Freeport-McMoRan 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report

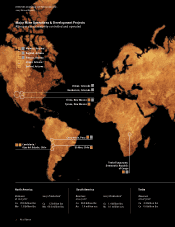

SOUTH AMERICA

OPERATIONS

FCX has four operating copper mines in

South America — Cerro Verde in Peru and

Candelaria, Ojos del Salado and El Abra

in Chile.

The company owns a 53.56 percent

interest in Cerro Verde, 80 percent of

the Candelaria and Ojos del Salado

mining complexes, and a 51 percent

interest in El Abra.

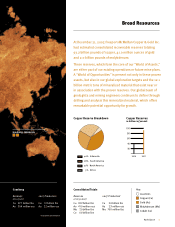

Consolidated pro forma copper sales

from these operations totaled 1.4 billion

pounds in 2007, and 1.1 billion pounds

in 2006 at average realized prices of

$3.25 per pound in 2007 and $3.03 per

pound in 2006. The increase in 2007

copper sales reflects higher production

from Cerro Verde resulting from the new

concentrator, which reached design

capacity in mid-2007.

DEVELOPMENT PROJECTS

In mid-2007, the recently expanded

mill at Cerro Verde reached design

capacity of 108,000 metric tons of ore

per day. This expansion enables Cerro

Verde to produce approximately 650

million pounds of copper and 8 million

pounds of molybdenum per year for

the next several years. Additionally,

as part of our initial step in reviewing

expansion opportunities associated with

existing ore bodies, we are pursuing an

incremental expansion at Cerro Verde.

At the end of 2006, a feasibility study

was completed to evaluate development

of a large sulfide mineral deposit

underlying the existing oxide ore pit

at El Abra. This project would extend

the mine life by over 10 years. Initial

production from the sulfide is expected

to begin in 2010, and is expected to

average approximately 325 million

pounds of copper per year beginning

in 2012. The existing facilities at El

Abra would be used in conjunction with

new facilities to process the additional

reserves, minimizing capital spending

requirements. FCX is currently working

with Chilean authorities on finalizing an

environmental impact study associated

with this project. The total capital

investment for the project is expected to

approximate $450 million.

EXPLORATION

Exploration in South America is ongoing

in and around Cerro Verde, Candelaria

and Ojos del Salado.

UNIT NET CASH COSTS

South American pro forma unit net cash

costs, including by-product credits

(primarily gold), averaged $1.02 per

pound for 2007, compared with $0.91 per

pound in 2006. Pro forma unit net cash

costs for our South American operations

were higher in 2007 than the previous

year, primarily reflecting higher costs at

El Abra because of lower copper sales.

In addition, higher pro forma unit net

cash costs reflect the impact of Cerro

Verde’s voluntary contribution programs,

including the liability associated with

local mining fund contributions. These

higher costs were partially offset by

lower overall costs at Cerro Verde

associated with significantly higher

production from the new concentrator.

Assuming an average copper price of

$3.00 per pound and achievement of

current 2008 sales projections, we

estimate that 2008 average unit net

cash costs for South American mines,

including gold and molybdenum

credits, would approximate $1.05 per

pound of copper.

See page 62 for a reconciliation of pro

forma South American unit net cash

costs per pound to production and

delivery costs applicable to pro forma

sales reported in FCX’s pro forma

consolidated financial results.

Expanding Horizons

FCX’s South American operations provide a significant portion of our copper

production and are positioned for significant growth through expansions

and optimization.

12

FREEPORT-McMoRan COPPER & GOLD INC.

Operational Overview