Walmart displays and sells the cards and GE Capital Retail Bank... -

Page 13

... GE Capital Retail Bank's or our inability or unwillingness to agree to requested pricing changes. Network Acceptance Members. A large number of institutions accept funds through our reload network, using our MoneyPak product. We provide reload services to over 120 third-party prepaid card programs... -

Page 14

... MoneyPak number and add the funds to a GPR card or other account, such as participating billers or a PayPal account. Alternatively, at many retail locations, consumers can add funds directly to their Green Dot- branded and co-branded cards at the point of sale through an automated POS swipe reload... -

Page 15

...in the United States. All card activations, reloads, support and lost/stolen inquiries are handled online and through various toll-free numbers at these locations. We also operate our own call center at our headquarters for handling customer and corporate escalations. Customer service is provided in... -

Page 16

... card issuing banks. Western Union, MoneyGram, Blackhawk Network, Inc., and Incomm each have a national network of retail and/or agent locations. In addition, we compete for consumers and billers with financial institutions that provide their retail customers with billing, payment and funds transfer... -

Page 17

... to our products and services. We own several trademarks, including Green Dot, MoneyPak, GoBank, and the Green Dot logo. These assets are essential to our business. Through agreements with our network acceptance members, retail distributors and customers, we authorize and monitor the use of our... -

Page 18

...or our retail distributors. We are registered with FinCEN as a money services business. As a result of being so registered, we have established anti-money laundering compliance programs that include: (i) internal policies and controls; (ii) designation of a compliance officer; (iii) ongoing employee... -

Page 19

... new laws or regulations may be adopted, that adversely affect our ability to engage in our current or additional businesses. Even if our activities are permissible for a bank holding company, as discussed under "- Capital Adequacy" below, the Federal Reserve Board has the authority to order a bank... -

Page 20

...ability to pay dividends. Federal and state banking regulations applicable to bank holding companies and banks generally require that dividends be paid from earnings and, as described under "- Capital Adequacy" below, require minimum levels of capital, which limits the funds available for payment of... -

Page 21

...in activities that are currently contemplated by our business strategies. Issuing Banks. All of the GPR cards that we provide and the Walmart gift cards we service are issued by either a federally- or state-chartered bank. Thus, we are subject to the oversight of the regulators for, and certain laws... -

Page 22

... of the Visa and/or MasterCard payment networks. Visa and MasterCard set the standards with which we and the card issuing banks must comply. Employees As of December 31, 2012, we had 596 employees, including 431 in general and administrative, 67 in sales and marketing, and 98 in research and product... -

Page 23

...in limited circumstances, such as our material breach or insolvency or, in the case of Walmart, our failure to meet agreed-upon service levels, certain changes in control of GE Capital Retail Bank or us, GE Capital Retail Bank's or our inability or unwillingness to agree to requested pricing changes... -

Page 24

... and new market entrants are bringing to market products and services that are, or that may be perceived to be, substantially similar to or better than ours. For example, Walmart began selling an American Express-branded checking account alternative product at its store locations in October 2012... -

Page 25

... prepaid card program managers, such as American Express Company, First Data Corporation, NetSpend Holdings, Inc., AccountNow, Inc., PreCash Inc. and other traditional banks, such as J.P. Morgan Chase & Co., that have recently entered the prepaid card market; reload network providers, such as Visa... -

Page 26

... to us, which could reduce the use and acceptance of our cards and other products and services, cause retail distributors or network acceptance members to cease doing business with us or lead to greater regulation that would increase our compliance costs. Fraudulent activity could also result in the... -

Page 27

... network participants, banks that issue our cards and regulators, and could materially and adversely affect our business, operating results and financial condition. Changes in rules or standards set by the payment networks, such as Visa and MasterCard, or changes in debit network fees or products... -

Page 28

... new terms that are less favorable to us. All of our cards under the Walmart MoneyCard program are issued by GE Capital Retail Bank, formerly GE Money Bank. Our relationship with GE Capital Retail Bank will be for the foreseeable future, a critical component of our ability to conduct our business... -

Page 29

... revenues. We, the banks that issue our cards and our retail distributors, network acceptance members and third-party processors receive, transmit and store confidential customer and other information in connection with the sale and use of our prepaid financial services. Our encryption software and... -

Page 30

... account balances in the year ended December 31, 2012, as compared to approximately 92% in the year ended December 31, 2011. Maintenance fee assessment overdrafts occur as a result of our charging a cardholder, pursuant to the card's terms and conditions, the monthly maintenance fee at a time... -

Page 31

... of management time and focus from operation of our then-existing business to acquisition integration challenges; coordination of product, sales, marketing and program, and systems management functions; transition of the acquired company's users and customers onto our systems; retention of employees... -

Page 32

... sell our products and services to consumers at their store locations. Our retail distributors collect funds from the consumers who purchase our products and services and then must remit these funds directly to accounts established for the benefit of these consumers at the banks that issue our cards... -

Page 33

...existing products and services and offer new products and services, is dependent on our information technology systems. If we are unable to manage the technology associated with our business effectively, we could experience increased costs, reductions in system availability and losses of our network... -

Page 34

... for external purposes in accordance with U.S. generally accepted accounting principles, or GAAP. If we are unable to maintain adequate internal control over financial reporting, we might be unable to report our financial information on a timely basis and might suffer adverse regulatory consequences... -

Page 35

• • • changes in accounting standards, policies, guidelines, interpretations or principles; general economic conditions; and sales of shares of our Class A common stock by us or our stockholders. In the past, many companies that have experienced volatility in the market price of their stock ... -

Page 36

... our stock price to decline. ITEM 1B. Unresolved Staff Comments Not applicable ITEM 2. Properties In December 2011, we entered into a ten-year office lease which became our new corporate headquarters, consisting of 140,000 square feet of office space in Pasadena, California. The initial term of the... -

Page 37

...'s risk-based and leverage capital requirements, as well as other federal laws applicable to banks and bank holding companies, could limit our ability to pay dividends. We expect to retain future earnings, if any, to fund the development and future growth of our business. Any future determination to... -

Page 38

... 118 Q2 50 $ 135 110 2012 Q3 28 $ 142 117 Q4 28 144 124 ITEM 6. Selected Financial Data The following tables present selected historical financial data for our business. You should read this information together with Item 7. Management's Discussion and Analysis of Financial Condition and Results of... -

Page 39

... Data: Operating revenues: Card revenues and other fees Cash transfer revenues Interchange revenues Stock-based retailer incentive compensation (2) Total operating revenues Operating expenses: Sales and marketing expenses Compensation and benefits expenses(3) Processing expenses Other general... -

Page 40

... our card issuing program with Synovus Bank to our subsidiary bank. Our retail distributors' remittance of these funds takes an average of two business days. Settlement assets represent the amounts due from our retail distributors for customer funds collected at the point of sale that have... -

Page 41

... services company providing simple, low-cost and convenient money management solutions to a broad base of U.S. consumers. We believe that we are the leading provider of general purpose reloadable, or GPR, prepaid debit cards in the United States and that our Green Dot Network is a leading reload... -

Page 42

... terms and conditions in our cardholder agreements. We charge new card fees when a consumer purchases a GPR or gift card in a retail store. Other revenues consist primarily of fees associated with optional products or services, which we generally offer to consumers during the card activation process... -

Page 43

... termination of our prepaid card program agreement with Walmart and GE Capital Retail Bank, formerly GE Money Bank. We recognize each month the fair value of the 36,810 shares issued to Walmart for which our right to repurchase has lapsed using the then-current fair market value of our Class... -

Page 44

... of the services purchased by the cardholders, and other factors. For all of our significant revenue-generating arrangements, including GPR and gift cards, we recognize revenues on a gross basis. Generally, customers have limited rights to a refund of the new card fee or a cash transfer fee. We have... -

Page 45

... the cardholder account is closed, depending on the card issuing bank. We generally recover overdrawn account balances from those GPR cardholders that perform a reload transaction. In addition, we recover some purchase transaction overdrafts through enforcement of payment network rules, which allow... -

Page 46

... transactions than the rest of our active card base. Additionally, we began offering our Walmart MoneyCard customers access to surcharge-free transactions via the nationwide MoneyPass ATM network in late June 2012, which also contributed to the decrease in ATM fee revenues. In addition, we believe... -

Page 47

... receive their tax refunds via direct deposit on our cards. Stock-based Retailer Incentive Compensation - Our right to repurchase lapsed as to 441,720 shares issued to Walmart during the year ended December 31, 2012. We recognized the fair value of the shares using the then-current fair market value... -

Page 48

... corporate office space located in Pasadena, California, which became our new headquarters facility in September 2012. We took control of the office space in January 2012 to construct tenant improvements, and accordingly, recorded rent expense thereafter. The increase in professional services fees... -

Page 49

... entering into our amended prepaid card agreement with Walmart and GE Capital Retail Bank in May 2010. Operating Expenses The following table presents a breakdown of our operating expenses among sales and marketing, compensation and benefits, processing, and other general and administrative expenses... -

Page 50

... the number of active cards in our portfolio and 55% in gross dollar volume and a $7.7 million increase in ATM processing fees as the volume of ATM transactions increased during the year ended December 31, 2011. Processing expenses were partially offset by volume incentives from the payment networks... -

Page 51

...Requirements for Bank Holding Companies As of December 31, 2012 and December 31, 2011, we were categorized as well capitalized under the regulatory framework. There were no conditions or events since December 31, 2012 which management believes would have changed our category as well capitalized. Our... -

Page 52

...its capital, leverage and other financial commitments at levels we have agreed to with our regulators. For example, in November 2012, we contributed approximately $26 million to our subsidiary bank in connection with the transition of our card issuing program with Synovus Bank to Green Dot Bank. 42 -

Page 53

...no material changes in our contractual obligations disclosed in Management's Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2012. Payments Due by Period Total Long-term debt obligations Capital lease... -

Page 54

... Item 1. Business, we became a bank holding company in December 2011. This section presents information required by the SEC's Industry Guide 3, "Statistical Disclosure by Bank Holding Companies." The tables in this section include Green Dot Bank information only. All average balance data related to... -

Page 55

... 31, 2012. There was no allowance as of December 31, 2011 as all loans were recorded at fair value as of the purchase date of Green Dot Bank on December 8, 2011. The increase in the allowance for loan loss balance during the year was due to seasoning of our loan portfolio and subsequent changes in... -

Page 56

...Loan Portfolio Concentrations Green Dot Bank, our subsidiary bank, operates at a single office in Provo, Utah located in the Utah County area. As of December 31, 2012, approximately 92.5% of our borrowers resided in the state of Utah and approximately 39.4% in the city of Provo. Consequently, we are... -

Page 57

... table shows Green Dot Bank's average deposits and the annualized average rate paid on those deposits for the year ended December 31, 2012 and from December 8, 2011 through December 31, 2011: Average Balance (In thousands) December 31, 2012 Interest-bearing deposit accounts Negotiable order of... -

Page 58

... institutions that hold our cash and cash equivalents, restricted cash, available-for-sale investment securities, settlement assets due from our retail distributors that collect funds and fees from our customers, and amounts due from our issuing banks for fees collected on our behalf. We manage the... -

Page 59

... Statements and Supplementary Data Index to Consolidated Financial Statements Page Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements... -

Page 60

... opinion, Green Dot Corporation maintained, in all material respects, effective internal control over financial reporting as of December 31, 2012, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the... -

Page 61

... 31, 2012, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Green Dot Corporation's internal control over financial reporting as of December 31, 2012, based... -

Page 62

GREEN DOT CORPORATION CONSOLIDATED BALANCE SHEETS December 31, 2012 Assets Current assets: Unrestricted cash and cash equivalents Federal funds sold Investment securities available-for-sale, at fair value Settlement assets Accounts receivable, net Prepaid expenses and other assets Income tax ... -

Page 63

GREEN DOT CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31, 2012 Operating revenues: Card revenues and other fees Cash transfer revenues Interchange revenues Stock-based retailer incentive compensation Total operating revenues Operating expenses: Sales and marketing expenses ... -

Page 64

GREEN DOT CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year Ended December 31, 2012 2011 2010 Net income Other comprehensive income (loss) Unrealized holding gains (losses) arising during period, net of reclassification adjustments for amounts included in net income Comprehensive ... -

Page 65

GREEN DOT CORPORATION CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY Convertible Preferred Stock Shares (In thousands) 24,942 - - - (24,942 7 - - 7 7 $ 7 31,798 31 - 1,495 1 1,495) - - 4,197 $ - 141 - 412 $ 7 30,162 $ 30 5,280 5 - - - (1) - - 4 7 15,296 15 (22,155) (22 9,524 ... -

Page 66

... receivable, net Prepaid expenses and other assets Deferred expenses Accounts payable and other accrued liabilities Amounts due issuing bank for overdrawn accounts Deferred revenue Income tax receivable Net cash provided by operating activities Investing activities Purchases of available-for-sale... -

Page 67

... consumers to use cash to reload our prepaid debit cards or to transfer cash to any of our Green Dot Network acceptance members, including competing prepaid card programs and other online accounts. We market our products and services to banked, underbanked and unbanked consumers in the United States... -

Page 68

... our card issuing program with Synovus Bank to our subsidiary bank. Our retail distributors' remittance of these funds takes an average of two business days. Settlement assets represent the amounts due from our retail distributors for customer funds collected at the point of sale that have... -

Page 69

... a retail location, we make the funds immediately available once the consumer goes online or calls a toll-free number to activate the new card or add funds from a cash transfer product. Since our retail distributors do not remit funds to our card issuing banks, on average, for two business days, we... -

Page 70

..., furniture and office equipment Computer software purchased Capitalized internal-use software Tenant improvements N/A 30 years 3-4 years 3 years 2 years Shorter of the useful life or the lease term We capitalize certain internal and external costs incurred to develop internal-use software during... -

Page 71

...-party card issuing banks fund overdrawn cardholder account balances on our behalf. Amounts funded are due from us to the card issuing banks based on terms specified in the agreements with the card issuing banks. Generally, we expect to settle these obligations within twelve months. Fair Value Under... -

Page 72

...to new card fees and monthly maintenance fees. We generate cash transfer revenues when consumers purchase our cash transfer products (reload services) in a retail store. We recognize these revenues when the cash transfer transactions are completed, generally within two business days from the time of... -

Page 73

... states related to purchases of materials since we do not charge sales tax to customers when new cards or cash transfer transactions are purchased. Employee Stock-Based Compensation We record employee stock-based compensation expense using the fair value method of accounting. For stock options... -

Page 74

... to comply with its applicable capital and leverage requirements, the Federal Reserve Board may limit our or Green Dot Bank's ability to pay dividends. In addition, as a bank holding company and a financial holding company, we are generally prohibited from engaging, directly or indirectly, in any... -

Page 75

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 2-Summary of Significant Accounting Policies (continued) In May 2011, the FASB issued ASU 2011-04, Fair Value Measurement: Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP ... -

Page 76

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 3 - Investment Securities (continued) As of December 31, 2012 and December 31, 2011, the gross unrealized losses and fair values of available-forsale investment securities that were in unrealized loss positions were ... -

Page 77

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 4-Accounts Receivable (continued) Activity in the reserve for uncollectible overdrawn accounts consisted of the following: Year Ended December 31, 2012 Balance, beginning of period Provision for uncollectible ... -

Page 78

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 5-Loans to Bank Customers (continued) The table below presents our primary credit quality indicators related to our loan portfolio: December 31, 2012 Non-Classified Real estate Commercial Installment Total loans $ $ ... -

Page 79

...maturity dates at a stated interest rate lower than the current market rate for new debt with similar risk: December 31, 2012 Unpaid Principal Balance Real estate Commercial Installment $ Carrying Value 96 136 173 (In thousands) 194 $ 280 403 Allowance for Loan Losses Activity in the allowance for... -

Page 80

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 6-Property and Equipment Property and equipment consisted of the following: December 31, 2012 (In thousands) Land Building Computer equipment, furniture, and office equipment Computer software purchased Capitalized ... -

Page 81

... or 2011. Note 8-Deposits In November 2012, we transitioned all outstanding customer deposits associated with our card issuing program with Synovus Bank to Green Dot Bank. These deposits are included as "GPR deposits" within non-interest bearing deposit accounts below. Deposits were categorized as... -

Page 82

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 9-Stockholders' Equity (continued) Voting Series A Preferred Stock is non-voting, subject to limited exceptions. Dividends Holders of shares of the Series A Preferred Stock are entitled to receive ratable dividends (... -

Page 83

..., which significantly increased the sales commission rates we pay to Walmart for our products sold in their stores. The new agreement commenced on May 1, 2010 with a five-year term. As an incentive to amend our prepaid card program agreement, we issued Walmart 2,208,552 shares of our Class A common... -

Page 84

... options to purchase 936,301 shares of Class B common stock with a weighted-average exercise price of $4.32 in order to sell the underlying shares of Class A common stock in the follow-on offering. We received aggregate proceeds of $4.0 million from these exercises. Registration Rights Agreement... -

Page 85

... granted: Year Ended December 31, 2012 Stock options granted Weighted-average exercise price Weighted-average grant-date fair value Restricted stock units granted Weighted-average grant-date fair value $ $ $ 2,247 19.35 8.92 613 14.14 $ $ $ 2011 (In thousands, except per share data) 889 38.70 18.62... -

Page 86

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 10-Employee Stock-Based Compensation (continued) We estimated the fair value of each stock option grant on the date of grant using the following weighted-average assumptions: Year Ended December 31, 2012 Risk-free ... -

Page 87

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 10-Employee Stock-Based Compensation (continued) Stock-Based Retailer Incentive Compensation As discussed in Note 9 - Stockholders' Equity, we issued Walmart 2,208,552 shares of our Class A common stock. We recognize... -

Page 88

...Net operating loss carryforwards Stock-based compensation Reserve for overdrawn accounts Accrued liabilities Purchase accounting adjustments Other Gross deferred tax assets Valuation allowance Total deferred tax assets, net of valuation allowance Deferred tax liabilities: Internal-use software costs... -

Page 89

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 11-Income Taxes (continued) The deferred tax assets and related valuation allowances recognized for the net operating loss and tax credit carryforwards were as follows: December 31, 2012 Deferred Tax Asset Net ... -

Page 90

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 12-Earnings per Common Share We calculate EPS using the two-class method. Refer to Note 2 - Summary of Significant Accounting Policies for a discussion of the calculation of EPS. The calculation of basic EPS and ... -

Page 91

... 22,267 25,867 11,568 26,566 183,787 (In thousands) We based the fair value of our fixed income securities held as of December 31, 2012 and 2011 on quoted prices in active markets for similar assets. We had no transfers between Level 1, Level 2 or Level 3 assets during the years ended December 31... -

Page 92

... customer deposits associated with our card issuing program with Synovus Bank to our subsidiary bank, our line of credit with Columbus Bank and Trust Company was terminated. Prior to the termination, we used the line of credit to fund timing differences between funds remitted by our retail... -

Page 93

... for 140,000 square feet of office space in Pasadena, California. This facility serves as our corporate headquarters. The initial term of the lease is ten years and is scheduled to expire on October 31, 2022. We are also bound to a property sub-lease agreement of approximately 5,000 square feet that... -

Page 94

...payments remaining on the date of termination. We have retained outside regulatory counsel to survey and monitor the laws of all 50 states to identify state laws or regulations that apply to prepaid debit cards and other stored value products. Many state laws do not specifically address stored value... -

Page 95

... no legal rights to the customer funds. Additionally, we have receivables due from GE Capital Retail Bank that are included in accounts receivable, net, on our consolidated balance sheets. The failure of this entity could result in significant business disruption, a potential material adverse affect... -

Page 96

...,701 (In thousands, except per share data) During the fourth quarter of 2012, we implemented new control procedures over the settlement of cardholder funds. As a result of these new controls, we identified an error relating to the calculation of overdrawn account balances that affects our financial... -

Page 97

... within our Consolidated Balance Sheet was as follows: As Reported Q3 2012 Accounts receivable, net Income tax receivable Amounts due to card issuing banks for overdrawn accounts Retained earnings Q2 2012 Accounts receivable, net Income tax receivable Amounts due to card issuing banks for overdrawn... -

Page 98

GREEN DOT CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 21- Selected Unaudited Quarterly Financial Information (continued) In each of the periods referenced above, the effect of the correction did not impact net cash provided by operating activities, net cash used in ... -

Page 99

...of this Annual Report on Form 10-K. Change in internal control over financial reporting - During the three months ended December 31, 2012, we implemented new control procedures over the settlement of cardholder funds in conjunction with the transition of our card issuing program with Synovus Bank to... -

Page 100

... by reference to our proxy statement for our 2013 Annual Meeting of Stockholders to be filed with the SEC within 120 days after the end of the year ended December 31, 2012. ITEM 14. Principal Accounting Fees and Services The information required by this Item is incorporated by reference to... -

Page 101

... sufficient to require submission of the schedule, or because the information required is included in the consolidated financial statements and notes thereto. 3. Exhibits: The following exhibits are filed as part of or furnished with this annual report on Form 10-K as applicable: The exhibit list in... -

Page 102

... registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Green Dot Corporation Date: March 1, 2013 By: Name: Title: /s/ Steven W. Streit Steven W. Streit Chairman, President, and Chief Executive Officer KNOW ALL PERSONS BY THESE PRESENTS that... -

Page 103

Date: March 1, 2013 By: Name: Title: By: Name: Title: By: Name: Title: /s/ Ross E. Kendell Ross E. Kendell Director /s/ Michael Moritz Michael Moritz Director /s/ William H. Ott, Jr. William H. Ott, Jr. Director Date: March 1, 2013 Date: March 1, 2013 93 -

Page 104

..., L.P. and GE Money Bank. First Amendment To Walmart MoneyCard Program Agreement dated as of January 12, 2012, by and among the Registrant, Walmart Stores Texas L.P., Wal-Mart Louisiana, LLC, Wal-Mart Stores Arkansas, LLC, Wal-Mart Stores East, L.P., Wal-Mart Stores, Inc., and GE Capital Retail Bank... -

Page 105

... by Reference Exhibit Number 10.9†Exhibit Title Card Program Services Agreement, dated as of October 27, 2006, by and between the Registrant and GE Money Bank, as amended. Agreement for Services, dated as of September 1, 2009, by and between the Registrant and Total System Services, Inc. Material... -

Page 106

... Keatley, Chief Financial Officer, pursuant to...Number Filed Herewith X 31.2 X 32.1 X 32.2 X 101.INS 101.SCH 101.CAL 101.DEF 101.LAB 101.PRE X X X X X X _____ * ** Indicates management contract or compensatory plan or arrangement. Pursuant to Rule 406T of Regulation S-T, the Interactive Data... -

Page 107

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 108

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 109

...from operations as we have historically calculated them. This charge results from the monthly lapsing of our right to repurchase a portion of the 2,208,552 shares we issued to our largest retail distributor, Walmart, in May 2010. By adding back this charge to our GAAP 2010 and future total operating... -

Page 110

..., CEO, Green Dot Bank John C. Ricci, General Counsel INVESTOR RELATIONS Chris Mammone (626) 765-2427 [email protected] INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Ernst & Young, LLP Los Angeles STOCK LISTING & SYMBOL New York Stock Exchange Symbol: GDOT ©2013 Green Dot Corporation. MoneyPak is...