Fifth Third Bank 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIFTH THIRD BANCORP4

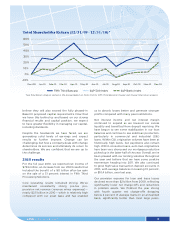

The

improvement in credit trends resulted in

reductions of our loan loss reserves by $745

million during the year; however, these reserves

are still among the strongest coverage levels in the

industry, at 3.88 percent of loans and 179 percent of

nonperforming loans.

Noninterest income benefited from solid mortgage

banking revenue of $647 million in 2010, an increase

of 17 percent over 2009. Our investment advisory

revenue increased 11 percent over the prior year

and deposit fees declined only 9 percent despite

the impact of the overdraft regulation.

Our capital position remains robust. Our Tier 1

capital ratio was 13.9 percent at year-end compared

with 13.3 percent at the end of 2009. Our tangible

common equity (TCE) ratio including unrealized

gains on securities, which increased to 7.3 percent,

continues to compare favorably with our peers and

is even more favorable when viewed in light of our

capital raise at the beginning of 2011. Given our

capital position and our strong reserve position,

Fifth Third has one of the strongest balance sheets

among commercial banks.

Strategic initiatives and

Lines of Business

Fifth Third has a simple overall value proposition

– we have the resources and technology to oer

products competitive with the largest banks in the

country for traditional banking business, but our

customer service rivals that of most community

banks. By focusing on this “sweet spot,” we

believe we are able to drive dierentiation to our

customers and value creation for our shareholders.

Our strategic plan is designed to further improve

that position through a variety of initiatives that

have the ultimate goal of developing deeper

customer relationships and growing our customer

base through the strength of the Fifth Third brand.

Our Commercial Banking line of business is

focused on maintaining a close relationship with

our customers, developing new value-added

products based on customer needs, and continuing

to enhance sales processes. We strive to develop

innovative solutions for our customers, such as

our Remote Currency Manager product, which

has enhanced our suite of treasury management

product oerings. We’ve also hired exceptional

talent across our footprint, and we expect this to

contribute to our revenue growth going forward.

Recently, we’ve begun to see some positive

signs within C&I lending, particularly within the

manufacturing and health care industries, and

we have seen significant growth in core deposits,

posting a 32 percent increase over last year.

Our Branch Banking line of business has continued

to post strong results. We have been successful

in introducing new product bundles in the last

few years, such as our Secure Checking Package

that combines identity theft protection with a

traditional

checking account. Our Relationship

Savings product

has attracted over $9 billion in

balances since inception and has more than tripled

in balances this year alone. We were one of the first

of our peers to eliminate free checking products,

and we continue to focus on providing value-added

products to our customers. Customer service

remains a top priority and during 2010 we expanded

our traditional branch hours on weeknights and

weekends at many locations in order to be even

more accessible to our customers. Additionally, we

have hired over 100 small business banking ocers

focused on customers in the $1 million to $3 million

revenue range, as we see additional opportunities

in this underpenetrated market space and are

committed to fostering economic growth through

investing in this area.

Our Consumer Lending line of business had another

outstanding year. Our mortgage originations

exceeded $18 billion and we generated over $600

million of mortgage banking revenue. Our recent J.D.

Power Mortgage Origination Customer Satisfaction

scores improved significantly compared with

2009 results. Our J.D. Power Mortgage Servicer

Satisfaction score increased – ranking Fifth Third in

the top five - while the industry average declined

compared with 2009. Our auto lending operations

continued to perform well as we maintained

strong credit quality and pricing discipline, while

generating more than $5 billion in originations.

We remain committed to oering responsible

credit solutions to our customers and helping them

through our mortgage modification programs,

while also keeping long-term value creation for

shareholders a priority.

Our Investment Advisors business benefited

from the overall lift in the equity and bond