Freeport-McMoRan 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report

10

FREEPORT-McMoRan COPPER & GOLD INC.

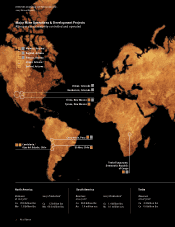

Operational Overview

Colorado. Climax is believed to be the

world’s largest, highest-grade and

lowest-cost undeveloped molybdenum

ore body in the world. The initial project

involves the restart of open-pit mining

and the construction of new milling

facilities. Annual production is expected

to approximate 30 million pounds of

molybdenum beginning in 2010 at

estimated cash costs approximating

$3.50 per pound. The project is

designed to enable the consideration

of further large-scale expansion of the

Climax mine. The capital investment

for the initial project is expected to

approximate $500 million.

We have also announced the restart

of copper mining operations at our

Miami mine in Arizona. We expect full

rates of production of approximately 100

million pounds of copper per year by

2010. The estimated capital investment

to restart the Miami copper mine is

approximately $100 million, primarily

for mining equipment.

In addition to the projects currently

under way, we are continuing to review

expansion opportunities associated with

existing ore bodies. As an initial step, we

are pursuing incremental expansions at

the Morenci, Sierrita and Bagdad mines in

Arizona. The estimated capital investment

for these projects is approximately $370

million. Detailed engineering for these

projects is under way.

EXPLORATION

Our exploration efforts in North America

include drilling of the Lone Star deposit

located approximately four miles from

the ore body within the Safford district,

as well as targets in the Morenci

and Bagdad districts, and near the

Henderson molybdenum ore body.

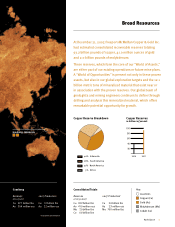

LEADING THROUGH TECHNOLOGY

FCX produces copper cathode at

leaching and SX/EW operations at

Morenci, Bagdad, Sierrita, Tyrone,

Chino and Safford. We are the world’s

leading producer of copper using

the SX/EW process, which is a cost-

effective method for extracting copper

from certain types of ore, and a major

factor in our continuing efforts to

maintain internationally competitive

costs. FCX is committed to

continuous improvement through

operational excellence and innovation.

Leading scientists and experts at our

Process Technology Center in Arizona

are at work developing cost-effective,

environmentally sound and less energy

intensive process improvements.

UNIT NET CASH COSTS

North American pro forma unit net cash

costs, including molybdenum credits,

averaged $0.86 per pound for 2007,

compared with $0.61 per pound in 2006.

Pro forma unit net cash costs at our

North American operations were higher

in 2007 than the previous year because

of higher labor, maintenance, operating

supplies and energy costs and also

reflect higher costs associated with the

ramp up of the Morenci mill operations.

These higher costs were partly offset by

favorable by-product credits as a result

of higher molybdenum prices.

Assuming an average copper price

of $3.00 per pound and an average

molybdenum price of $30 per pound

for 2008 and achievement of current

2008 sales estimates, we estimate that

the 2008 average unit net cash costs

for North American mines, including

molybdenum credits, would approximate

$1.00 per pound of copper.

Henderson’s pro forma unit net cash

costs averaged $4.32 per pound for

2007, compared with $3.71 per pound

in 2006. Henderson’s higher unit net

cash costs per pound of molybdenum

were primarily associated with higher

input costs, including labor, supplies

and service costs, and higher taxes.

These higher costs were partly offset by

lower energy costs resulting from energy

credits received in 2007.

Assuming an average price of $30

per pound of molybdenum for 2008

and achievement of current 2008

sales estimates, we estimate that the

2008 average unit net cash costs for

Henderson would approximate $4.50 per

pound of molybdenum.

See pages 59 through 61 for a

reconciliation of pro forma North

American and Henderson unit net

cash costs per pound to production

and delivery costs applicable to pro

forma sales reported in FCX’s pro forma

consolidated financial results.

Concentrate leach technology at

Morenci is among the numerous

projects commissioned in 2007

to optimize production and enhance

cost savings.