Freeport-McMoRan 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

underpinned by limited new supply, the depletion of currently producing

mines, the important role of copper in the development of emerging

economies’ infrastructure and the fundamental requirements in the

world’s developed economies. We are in a strong position as one of

the world’s largest copper producers to benet from the very favorable

fundamentals of the copper marketplace.

We generated strong nancial results in 2009, which enabled us to

strengthen our nancial position and enhance our liquidity. We repaid

$1 billion in debt during the year, reducing our $17.6 billion of debt at

our 2007 acquisition of Phelps Dodge by a cumulative $11 billion.

As we progress, we are preparing for eventual improvement in

conditions in the world’s developed economies, which will be highly

favorable to the demand for our products. We have an attractive

portfolio of potential investment opportunities within our existing asset

base and are prepared to move forward as market conditions warrant.

With current copper prices above $3 per pound, gold prices above

$1,000 per ounce and molybdenum prices over $15 per pound, we

would generate signicant cash ows. We will continue to invest in

attractive growth projects and maintain our strong balance sheet.

Our environmental management and community development

programs are important to our success. We will continue to invest

in the communities where we operate and aggressively manage to

mitigate the environmental impacts of our operations.

The safety of our workforce is our highest priority. Our programs

are designed to achieve a safe environment for all our workers. Our

comprehensive Working Toward Sustainable Development report,

During 2009, copper was

one of the best performing

metals, with its price rising

over 150 percent, as strong

demand from China and

limited supply offset weak

conditions in the developed

economies of the United

States, Europe and Japan.

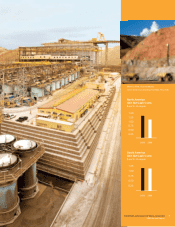

In 2009, we resumed construction activities

associated with the development of the

sulde ore deposit at El Abra (pictured

above) in Chile. This project will extend the

mine life by over 10 years.

4 FREEPORT-McMoRan COPPER & GOLD INC.

2009 Annual Report

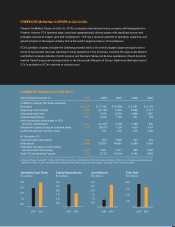

Total Debt

$ in billions

10

20

15

5

Year End

2009

2007+

+ At time of the Phelps Dodge

acquisition (March 2007)

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

LME Copper Price

$ per lb.

2.50

2.00

3.50

3.00

1.50

1.00

0.50

DEC

2009 FEB

2010

DEC

2008 APR

2009

Copper Price

SEP

2009

-- 2009 Average Price of Copper