Fifth Third Bank 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Charting the Course

with Confidence

2010 ANNUAL REPORT

Table of contents

-

Page 1

Charting the Course with Conï¬dence 2010 ANNUAL REPORT -

Page 2

... grocery stores and 2,445 ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Pennsylvania, Missouri, Georgia and North Carolina. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending and Investment Advisors. Fifth Third... -

Page 3

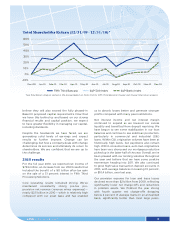

...million in net income for the full year. Our return on assets was 0.7 percent in 2010 and 1.2 percent in the most recent quarter, which demonstrates our progress to normalized levels. In February 2011, we fully repaid the U.S. Department of Treasury's $3.4 billion investment in preferred stock under... -

Page 4

... effect in the middle of the year and prohibits banks from processing electronic withdrawal transactions and charging overdraft fees in accounts that lack sufficient funds, unless the customer has "opted-in" to the program. Many of our customers have opted-in, and therefore 2 FIFTH THIRD BANCORP -

Page 5

... into 2011. We also continued to grow high-value transaction deposit accounts in 2010, with average balances increasing 19 percent, or $10.4 billion, over last year. Our provision expense for loan and lease losses declined more than $2 billion from 2009, reï¬,ecting signiï¬cantly lower net charge... -

Page 6

... the Fifth Third brand. Our Commercial Banking line of business is focused on maintaining a close relationship with our customers, developing new value-added products based on customer needs, and continuing to enhance sales processes. We strive to develop innovative solutions for our customers, such... -

Page 7

... our sales force, investment advisory revenue increased more than $30 million compared with 2009. Additionally, assets under care were up 46 percent on a year-over-year basis, reï¬,ecting inï¬,ows from new business won in 2010. In terms of year-overyear revenue growth, Fifth Third's retail brokerage... -

Page 8

... our employees in a challenging operating environment. We have maintained the advantages of our strong sales culture while signiï¬cantly increasing our focus on customer satisfaction and employee engagement. Kevin T. Kabat President and Chief Executive Officer February 2011 6 FIFTH THIRD BANCORP -

Page 9

...of the FDIC from 1981 to 1985. The addition of a non-executive chairman to the board of directors improves our already strong corporate governance practices and provides support to the executive leadership team. For more on Fifth Third's corporate governance, visit www.53.com. 2010 ANNUAL REPORT 7 -

Page 10

... Rewards and Secure checking, drove growth in fee income from value-added services that are bundled with deposit accounts. Balances of the Relationship Savings product, which doubles a customer's interest rate when accompanied by an active checking account, more than tripled over the year. Customer... -

Page 11

... terms. Business Description Consumer Lending provides loan solutions to customers across and beyond Fifth Third's footprint. Our loan products include mortgages and home equity loans and lines. Consumer Lending also partners with a network of auto dealers that originate loans on the Bank's behalf... -

Page 12

.... Strategy Our Commercial line of business delivers innovative and client-speciï¬c solutions that leverage Fifth Third's expertise in treasury management, capital markets and international products and services. Our sales process drives the delivery of ï¬nancial solutions through a relationship... -

Page 13

... Third Private Bank, Fifth Third Securities, Fifth Third Asset Management, Fifth Third Institutional Services and Fifth Third Insurance. We have more than 100 years of experience helping our individual, business and institutional clients build and manage their wealth. Strategy Investment Advisors... -

Page 14

... Cincinnati Public Schools; Gail Williams, community relations manager for Fifth Third Bank; Bob Sullivan, former president and CEO of Fifth Third Bank (Greater Cincinnati); Jim King, vice president of high school curriculums, The Lampo Group; and Kevin Boyce, former Ohio State Treasurer. Community... -

Page 15

... Se elected Financial Data D Ov verview Non-GAAP Financ cial Measures Cr ritical Accounting g Policies Ri isk Factors Statements of Incom me Analysis Bu usiness Segment Review R Fo ourth Quarter Rev view Ba alance Sheet Analy ysis Ri isk Management Off-Balance Sheet Arrangements A ontractual... -

Page 16

...Industrial CARD: Card Accountability, Responsibility and Disclosure CDC: Fifth Third Community Development Corporation CPP: Capital Purchase Program DCF: Discounted Cash Flow DIF: Deposit Insurance Fund EESA: Emergency Economic Stabilization Act of 2008 ERISA: Employee Retirement Income Security Act... -

Page 17

... of this filing. Reference to the Bancorp incorporates the parent holding company and all consolidated subsidiaries. TABLE 1: SELECTED FINANCIAL DATA For the years ended December 31 ($ in millions, except per share data) 2010 2009 2008 2007 2006 Income Statement Data Net interest income (a) $3,622... -

Page 18

... OF OPERATIONS OVERVIEW Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. At December 31, 2010, the Bancorp had $111 billion in assets and operated 15 affiliates with 1,312 full-service Banking Centers including 103 Bank Mart® locations open seven... -

Page 19

..., Inc. Class B shares in 2009. Mortgage banking net revenue increased $94 million as a result of strong net servicing revenue and higher margins on sold loans, partially offset by a decline in mortgage originations. Card and processing revenue decreased 49% due to the Processing Business Sale in the... -

Page 20

..., leases and other assets, including other real estate owned (excluding nonaccrual loans held for sale) decreased to 2.79% at December 31, 2010, from 4.22% at December 31, 2009. Refer to the Credit Risk Management section in MD&A for more information on credit quality. The Bancorp took a number of... -

Page 21

... income, before tax Tangible assets, excluding unrealized gains / losses (3) Total Bancorp shareholders' equity (U.S. GAAP) Goodwill and certain other intangibles Unrealized gains Qualifying trust preferred securities Other Tier I capital Less: Preferred stock Qualifying trust preferred securities... -

Page 22

..., commercial construction, and commercial leasing. The residential mortgage portfolio segment is also considered a class. Classes within the consumer segment include home equity, automobile, credit card, and other consumer loans and leases. For an analysis of the Bancorp's ALLL by portfolio segment... -

Page 23

... Bancorp monitors risk and adjusts its valuation allowance as necessary to adequately reserve for impairment in the servicing portfolio. For purposes of measuring impairment, the mortgage servicing rights are stratified into classes based on the financial asset type and interest rates. Fees received... -

Page 24

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 31, 2010, the Bancorp measured fair value using a discount rate based on the assumed holding period. Residential mortgage loans held for sale and held for investment For residential mortgage loans held for sale, ... -

Page 25

... of Fifth Third's residential mortgage and commercial real estate loan portfolios are comprised of borrowers in Michigan, Northern Ohio and Florida, which markets have been particularly adversely affected by job losses, declines in real estate value, declines in home sale volumes, and declines in... -

Page 26

...pace of consolidation among financial service providers. Fifth Third and/or the holders of its securities could be adversely affected by unfavorable ratings from rating agencies. Fifth Third's ability to access the capital markets is important to its overall funding profile. This access is affected... -

Page 27

...the fees it receives for originating mortgage loans and for servicing mortgage loans. When rates rise, the demand for mortgage loans tends to fall, reducing the revenue Fifth Third receives from loan originations. At the same time, revenue from MSRs can increase through increases in fair value. When... -

Page 28

... as lending practices, data security, corporate governance and acquisitions, and may damage Fifth Third's reputation. Negative public opinion has been observed in relation to banks participating in the U.S. Treasury's TARP program, in which Fifth Third was a participant. Additionally, actions taken... -

Page 29

... limit or impair Fifth Third's operations, restrict its growth and/or affect its dividend policy. Such actions and activities subject to prior approval include, but are not limited to, increasing dividends paid by Fifth Third or its subsidiary bank, purchasing or redeeming any shares of its stock... -

Page 30

...operate and how it plans capital and liquidity levels (including a phased-in elimination of Fifth Third's existing trust preferred securities as Tier 1 capital); • Subject Fifth Third to new and/or higher fees paid to various regulatory entities, including but not limited to deposit insurance fees... -

Page 31

... debt securities, loans and leases (including yield-related fees) and other interest-earning assets less the interest paid for core deposits (includes transaction deposits and other time deposits) and wholesale funding (includes certificates $100,000 and over, other deposits, federal funds purchased... -

Page 32

... on the Bancorp's interest rate risk management, including estimated earnings sensitivity to changes in market interest rates, see the Market Risk Management section of MD&A. . TABLE 5: CONSOLIDATED AVERAGE BALANCE SHEETS AND ANALYSIS OF NET INTEREST INCOME For the years ended December 31 2010 2009... -

Page 33

... the years ended December 31 2010 Compared to 2009 2009 Compared to 2008 ($ in millions) Volume Yield/Rate Total Volume Assets Increase (decrease) in interest income: Loans and leases: Commercial and industrial loans ($53) 129 76 ($45) Commercial mortgage (39) (30) (69) (17) Commercial construction... -

Page 34

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS TABLE 7: NONINTEREST INCOME For the years ended December 31 ($ in millions) Mortgage banking net revenue Service charges on deposits Corporate banking revenue Investment advisory revenue Card and processing ... -

Page 35

... related to market value declines. Net securities gains totaled $47 million in 2010 compared to $10 million of net securities losses during 2009. TABLE 9: COMPONENTS OF OTHER NONINTEREST INCOME For the years ended December 31 ($ in millions) 2010 2009 BOLI income (loss) 194 (2) Operating lease... -

Page 36

... NONINTEREST EXPENSE For the years ended December 31 ($ in millions) 2010 2009 2008 FDIC insurance and other taxes $242 269 73 Loan and lease 211 234 188 Losses and adjustments 187 110 95 Affordable housing investments impairment 100 83 67 Marketing 98 79 102 Professional services fees 77 63 102... -

Page 37

...years ended December 31 ($ in millions) Income Statement Data Commercial Banking Branch Banking Consumer Lending Investment Advisors General Corporate and Other Net income (loss) Less: Net income attributable to noncontrolling interest Net income (loss) attributable to Bancorp Dividends on preferred... -

Page 38

... trade finance, derivatives and capital markets services, asset-based lending, real estate finance, public finance, commercial leasing and syndicated finance. The following table contains selected financial data for the Commercial Banking segment. TABLE 14: COMMERCIAL BANKING For the years ended... -

Page 39

... contains selected financial data for the Branch Banking segment. TABLE 15: BRANCH BANKING For the years ended December 31 ($ in millions) Net interest income Provision for loan and lease losses Noninterest income: Service charges on deposits Card and processing revenue Investment advisory revenue... -

Page 40

... OF OPERATIONS Consumer Lending Consumer Lending includes the Bancorp's mortgage, home equity, automobile and other indirect lending activities. Mortgage and home equity lending activities include the origination, retention and servicing of mortgage and home equity loans or lines of credit, sales... -

Page 41

... Asset Management, Inc. provides asset management services and also advises the Bancorp's proprietary family of mutual funds. Fifth Third Private Banking offers holistic strategies to affluent clients in wealth planning, investing, insurance and wealth protection. Fifth Third Institutional Services... -

Page 42

...related to reduction in the cash surrender value of one of the Bancorp's BOLI policies. Provision expense in excess of net charge-offs decreased from $1.9 billion in 2008 to $967 million in 2009. Dividends on preferred stock increased from $67 million in 2008 to $226 million in 2009. 40 Fifth Third... -

Page 43

... percent from the fourth quarter of 2009. The sequential growth was driven by higher private client service revenue, institutional trust revenue and brokerage fees due to market value increases and improved sales production resulting in improved net asset and account growth. Including the previously... -

Page 44

... the Bancorp's Visa, Inc. Class B shares. Mortgage banking net revenue increased $354 million as a result of strong growth in originations, which were up 89% to $21.7 billion in 2009. Card and processing revenue decreased 33% compared to 2008 due to the Processing Business Sale in the second quarter... -

Page 45

...of a 51% increase in origination activity for the fourth quarter of 2010 compared to the fourth quarter of 2009 and management's decision in the third quarter of 2010 to retain certain mortgage loans primarily originated through the Bancorp's retail branches. Home equity loans decreased $660 million... -

Page 46

... of AAA-rated agency mortgage-backed securities. In 2010, the Bancorp recognized $3 million of OTTI on its investment securities portfolio. During the year ended December 31, 2009, OTTI was immaterial to the Consolidated Financial Statements. In 2008, the Bancorp recognized OTTI charges of $67... -

Page 47

...driven by the sale of VRDNs which were held by the Bancorp in its trading securities portfolio. These securities were purchased from the market during 2008 and 2009 through FTS who was also the remarketing agent. During the fourth quarter of 2009 and into 2010, the rates on these securities began to... -

Page 48

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS TABLE 22: DEPOSITS As of December 31 ($ in millions) Demand Interest checking Savings Money market Foreign office Transaction deposits Other time Core deposits Certificates - $100,000 and over Other Total deposits... -

Page 49

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Borrowings Total borrowings declined $693 million from December 31, 2009, as the result of a decrease in long-term debt partially offset by an increase in federal funds purchased and other short-term borrowings. ... -

Page 50

... and recovery services for the Bancorp; Capital Markets Risk Management is responsible for instituting, monitoring, and reporting appropriate trading limits, monitoring liquidity, interest rate risk, and risk tolerances within Treasury, Mortgage, and Capital Markets groups and utilizing a value at... -

Page 51

... limits based on industry, lines of business within the commercial segment and credit product type. The risk within the commercial loan and lease portfolio is managed and monitored through an underwriting process utilizing detailed origination policies, continuous loan level reviews, the monitoring... -

Page 52

...: COMMERCIAL LOAN AND LEASE PORTFOLIO EXPOSURE As of December 31 ($ in millions) By industry: Real estate Manufacturing Financial services and insurance Healthcare Business services Wholesale trade Construction Retail trade Transportation and warehousing Other services Communication and information... -

Page 53

...384 109 146 49 154 1,219 For the Year Ended December 31, 2009 Net Charge-offs 111 153 229 48 54 27 99 721 TABLE 29: HOME BUILDER AND DEVELOPER (a) As of December 31, 2010 ($ in millions) By State: Ohio Michigan Florida North Carolina Indiana All other states Total Outstanding $202 151 103 68 67 108... -

Page 54

...Nonaccrual Net Charge-offs Ohio $673 4 25 18 Michigan 350 3 13 21 Florida 388 9 50 68 North Carolina 169 5 9 8 Indiana 145 1 7 4 Kentucky 92 1 3 2 Illinois 62 1 6 2 All other states 141 2 8 5 Total $2,020 26 121 128 Home Equity Portfolio The home equity portfolio is managed in two categories, loans... -

Page 55

...7 Nonaccrual 2 2 For the Year Ended December 31, 2010 Net Charge-offs 5 5 4 3 5 3 33 58 TABLE 36: AUTOMOBILE LOANS OUTSTANDING WITH LTV GREATER THAN 100% As of December 31, 2009 ($ in millions) By State: Ohio Illinois Michigan Indiana Florida Kentucky All other states Total Outstanding $422 357 252... -

Page 56

... due to actions taken by the Bancorp to address problem loans, reflected by significant net charge-offs recorded in 2008 and 2009 and the impact of loss mitigation activities such as suspending home builder and developer lending and non-owner occupied commercial real estate lending in 2007 and 2008... -

Page 57

... loans Commercial construction loans Commercial leases Residential mortgage loans(d) Home equity Automobile loans Credit card Other consumer loans and leases Total 90 days past due loans and leases Nonperforming assets as a percent of total loans, leases and other assets, including other real estate... -

Page 58

...Commercial construction loans 8.48 Commercial leases 0.05 Total commercial loans and leases 3.10 Residential mortgage loans 5.49 Home equity 2.20 Automobile loans 0.85 Credit card 8.28 Other consumer loans and leases 2.58 Total consumer loans and leases 2.92 Total net losses charged off 3.02 % 2009... -

Page 59

...ratings or loss rates. Given current processes employed by the Bancorp, management believes the risk grades and estimated loss rates currently assigned are appropriate. Total impaired loans consist of loans and leases that are restructured in a troubled debt restructuring and larger commercial loans... -

Page 60

... on loan demand, credit losses, mortgage originations, the value of servicing rights and other sources of the Bancorp's earnings. Stability of the Bancorp's net income is largely dependent upon the effective management of interest rate risk. Management continually reviews the Bancorp's balance sheet... -

Page 61

... - commercial 16,837 Residential mortgage loans 1,437 Home equity 1,656 Automobile loans 4,324 Credit card 191 Other consumer loans and leases 517 Subtotal - consumer 8,125 Total $24,962 repaid loans. The Bancorp maintains a non-qualifying hedging strategy relative to its mortgage banking activity... -

Page 62

... cash upon origination. Additional assets such as jumbo fixedrate residential mortgages, certain commercial loans, home equity lines and loans, automobile loans and other consumer loans are also capable of being securitized or sold. For the years ended December 31, 2010 and 2009, loans totaling $18... -

Page 63

... Fifth Third Bank's outlook from negative to stable. During 2010, DBRS Investors Service downgraded the long-term debt rating and deposit ratings for the Bancorp's subsidiary to "A" from "AH". * As an investor, you should be aware that a security rating is not a recommendation to buy, sell or hold... -

Page 64

... each of the years ended December 31, 2010 and 2009, the Bancorp paid dividends per common share of $0.04. The Bancorp issued $3.4 billion in senior preferred stock (Series F) and related warrants to the U.S. Treasury as part of the CPP. Upon issuance, the Bancorp agreed to limit dividends to common... -

Page 65

...course of business, the Bancorp enters into financial transactions to extend credit and various forms of commitments and guarantees that may be considered off-balance sheet arrangements. These transactions involve varying elements of market, credit and liquidity risk. Residential Mortgage Loan Sales... -

Page 66

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS ended December 31, 2009, the VIE did not transfer any loans back to the Bancorp as a result of a credit event. The VIE issued commercial paper and used the proceeds to fund the acquisition of commercial loans ... -

Page 67

... investments and market tax credits. (h) See Note 22 of the Notes to Consolidated Financial Statements for additional information on pension obligations. (i) Represents agreements to purchase goods or services and includes commitments to various general contractors for work related to banking center... -

Page 68

... the participation of the Bancorp's management, including the Bancorp's Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Bancorp's disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange... -

Page 69

...as of and for the year ended December 31, 2010 of the Bancorp and our report dated February 28, 2011 expressed an unqualified opinion on those consolidated financial statements. Cincinnati, Ohio February 28, 2011 To the Shareholders and Board of Directors of Fifth Third Bancorp: We have audited the... -

Page 70

...Total Assets Liabilities Deposits: Demand Interest checking Savings Money market Other time Certificates - $100,000 and over Foreign office and other Total deposits Federal funds purchased Other short-term borrowings Accrued taxes, interest and expenses Other liabilities (a) Long-term debt (a) Total... -

Page 71

...-term debt Total interest expense Net Interest Income Provision for loan and lease losses Net Interest Income (Loss) After Provision for Loan and Lease Losses Noninterest Income Mortgage banking net revenue Service charges on deposits Corporate banking revenue Investment advisory revenue Card and... -

Page 72

..., including treasury shares issued Loans repaid related to the exercise of stockbased awards, net Impact of cumulative effect of change in accounting principle Noncontrolling interest Other Balance at December 31, 2010 Common Preferred Stock Stock $1,295 9 Bancorp Shareholders' Equity Accumulated... -

Page 73

... value adjustments on loans held for sale Capitalized mortgage servicing rights Loss on recalculation of the timing of tax benefits on leveraged leases Impairment charges on goodwill Loans originated for sale, net of repayments Proceeds from sales of loans held for sale Dividends representing return... -

Page 74

... CONSOLIDATED FINANCIAL STATEMENTS 1. SUMMARY OF SIGNIFICANT ACCOUNTING AND REPORTING POLICIES Nature of Operations Fifth Third Bancorp, an Ohio corporation, conducts its principal lending, deposit gathering, transaction processing and service advisory activities through its banking and non-banking... -

Page 75

... market. Gains or losses on sales are recognized in mortgage banking net revenue upon delivery. Loans held for sale are placed on nonaccrual status consistent with the Bancorp's nonaccrual policy for portfolio loans and leases. Other Real Estate Owned OREO, which is included in other assets... -

Page 76

..., commercial construction, and commercial leasing. The residential mortgage portfolio segment is also considered a class. Classes within the consumer segment include home equity, automobile, credit card, and other consumer loans and leases. For an analysis of the Bancorp's ALLL by portfolio segment... -

Page 77

... reserve for impairment in the servicing portfolio. For purposes of measuring impairment, the mortgage servicing rights are stratified into classes based on the financial asset type (fixed-rate vs. adjustable-rate) and interest rates. Fees received for servicing loans owned by investors are based on... -

Page 78

... revenues net of certain costs (primarily interchange fees charged by credit card associations) not controlled by the Bancorp. The Bancorp purchases life insurance policies on the lives of certain directors, officers and employees and is the owner and beneficiary of the policies. The Bancorp invests... -

Page 79

... Financial Statements. Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses In July 2010, the FASB issued guidance that requires the Bancorp to disclose a greater level of disaggregated information about the credit quality of its loans and leases... -

Page 80

... issued Impact of change in accounting principle: Decrease in available-for-sale securities, net Increase in portfolio loans Decrease in demand deposits Increase in other short-term borrowings Increase in long-term debt 2010 $650 160 662 68 941 2,217 18 122 1,344 2009 $45 47 136 377 36 7 13 (4) 2008... -

Page 81

...holdings. The following table presents realized gains and losses recognized in income from available-for-sale securities for the years ended December 31: ($ in millions) Realized gains Realized losses Net realized gains 2010 $69 (13) $56 2009 91 (34) 57 2008 161 (130) 31 Trading securities totaled... -

Page 82

...of 2009, the Bancorp concluded that the OTTI charges on the trust preferred securities were due to non-credit related factors. Therefore, the Bancorp recognized an increase of $37 million to the investment balance and related unrealized losses during the year ended December 31, 2009. 80 Fifth Third... -

Page 83

... leasing portfolio. Declines in residual values that are deemed to be other-than-temporary are recognized as a loss. Residual value write-downs related to consumer automobile leases for the year ended December 31, 2010 were immaterial to the Consolidated Financial Statements. The Bancorp recognized... -

Page 84

... mortgage loans measured at fair value, and includes $1,039 of leveraged leases, net of unearned income. Credit Risk Profile For purposes of monitoring the credit quality and risk characteristics of its commercial portfolio segment, the Bancorp disaggregates the segment into the following classes... -

Page 85

... Commercial mortgage nonowner-occupied Commercial construction Commercial leasing Residential mortgage loans (a) Consumer: Home equity loans Automobile loans Credit card loans Other consumer loans and leases Total portfolio loans and leases (a) (a) Excludes $46 of loans measured at fair value... -

Page 86

...TO CONSOLIDATED FINANCIAL STATEMENTS The following table summarizes the Bancorp's recorded investment in impaired loans and leases and related allowance as of December 31: 2010 ($ in millions) With a related allowance recorded: Commercial Residential mortgage Consumer Total with a related allowance... -

Page 87

... applying purchase accounting. Loans carried at fair value, mortgage loans held for sale and loans under revolving credit agreements are excluded from the scope of this guidance on loans acquired with deteriorated credit quality. During the years ended December 31, 2010, 2009 and 2008, the Bancorp... -

Page 88

... Acquisition activity Sale of Processing Business Balance as of December 31, 2009 Acquisition activity Balance as of December 31, 2010 Commercial Banking $614 (1) 613 $613 Branch Banking 1,657 (1) 1,656 1,656 Consumer Lending Investment Advisors 148 148 148 Processing Solutions (a) 205 7 (212) Total... -

Page 89

... 17.4% Commercial Banking Branch Banking Investment Advisors Discount rates were estimated based on a capital asset pricing model, which considers the risk-free interest rate, an estimated equity risk premium, an estimated beta for the Bancorp's common stock and size premium adjustments specific... -

Page 90

... is managed through credit enhancement in the form of reserve accounts, overcollateralization, excess interest on the loans, the subordination of certain classes of asset-backed securities to other classes, and in the case of the home equity transaction, an 88 Fifth Third Bancorp insurance policy... -

Page 91

... to meet the investor member's defined target rate of return. Non-consolidated VIEs The following table provides a summary of assets and liabilities carried on the Bancorp's Consolidated Balance Sheet as of December 31, 2010 related to non-consolidated VIEs for which the Bancorp holds a variable... -

Page 92

...residential mortgage loan sales and the Bancorp's mortgage banking activity, which is included in mortgage banking net revenue in the Consolidated Statements of Income for the years ended December 31 is as follows: 2010 $17,861 490 221 2009 20,605 485 197 2008 11,529 260 164 Servicing Assets The... -

Page 93

... hedging strategy to manage a portion of the risk associated with changes in value of the MSR portfolio. This strategy includes the purchase of free-standing derivatives and various available-for-sale securities. The interest income, mark-to-market adjustments and gain or loss from sale activities... -

Page 94

... in the form of asset-backed securities totaling $63 million and residual interests totaling $98 million. These retained interests were included in available-for-sale securities in the Consolidated Balance Sheets. During the years ended December 31, 2009 and 2008, the Bancorp received cash flows... -

Page 95

... related to interest rate, prepayment and foreign currency volatility. Additionally, the Bancorp holds derivative instruments for the benefit of its commercial customers. The Bancorp does not enter into unhedged speculative derivative positions. The Bancorp's interest rate risk management strategy... -

Page 96

... for sale mortgage loans Interest rate swaps related to long-term debt Foreign exchange contracts for trading purposes Put options associated with Processing Business Sale Stock warrants associated with Processing Business Sale Swap associated with the sale of Visa, Inc. Class B shares Total free... -

Page 97

... risk management strategy relative to its mortgage banking activity, the Bancorp may enter into various free-standing derivatives (principal-only swaps, swaptions, floors, options and interest rate swaps) to economically hedge changes in fair value of its largely fixed-rate MSR portfolio. Principal... -

Page 98

... rate, foreign exchange, commodity and other commercial customer derivative contracts are recorded as a component of corporate banking revenue in the Consolidated Statements of Income. The Bancorp enters into risk participation agreements, under which the Bancorp assumes credit exposure relating... -

Page 99

... underlying investments. During 2008 and 2009, the value of the investments underlying one of the Bancorp's BOLI policies continued to decline due to disruptions in the credit markets, widening of credit spreads between U.S. treasuries/swaps versus municipal bonds and bank trust preferred securities... -

Page 100

... in reserve accounts held at Federal Reserve Banks that the Bancorp purchased from other member banks on an overnight basis. Other short-term borrowings include securities ($ in millions) As of December 31: Federal funds purchased Other short-term borrowings Average for the years ended December 31... -

Page 101

... Bancorp's trust preferred securities are callable at par as of certain dates, or may become callable at par under certain circumstances. Parent Company Long-Term Borrowings In April 2008, the Bancorp issued $750 million of senior notes to third party investors. The senior notes bear a fixed rate... -

Page 102

... swap to convert $275 million of the fixed rate debt into a floating rate. At December 31, 2010, the rate paid on the swap was 3.54%. The obligations were issued by Fifth Third Capital Trust VII. The Bancorp's obligations under the transaction documents, taken together, have the effect of providing... -

Page 103

...can include commercial real estate, physical plant and property, inventory, receivables, cash and marketable securities. At December 31, 2010 and 2009, the reserve related to these standby letters of credit was $10 million and $6 million, respectively. The Bancorp monitors the credit risk associated... -

Page 104

... in the summary of commitments table. The Bancorp or its subsidiaries have also entered into a limited number of agreements for work related to banking center construction and to purchase goods or services. Contingent Liabilities Private mortgage reinsurance For certain mortgage loans originated by... -

Page 105

...tax benefit of $288 million ($187 million aftertax) recognized by the Bancorp for the year ended December 31, 2009. In the second quarter of 2010, Visa funded an additional $500 million into the escrow account which resulted in further dilution in the conversion of Class B shares into Class A shares... -

Page 106

... policies and procedures covering related party transactions to principal shareholders, directors and executives of the Bancorp. These procedures cover transactions such as employee-stock purchase loans, personal lines of credit, residential secured loans, overdrafts, letters of credit and increases... -

Page 107

...net of participations: Directors and their affiliated companies Executive officers Total Outstanding balance on loans, net of participations and undrawn commitments 2010 $157 3 160 74 2009 143 6 149 68 The commitments to lend are in the form of loans and guarantees for various business and personal... -

Page 108

... in the Consolidated Balance Sheets. At December 31, 2010 and 2009, the Bancorp had recorded deferred tax assets of $66 million and $81 million, respectively, related to state net operating loss carryforwards. The deferred tax assets relating to state net operating losses are presented net of... -

Page 109

... third quarter of 2010. As a result, all issues have been resolved with the IRS through 2007. The statute of limitations for the Bancorp's federal income tax returns remains open for tax years 2007 through 2010. The IRS is currently auditing the Bancorp's federal income tax returns for 2008 and 2009... -

Page 110

...net prior service cost Settlement Net periodic benefit cost 108 Fifth Third Bancorp 2010 $12 (14) 12 1 $11 2009 12 (12) 15 1 13 29 2008 13 (18) 7 1 10 13 For further information on fair value hierarchy levels, see Note 28. Includes holdings in Bancorp common stock Includes debt securities issued... -

Page 111

... target asset allocations relating to equity securities (including the Bancorp's common stock), fixed income securities As of December 31, 2010 and 2009, $172 million and $160 million, respectively, of plan assets were managed through mutual funds by Fifth Third Bank, a subsidiary of the Bancorp... -

Page 112

... plans: Net prior service cost Net actuarial loss Defined benefit plans, net Total 2009 Unrealized holding gains on available-for-sale securities arising during period Reclassification adjustment for net gains included in net income Reclassification adjustment related to prior OTTI charges Net... -

Page 113

... 31, 2008, the U.S. Treasury purchased $3.4 billion, or 136,320 shares, of the Bancorp's Fixed Rate Cumulative Perpetual Preferred Stock, Series F, with a liquidation preference of $25,000 per share and related 10-year warrants in the amount of 15% of the preferred stock investment. The warrants... -

Page 114

... compensation will be awarded to executives, directors or key employees of the Bancorp. SARs, restricted stock, stock options and performance units outstanding represent six percent of the Bancorp's issued shares at December 31, 2010. During 2009, the Bancorp's Board of Directors approved the use of... -

Page 115

... for the years ended: Expected life (in years) Expected volatility Expected dividend yield Risk-free interest rate 2010 6 38% 2.0% 3.1% 2009 6 73% 1.3% 2.2% 2008 6 30% 8.7% 3.3% contractual life of the option is based on the U.S. Treasury yield curve in effect at the time of grant. Stock-based... -

Page 116

... year ended 2008 was $2.87 per share. The total intrinsic value of options exercised was immaterial to the Bancorp's Consolidated Financial Statements in 2010, 2009 and 2008. Cash received from options exercised during 2010 and 2009 was immaterial to the Bancorp's Consolidated Financial 2010 Stock... -

Page 117

...fees Consumer loan and lease fees Banking center income Loss on sale of OREO Gain on sale/redemption of Visa, Inc. ownership interests Litigation settlement Other, net Total Other noninterest expense: FDIC insurance and other taxes Loan and lease Losses and adjustments Affordable housing investments... -

Page 118

... for the years ended December 31: 2010 (in millions, except per share data) Earnings per share: Net income (loss) attributable to Bancorp Dividends on preferred stock Net income (loss) available to common shareholders Income (loss) allocated to participating securities Net income (loss) allocated to... -

Page 119

... and debentures Other securities Trading securities Residential mortgage loans held for sale Residential mortgage loans (b) Derivative assets: Interest rate contracts Foreign exchange contracts Equity contracts Commodity contracts Derivative assets Total assets Liabilities: Derivative liabilities... -

Page 120

... in the market for these types of securities at 118 Fifth Third Bancorp December 31, 2010 and 2009, the Bancorp measured fair value using a discount rate based on the assumed holding period. Residential mortgage loans held for sale and held for investment For residential mortgage loans held for... -

Page 121

... in Trading Mortgage Derivatives, For the year ended December 31, 2009 ($ in millions) Securitizations Securities Loans Net (e) Beginning balance $146 7 24 Total gains or losses (realized/unrealized): Included in earnings 10 (4) (2) 145 Included in other comprehensive income 3 Purchases, sales... -

Page 122

... Consolidated Statements of Income as follows: ($ in millions) Interest income Mortgage banking net revenue Corporate banking revenue Other noninterest income Securities losses, net Other noninterest expense Total gains 2010 $60 1 (15) $46 2009 11 (7) 1 20 (5) (4) 16 2008 7 21 1 5 (23) 11 Assets... -

Page 123

... value option was elected included losses of $191 million and $162 million, respectively during 2010 and 2009. These losses are reported as mortgage banking net revenue in the Consolidated Statements of Income. Valuation adjustments related to instrument-specific credit risk for residential mortgage... -

Page 124

... construction loans Commercial leases Residential mortgage loans (a) Home equity Automobile loans Credit card Other consumer loans and leases Unallocated allowance for loan and lease losses Total portfolio loans and leases, net (a) Financial liabilities: Deposits Federal funds purchased Other short... -

Page 125

... shortterm investments, certain deposits (demand, interest checking, savings, money market and foreign office deposits), and federal funds purchased. Fair values for other time deposits, certificates of deposit $100,000 and over and other short-term borrowings were estimated using a discounted cash... -

Page 126

...preferred stock and, subject to limitations, allowances for loan and lease losses. ($ in millions) Total risk-based capital (to risk-weighted assets): (a) Fifth Third Bancorp (Consolidated) Fifth Third Bank Tier I capital (to risk-weighted assets): Fifth Third Bancorp (Consolidated) Fifth Third Bank... -

Page 127

...-term debt Total Liabilities Shareholders' Equity Total Liabilities and Shareholders' Equity ($ in millions) 2008 80 293 57 24 374 (294) 84 (210) (1,903) (2,113) Condensed Statements of Cash Flows (Parent Company Only) For the years ended December 31 2010 2009 Operating Activities Net income (loss... -

Page 128

.... Additionally, the Bancorp retained its retail credit card and commercial multi-card service businesses, which were also originally reported in the former Processing Solutions segment through June 30, 2009, and are now included in the Consumer Lending and Commercial Banking segments, respectively... -

Page 129

... three years ended December 31 are: Commercial 2010 ($ in millions) Banking Net interest income (a) $1,545 Provision for loan and lease losses 1,159 Net interest income (loss) after provision for loan and lease losses 386 Noninterest income: Mortgage banking net revenue Service charges on deposits... -

Page 130

... CONSOLIDATED FINANCIAL STATEMENTS Commercial 2008 ($ in millions) Banking Net interest income (a) $1,567 Provision for loan and lease losses 1,864 Net interest income (loss) after provision for loan and lease losses (297) Noninterest income: Mortgage banking net revenue Service charges on deposits... -

Page 131

... CHANGE COM MMISSION Washington n, D.C. 20549 FORM M 10-K ANNUAL RE EPORT PURSU UANT TO SEC CTION 13 OR R 1 15(d) OF THE SECURITIES S EXCHANGE E ACT OF 1934 For the fiscal year end ded December 31, 3 2010 Co ommission file number n 001-336 653 Ind dicate by check mark m whether the registrant is... -

Page 132

... and services to the retail, commercial, financial, governmental, educational and medical sectors, including a wide variety of checking, savings and money market accounts, and credit products such as credit cards, installment loans, mortgage loans and leases. Fifth Third Bank has deposit insurance... -

Page 133

... that may be charged on loans. Various federal and state consumer laws and regulations also affect the operations of banks. In 2006, the Federal Deposit Insurance Reform Act of 2005 was signed into law ("FDIRA"). Pursuant to the FDIRA, the Bank Insurance Fund and Savings Association Fund were merged... -

Page 134

..."transfer date" (currently anticipated to be July 21, 2011), the Bancorp also must be well capitalized and well managed to retain its financial holding company status. 132 Fifth Third Bancorp Historically, the minimum risk-based capital requirements adopted by the federal banking agencies typically... -

Page 135

..., participating institutions were required to issue to Treasury immediately exercisable 10-year warrants to purchase common stock with an aggregate market price equal to 15% of the amount of senior preferred. On December 31, 2008, the Bancorp entered into a Letter Agreement (including the Securities... -

Page 136

... a number of provisions that are targeted at improving the reliability of credit ratings. The SEC has been charged with adopting various rules in this regard. Consumer Issues The Dodd-Frank Act creates a new Bureau of Consumer Financial Protection, which will be housed within the Federal Reserve... -

Page 137

..., as well as certain investments in small business investment companies. Transactions on behalf of customers and in connection with certain underwriting and market making activities, as well as risk-mitigating hedging activities and certain foreign banking activities are also permitted. Dodd... -

Page 138

... and CEO of Fifth Third Bank (Northwestern Ohio) since July 2002. Daniel T. Poston, 52. Executive Vice President of the Bancorp since June 2003, and Chief Financial Officer of the Bancorp since September 2009. Previously, Mr. Poston was the Controller of the Bancorp from July 2007 to May 2008 and... -

Page 139

..., RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES The Bancorp's common stock is traded in the over-the-counter market and is listed under the symbol "FITB" on the NASDAQ® Global Select Market System. High and Low Stock Prices and Dividends Paid Per Share 2010 Fourth Quarter... -

Page 140

... by refere ence into any other Compan ny filing under the Securities s Act of 1933 or o the Securiti ies Exchange Act A of 1934, ex xcept to the extent the Bancorp specifically s inc corporates the performance graphs g by refer rence therein. Total l Return Analy ysis The graphs g below su ummarize... -

Page 141

...31, 2006. Global security representing Fifth Third Bancorp's $250,000,000 Floating Rate Subordinated Notes due 2016. Incorporated by reference to Registrant's Annual Report on Form 10-K filed for the fiscal year ended December 31, 2006. First Supplemental Indenture dated as of March 30, 2007 between... -

Page 142

... amount $25 per Trust Preferred Security). Incorporated by reference to Registrant's Quarterly Report on Form 10-Q filed for the quarter ended June 30, 2007. Guarantee Agreement, dated as of August 8, 2007 between Fifth Third Bancorp, as Guarantor, and Wilmington Trust Company, as Guarantee Trustee... -

Page 143

... Securities and Exchange Commission on January 25, 2011. (3) Fifth Third Bancorp Unfunded Deferred Compensation Plan for Non-Employee Directors. Incorporated by reference to Registrant's Annual Report on Form 10-K filed for fiscal year ended December 31, 1985. * Fifth Third Bancorp 1990 Stock Option... -

Page 144

... Charges and Preferred Stock Dividend Requirements. Code of Ethics. Incorporated by reference to Exhibit 14 of the Registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on January 23, 2007. 10.44 Warrant dated June 30, 2009 issued by FTPS Holding, LLC to Fifth... -

Page 145

... Chief Executive Officer 99.2 Certification Pursuant to Section 111 (b)(4) of the Emergency Economic Stabilization Act of 2008 by Chief Financial Officer 101 Interactive data files pursuant to Rule 405 of Regulation S-T: (i) the Consolidated Balance Sheets, (ii) the Consolidated Statements of Income... -

Page 146

... duly authorized. FIFTH THIRD BANCORP Registrant /s/ Kevin T. Kabat Kevin T. Kabat President and CEO Principal Executive Officer February 28, 2011 Pursuant to requirements of the Securities Exchange Act of 1934, this report has been signed on February 28, 2011 by the following persons on behalf of... -

Page 147

CONSOLIDATED TEN YEAR COMPARISON AVERAGE ASSETS ($ IN MILLIONS) Interest-Earning Assets Interest-Bearing Deposits in Loans and Federal Funds Banks (a) Securities Year Leases Sold (a) 2010 $79,232 11 3,317 16,371 2009 83,391 12 1,023 17,100 2008 85,835 438 183 13,424 2007 78,348 257 147 11,630 2006 ... -

Page 148

... Bank Gary R. Heminger Executive Vice President Marathon Oil Corporation Jewell D. Hoover Principal Hoover and Associates, LLC Kevin T. Kabat President & CEO Fifth Third Bancorp Mitchel D. Livingston, Ph.D. Vice President for Student Affairs & Chief Diversity Officer University of Cincinnati Hendrik... -

Page 149

2010 Financial Highlights -

Page 150

www.53.com