Freeport-McMoRan 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Operational Overview

NORTH AMERICA

OPERATIONS

Freeport-McMoRan Copper & Gold Inc.

(FCX), through its successful 2007

acquisition and integration of

Phelps Dodge, is a leader in North

American copper production and

is working to optimize and expand

production at its mines in the

southwestern United States (U.S.).

The company operates six copper

mines in two states — Morenci,

Bagdad, Sierrita and Safford in Arizona

and Chino and Tyrone in New Mexico.

All of these mines are wholly owned,

except for Morenci, in which FCX holds

an 85-percent joint venture interest.

Consolidated pro forma copper sales

from North American operations

totaled 1.3 billion pounds in 2007 and

2006 at average realized prices of

$3.12 per pound in 2007 and $2.26

per pound in 2006, which is net of a

$0.14 per pound impact on 2007 and

a $0.77 impact on 2006 for hedging

losses related to copper price protection

programs. Our North American mines

have long-lived reserves and substantial

additional development potential.

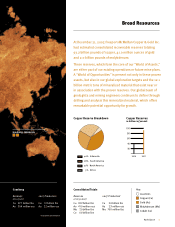

FCX is the world’s largest producer

of molybdenum through its wholly

owned Henderson molybdenum mine

in Colorado and as a by-product at the

Sierrita, Bagdad, Chino and Morenci

operations in the U.S. and at the Cerro

Verde mine in Peru. The Henderson

block-cave underground mining complex

produces high-purity, chemical-grade

molybdenum concentrates, which are

further processed into value-added

molybdenum chemical products.

Consolidated pro forma molybdenum

sales from the Henderson and by-

product mines totaled 69 million pounds

in 2007 and 2006 at average realized

prices of $25.87 per pound in 2007 and

$21.87 in 2006.

DEVELOPMENT PROJECTS

The Safford mine in Arizona, where

production commenced in late 2007,

is the first new copper mine in North

America in decades. The Safford

operation will produce ore from two

open-pit mines and includes a solution

extraction/electrowinning (SX/EW)

facility. Ramp up to full production of

240 million pounds of copper per year

is expected in the first half of 2008. The

total capital investment for the Safford

project is approximately $675 million.

A concentrate-leach, direct electrowinning

facility at the Morenci mine in Arizona

was commissioned in 2007. The project

uses the company’s proprietary medium-

temperature, pressure-leaching and

direct electrowinning technology, which

will enhance cost savings by processing

concentrate on-site instead of shipping

the product to smelters for treatment.

This project also included the restart

of a mill. Mill throughput adds 115

million pounds of copper per year and is

operating near capacity of 49,000 metric

tons per day. The capital investment

for these projects at Morenci was

approximately $250 million.

We are pursuing a project to restart the

Climax molybdenum mine near Leadville,

Positioned for Success

FCX is the world’s largest producer of

molybdenum through its wholly owned

Henderson molybdenum mine in Colorado

and as a by-product at several operations

in the U.S. and Cerro Verde in Peru.

Photo: Henderson molybdenum mine in Colorado

A series of incremental expansion projects at various sites in North America will

add to an expanding copper production profile. Our standing as the world’s largest

producer of molybdenum will grow stronger as we proceed with the restart of the

Climax mine in Colorado.