Google 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

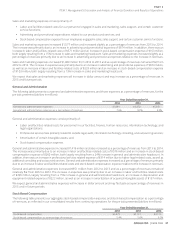

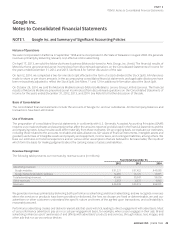

relationships and acquired patents and developed technology; and discount rates. Management

based upon assumptions believed to be reasonable, but which are inherently uncertain and unpredictable and, as a result, actual

Other estimates associated with the accounting for acquisitions may change as additional information becomes available regarding

the assets acquired and liabilities assumed, as more fully discussed in Note 5 of Notes to Consolidated Financial Statements

included in Item 8 of this Annual Report on Form 10-K.

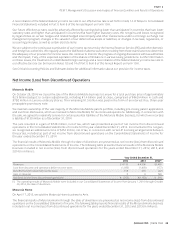

Goodwill

reporting unit level at least annually, or more frequently if events or changes in circumstances occur that would more likely than

not reduce the fair value of a reporting unit below its carrying value. Goodwill impairment tests require judgment, including the

Long-lived Assets

Long-lived assets, including property and equipment, long-term prepayments, and intangible assets, excluding goodwill, are reviewed

for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Measurement of an impairment loss would be based on the excess of the carrying amount of the asset group over its fair value.

Impairment of Marketable and Non-Marketable Securities

We periodically review our marketable and non-marketable securities for impairment. If we conclude that any of these investments

are impaired, we determine whether such impairment is other-than-temporary. Factors we consider to make such determination

include the duration and severity of the impairment, the reason for the decline in value and the potential recovery period and

our intent to sell. For marketable debt securities, we also consider whether (1) it is more likely than not that we will be required

to sell the security before recovery of its amortized cost basis, and (2) the amortized cost basis cannot be recovered as a result

of credit losses. If any impairment is considered other-than-temporary, we will write down the asset to its fair value and record

the corresponding charge as interest and other income, net.

ITEM7A. Quantitative and Qualitative Disclosures About

MarketRisk

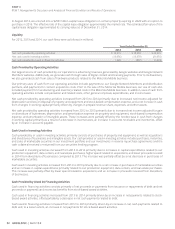

Foreign Currency Exchange Risk

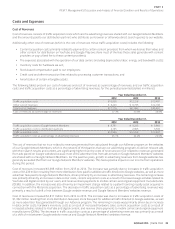

We transact business globally in multiple currencies. Our international revenues, as well as costs and expenses denominated

strengthening of the U.S. dollar relative to the foreign currency.

are the British pound, Euro, and Japanese Yen.

We use foreign exchange option contracts to protect our forecasted U.S. dollar-equivalent earnings from adverse changes in

foreign currency exchange rates. These hedging contracts reduce, but do not entirely eliminate the impact of adverse currency

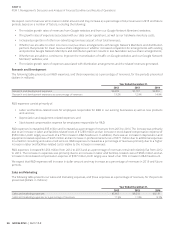

The fair value of

the option contract is separated into its intrinsic and time values. Changes in the time value are recorded in interest and other

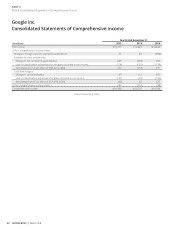

income, net. Changes in the intrinsic value are recorded as a component of accumulated other comprehensive income (AOCI)

35GOOGLE INC.