First Data 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

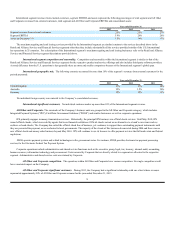

provide POS devices and other equipment necessary to capture merchant transactions. A majority of these services are offered to the merchants through

contractual alliance arrangements primarily with financial institutions, relationships with independent sales organizations and other referral/sales partners.

The segment’s processing services include authorization, transaction capture, settlement, chargeback handling, and internet-based transaction processing. The

vast majority of these services pertain to transactions in which consumer payments to merchants are made through a card association (such as VISA or

MasterCard), a debit network, or another payment network (such as Discover).

Revenues are generated from, among other things:

· discount fees charged to a merchant, net of credit card interchange and assessment fees charged by the bankcard associations or payment

networks (VISA, MasterCard or Discover). The discount fee is typically either a percentage of the credit card transaction or the interchange fee

plus a fixed dollar amount;

· processing fees charged to unconsolidated alliances discussed below;

· processing fees charged to merchant acquirers who have outsourced their transaction processing to the Company;

· selling and leasing POS devices; and

· debit network fees.

Most of this segment’s revenue is derived from regional and local merchants. The items listed above are included in the Company’s consolidated

revenues and, for equity earnings from unconsolidated alliances, the “Equity earnings in affiliates” line item in the Consolidated Statements of Operations.

The Retail and Alliance Services segment revenue and EBITDA are presented using proportionate consolidation, accordingly, segment revenue also includes

the alliance partner’s share of processing fees charged to consolidated alliances. In addition, segment revenue excludes debit network fees and other

reimbursable items.

Retail and Alliance Services provides merchant acquiring and processing services, prepaid services and check verification, guarantee and settlement

services to merchants operating in approximately 3.9 million merchant locations across the U.S. and acquired $1.7 trillion of payment transaction dollar

volume on behalf of U.S. merchants in 2013. Retail and Alliance Services provides full service merchant processing primarily on VISA and MasterCard

transactions and PIN-debit at the point of sale.

Retail and Alliance Services approaches the market through diversified sales channels including equity alliances, revenue sharing alliances and referral

arrangements with more than 400 financial institution partners, more than 1,500 non-bank referral partners, and approximately 600 independent sales

organization partners, as of December 31, 2013. Growth in the Retail and Alliance Services business is derived from entering into new merchant relationships,

new and enhanced product and service offerings, cross selling products and services into existing relationships, the shift of consumer spending to increased

usage of electronic forms of payment and the strength of FDC’s alliances and relationships with banks and other entities. The Company’s alliance structures

take on different forms, including consolidated subsidiaries, equity method investments and revenue sharing arrangements. Under the alliance and referral

programs, the alliance/referral partners typically act as a merchant referral source. The Company benefits by providing processing services for the

alliance/referral partners and their merchant customers. Both the Company and the alliance may provide management, sales, marketing, and other

administrative services. The alliance strategy could be affected by consolidation among financial institutions.

The Company’s strategy with banks, independent sales organizations and referral/sales partners provides the Company with broad geographic

coverage, regionally and nationally, as well as a presence in various industries. The alliance/referral partner structure allows the Company to be the processor

for multiple financial institutions, any one of which may be selected by the merchant as their bank partner. Additionally, bank partners provide brand loyalty

and a distribution channel through their branch networks which increases merchant retention.

There are a number of different entities involved in a merchant transaction including the cardholder, card issuer, card association, merchant, merchant

acquirer, electronic processor for credit and signature debit transactions, and debit network for personal identification number (“PIN”) debit transactions. The

card issuer is the financial institution that issues credit or debit cards, authorizes transactions after determining whether the cardholder has sufficient available

credit or funds for the transaction, and provides funds for the transaction. Some of these functions may be performed by an electronic processor (such as the

Company’s Financial Services business) on behalf of the issuer. The card associations, VISA or MasterCard, a debit network (such as STAR Network) or

another payment network (such as Discover) route transactions between the Company and the card issuer. The merchant is a business from which a product

or service is purchased by a cardholder. The acquirer (such as the Company or one of its alliances) contracts with merchants to facilitate their acceptance of

cards. A merchant acquirer may do its own processing or, more commonly,

3