Fifth Third Bank 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

2009

THE POWER OF

PERSEVERANCE

Table of contents

-

Page 1

PERSEVERANCE THE POWER OF 2009 ANNUAL REPORT -

Page 2

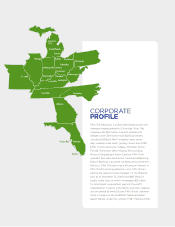

... inside select grocery stores and 2,358 ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Pennsylvania, Missouri, Georgia and North Carolina. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Investment Advisors... -

Page 3

... OUR SHAREHOLDERS KEVIN T. KABAT ChAirMAn, PrESidEnT And ChiEf ExECuTivE OffiCEr Dear Shareholders: While overall conditions improved this year, 2009 still presented a challenging environment for the banking industry. Despite these headwinds, Fifth Third took important steps on a number of fronts... -

Page 4

...career. Customers continue to be cautious in early 2010, although we've begun to see some signs of renewed appetite for expansion and investment. Retail customers also are showing a great deal of conservatism. Savings rates as a percentage of disposable income continue 2 fifth third bancorp | 2009... -

Page 5

"wE'rE MAkinG STrOnG PArTnErShiPS wiTh CuSTOMErS durinG ThiS diffiCulT TiME, And EvEry CuSTOMEr wE hElP STAy in hiS Or hEr hOME TOdAy PrOvidES A STrOnG fOundATiOn fOr A lifElOnG rElATiOnShiP wiTh fifTh Third." fifth third bancorp | 2009 annual report 3 -

Page 6

... a number of our businesses. In 2009 we generated $553 million of mortgage banking revenue, an increase of $354 million, or 178 percent compared with 2008. Net interest margin expanded significantly, rising every quarter since 1Q 2009. We also had an exceptional 4 fifth third bancorp | 2009 annual... -

Page 7

... BAnkS likE fifTh Third." year for deposit growth, growing deposits in every one of our affiliate markets, and increasing our deposit market share in 75 percent of them. Demand deposits were up $4.1 billion, or 27 percent on a year-over-year basis, fueled by strong growth in both the consumer... -

Page 8

.... Thank you for your confidence in Fifth Third through an unforgiving and unpredictable environment. We look forward to better times and better performance in 2010. Sincerely, Kevin T. Kabat Chairman, President and Chief Executive Officer Fesruary 2010 6 fifth third bancorp | 2009 annual report -

Page 9

..., 2010, Fifth Third's Corporate Governance Quotient outperformed 92.4 percent of the companies in the S&P 500 and 100 percent of the companies in the "Banks" group. Fifth Third Bancorp's board is controlled by a majority of independent outsiders. In October 2009, Fifth Third appointed two new board... -

Page 10

...designed to provide significant customer benefits for a standard monthly fee. Packages such as Gold, Rewards, Secure and Balance Builder checking were launched to drive growth in fee income from value-added services that are bundled with deposit accounts. 8 fifth third bancorp | 2009 annual report -

Page 11

... to customers across and beyond Fifth Third's footprint. Our loan products include real estate-secured mortgages, home equity loans and lines, credit cards, and federal and private student education loans. Consumer Lending also partners with a network of auto dealers that originate loans on the Bank... -

Page 12

... lending and depository offerings, our products and services include global cash management, foreign exchange and international trade finance, derivatives and capital markets services, asset-based lending, real estate finance, public finance, commercial leasing and syndicated finance. STRATEGY... -

Page 13

...by offering retirement, investment and education planning, managed money, annuities, transactional brokerage and insurance services. Fifth Third Asset Management provides asset management services to institutional clients and also advises the Company's proprietary family of mutual funds, Fifth Third... -

Page 14

... maintain their score. They also can receive personalized information about avoiding foreclosure or obtaining a mortgage or other consumer loan. In addition to promoting financial literacy in youth and adults, Fifth Third Bank is active in supporting programs that give kids a good start in life. One... -

Page 15

2009 ANNUAL REPORT FINANCIAL CONTENTS Management's Discussion and Analysis of Financial Condition and Results of Operations Selected Financial Data Overview Non-GAAP Financial Measures Critical Accounting Policies Risk Factors Statements of Income Analysis Business Segment Review Fourth Quarter ... -

Page 16

... checking, savings, money market and foreign office deposits. (i) Includes transaction deposits plus other time deposits. (j) Includes certificates $100,000 and over, other foreign office deposits, federal funds purchased, short-term borrowings and long-term debt. TABLE 2: QUARTERLY INFORMATION... -

Page 17

... Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. At December 31, 2009, the Bancorp had $113 billion in assets, operated 16 affiliates with 1,309 full-service Banking Centers including 103 Bank Mart® locations open seven days a week inside select grocery stores... -

Page 18

... 2008. Card and processing revenue decreased 33% due to the Processing Business Sale in the second quarter of 2009. Corporate banking revenue decreased 10% largely due to a lower volume of interest rate derivatives sales and foreign exchange revenue, partially offset by growth in institutional sales... -

Page 19

... Note 1 of the Notes to Consolidated Financial Statements provides a discussion of the significant new accounting standards adopted by the Bancorp during 2009 and 2008 and the expected impact of significant accounting standards issued, but not yet required to be adopted. Fifth Third Bancorp 17 -

Page 20

...the value of the Bancorp's assets or liabilities and results of operations and cash flows. The Bancorp's critical accounting policies include the accounting for allowance for loan and lease losses, reserve for unfunded commitments, income taxes, valuation of servicing rights, fair value measurements... -

Page 21

... classes based on the financial asset type and interest rates. Fees received for servicing loans owned by investors are based on a percentage of the outstanding monthly principal balance of such loans and are included in noninterest income in the Consolidated Statements of Income as loan payments... -

Page 22

... a terminal value approach to estimate cash flows beyond the final year of the forecast) and the reporting unit's estimated cost of equity as the discount rate. Additionally, the Bancorp determines its market capitalization based on the average of the closing price of the Bancorp's stock during the... -

Page 23

...of Fifth Third's residential mortgage and commercial real estate loan portfolios are comprised of borrowers in Michigan, Northern Ohio and Florida, which markets have been particularly adversely affected by job losses, declines in real estate value, declines in home sale volumes, and declines in new... -

Page 24

... with insurance companies, mutual funds, hedge funds, and other companies offering financial services in the U.S., globally and over the internet. Fifth Third competes on the basis of several factors, including capital, access to capital, revenue generation, products, services, transaction execution... -

Page 25

... its capital and results of operations. Fifth Third's mortgage banking revenue can be volatile from quarter to quarter. Fifth Third earns revenue from the fees Fifth Third receives for originating mortgage loans and for servicing mortgage loans. When rates rise, the demand for mortgage loans tends... -

Page 26

...Third sold such businesses, the loss of income could have an adverse effect on its earnings and future growth. Fifth Third owns several non-strategic businesses that are not significantly synergistic with its core financial services businesses. Fifth Third has, from time to time, considered the sale... -

Page 27

... the liquidity support available to financial institutions, establishing a commercial paper funding facility, temporarily guaranteeing money market funds and certain types of debt issuances, and increasing insured deposits. These programs subject the Bancorp and other financial institutions who have... -

Page 28

...suspension of new originations on nonowner occupied commercial real estate loans in the second quarter of 2008. Additionally, the decrease in commercial loans and commercial mortgage loans was due to decreases in line utilization, overall customer demand for commercial loan products, net charge-offs... -

Page 29

...The decreased reliance on wholesale funding in 2009 was a result of the increase in the Bancorp's average equity position compared to 2008 due to the issuance of $1 billion of common stock in the second quarter of 2009 and from the sale of $3.4 billion of senior preferred shares and related warrants... -

Page 30

... primarily by the Processing Business Sale in the second quarter of 2009 as well as strong growth in mortgage banking net revenue, partially offset by lower card and processing revenue in the second half of 2009. The components of noninterest income are shown in Table 7. 28 Fifth Third Bancorp -

Page 31

...) Service charges on deposits Card and processing revenue Mortgage banking net revenue Corporate banking revenue Investment advisory revenue Gain on sale of processing business Other noninterest income Securities gains (losses), net Securities gains, net - non-qualifying hedges on mortgage servicing... -

Page 32

... the management of problem assets and higher FDIC insurance costs from an increase in assessment rates during 2009, partially offset by lower card and processing expense due to the Processing Business Sale on June 30, 2009. Total personnel costs (salaries, wages and incentives plus employee benefits... -

Page 33

...Marketing 79 102 84 Professional services fees 63 102 54 Intangible asset amortization 57 56 42 Postal and courier 53 54 52 Insurance expense 50 30 17 Travel 41 54 54 Operating lease 39 32 22 Recruitment and education 30 33 41 Supplies 25 31 31 Other real estate owned expense 24 11 6 Data processing... -

Page 34

... 31 ($ in millions) Income Statement Data Commercial Banking Branch Banking Consumer Lending Investment Advisors General Corporate and Other Net income (loss) Dividends on preferred stock Net income (loss) available to common shareholders 2009 ($120) 324 23 53 457 737 226 $511 2008 (733) 632 (148... -

Page 35

... from the sale or transfer to held-for-sale of $1.3 billion in commercial loans and commercial mortgage loans in the fourth quarter of 2008. Noninterest income increased $101 million compared to 2007 due to corporate banking revenue growth of $70 million and increased service charges on deposits of... -

Page 36

...savings accounts, home equity loans and lines of credit, credit cards and loans for automobile and other personal financing needs, as well as products designed to meet the specific needs of small businesses, including cash management services. Table 15 contains selected financial data for the Branch... -

Page 37

... (loss) before taxes Applicable income tax expense (benefit) Net income (loss) Average Balance Sheet Data Residential mortgage loans Home equity Automobile loans Consumer leases values within the Bancorp's footprint, particularly in Michigan and Florida. During 2009, Michigan and Florida accounted... -

Page 38

... Asset Management, Inc., provides asset management services and also advises the Bancorp's proprietary family of mutual funds. Fifth Third Private Banking offers holistic strategies to affluent clients in wealth planning, investing, insurance and wealth protection. Fifth Third Institutional services... -

Page 39

... the fourth quarter of 2008. Fourth quarter 2009 results included a benefit of $20 million in mark-to-market adjustments on warrants related to the Processing Business Sale while third quarter results included a $244 million gain from the sale of the Bancorp's Visa, Inc. Class B shares. The decrease... -

Page 40

... stock and certain bank trust preferred securities. Growth occurred in several categories compared to 2007. Card and processing revenue increased 11% due to higher transaction volumes. Service charges on deposits grew 11% due to decreased earnings credits and higher customer activity. Corporate... -

Page 41

... the Bancorp sells nearly all of its newly originated mortgage loans at or near loan closing. Home equity loans decreased $578 million, or five percent, from December 31, 2008 due to tighter underwriting standards on loan to value ratios and net charge-offs of $322 million. Other consumer loans and... -

Page 42

...2009, the Bancorp concluded that the OTTI charges on these trust preferred debt securities were due to non-credit related factors and therefore, recognized an increase of $37 million to the investment balance and related unrealized losses. See Note 1 to the Notes to Consolidated Financial Statements... -

Page 43

...Home Loan Bank (FHLB) and Federal Reserve Bank restricted stock holdings that are carried at par, FHLMC and FNMA preferred stock, certain mutual fund holdings and equity security holdings. Deposits Deposit balances represent an important source of funding and revenue growth opportunity. The Bancorp... -

Page 44

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS TABLE 22: DEPOSITS As of December 31 ($ in millions) Demand Interest checking Savings Money market Foreign office Transaction deposits Other time Core deposits Certificates - $100,000 and over Other Total deposits... -

Page 45

... services for the Bancorp; Capital Markets Risk Management is responsible for instituting, monitoring, and reporting appropriate trading limits, monitoring liquidity, interest rate risk, and risk tolerances within the Treasury, Mortgage Company, and Capital Markets groups and utilizing a value... -

Page 46

... fourth quarter of 2007 and new commercial nonowner occupied real estate lending in the second quarter of 2008, discontinued the origination of brokered home equity products at the end of 2007, and raised underwriting standards across both the commercial and consumer loan product offerings. During... -

Page 47

... key lending areas. Tables 26 - 33 provide analysis of each of the categories of loans as of and for the years ended December 31, 2009 and 2008. TABLE 26: NON-OWNER OCCUPIED COMMERCIAL REAL ESTATE As of December 31, 2009 ($ in millions) By State: Ohio Michigan Florida Illinois North Carolina Indiana... -

Page 48

... OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS TABLE 27: NON-OWNER OCCUPIED COMMERCIAL REAL ESTATE As of December 31, 2008 ($ in millions) By State: Ohio Michigan Florida Illinois North Carolina Indiana All other states Total TABLE 28: HOME BUILDER AND DEVELOPER (a) As of December 31, 2009 ($ in... -

Page 49

... in index rates over the past year. Certain residential mortgage products have contractual features that may increase credit exposure to the Bancorp in the event of a decline in housing prices. These types of mortgage products offered by the Bancorp include loans with high LTV ratios, multiple loans... -

Page 50

...Ohio, Michigan, Kentucky, Indiana and Illinois. The portfolio has an average FICO score of 730 as of December 31, 2009 compared with 736 as of December 31, 2008. The Bancorp stopped origination of brokered home equity loans during the fourth quarter of 2007. In addition, the Bancorp actively manages... -

Page 51

...) By State: Ohio Illinois Michigan Indiana Florida Kentucky All other states Total Outstanding $467 365 301 249 215 205 1,683 $3,485 90 Days Past Due 2 1 1 1 1 1 6 13 Nonaccrual 1 1 For the Year Ended December 31, 2008 Net Charge-offs 10 11 6 5 9 4 37 82 Analysis of Nonperforming Assets Prior to... -

Page 52

...of the total net charge-offs in the commercial loan product portfolio in 2009. For the year ended December 31, 2008, Florida and Michigan accounted for approximately 63% of total commercial net charge-offs. The ratio of consumer loan net charge-offs to average consumer loans outstanding increased to... -

Page 53

...and leases: Commercial loans 47 Residential mortgage loans (a) 137 Home equity (a) 33 Automobile loans (a) 1 Credit card 87 Total nonperforming loans and leases 2,947 Repossessed personal property and other real estate owned 297 Total nonperforming assets (b) 3,244 Nonaccrual loans held for sale 224... -

Page 54

... OF OPERATIONS TABLE 42: SUMMARY OF CREDIT LOSS EXPERIENCE For the years ended December 31 ($ in millions) 2009 Losses charged off: Commercial loans ($768) Commercial mortgage loans (436) Commercial construction loans (420) Commercial leases (11) Residential mortgage loans (359) Home equity (330... -

Page 55

... key lending markets of the Bancorp, with metropolitan areas in Florida, Michigan and Ohio experiencing some of the most severe declines nationally. The deterioration in real estate values increased the inherent loss once a loan defaults, particularly for residential mortgage and home equity loans... -

Page 56

... of December 31 ($ in millions) 2009 2008 2007 2006 Allowance attributed to: Commercial loans $1,282 824 271 252 Commercial mortgage loans 734 363 135 95 Commercial construction loans 380 252 98 49 Commercial leases 121 61 27 24 Residential mortgage loans 375 388 67 51 Consumer loans 660 611 287 247... -

Page 57

... on loan demand, credit losses, mortgage originations, the value of servicing rights and other sources of the Bancorp's earnings. Stability of the Bancorp's net income is largely dependent upon the effective management of interest rate risk. Management continually reviews the Bancorp's balance sheet... -

Page 58

.... The Bancorp maintains a non-qualifying hedging TABLE 47: PORTFOLIO LOAN AND LEASE PRINCIPAL CASH FLOWS As of December 31, 2009 ($ in millions) Commercial loans Commercial mortgage loans Commercial construction loans Commercial leases Subtotal - commercial Residential mortgage loans Home equity... -

Page 59

... Federal Home Loan Banks. Certificates carrying a balance of $100,000 or more and deposits in the Bancorp's foreign branch located in the Cayman Islands are wholesale funding tools utilized to fund asset growth. Management does not rely on any one source of liquidity and manages availability... -

Page 60

... Risk-weighted assets Regulatory capital ratios: Tier I capital Total risk-based capital Tier I leverage Tier I common equity 58 Fifth Third Bancorp Capital Ratios The Federal Reserve Board established quantitative measures that assign risk weightings to assets and off-balance sheet items and... -

Page 61

... common stock dividend policy reflects its earnings outlook, desired payout ratios, the need to maintain adequate capital levels and alternative investment opportunities. In 2009, the Bancorp paid dividends per common share of $0.04, a decrease from the $0.75 paid in 2008. The reduction in quarterly... -

Page 62

.... The Bancorp did not purchase any commercial loans from the QSPE during 2009. Fair value adjustments of $3 million were recorded 60 Fifth Third Bancorp on these loans upon repurchase. As of December 31, 2009 and 2008, there were no outstanding balances on the line of credit from the Bancorp to the... -

Page 63

...256 49,338 (a) Includes demand, interest checking, savings, money market and foreign office deposits. For additional information, see the Deposits discussion in the Balance Sheet Analysis section of Management's Discussion and Analysis. (b) Includes other time and certificates $100,000 and over. For... -

Page 64

... over financial reporting. Based on this evaluation, there has been no such change during the year covered by this report. Kevin T. Kabat President and Chief Executive Officer February 26, 2010 Daniel T. Poston Executive Vice President and Chief Financial Officer February 26, 2010 62 Fifth Third... -

Page 65

... those consolidated financial statements. Cincinnati, Ohio February 26, 2010 To the Shareholders and Board of Directors of Fifth Third Bancorp: We have audited the accompanying consolidated balance sheets of Fifth Third Bancorp and subsidiaries (the "Bancorp") as of December 31, 2009 and 2008, and... -

Page 66

... Bank premises and equipment Operating lease equipment Goodwill Intangible assets Servicing rights Other assets Total Assets Liabilities Deposits: Demand Interest checking Savings Money market Other time Certificates - $100,000 and over Foreign office and other Total deposits Federal funds purchased... -

Page 67

... for Loan and Lease Losses Noninterest Income Service charges on deposits Card and processing revenue Mortgage banking net revenue Corporate banking revenue Investment advisory revenue Gain on sale of processing business Other noninterest income Securities gains (losses), net Securities gains - non... -

Page 68

... Employee stock ownership through benefit plans Impact of diversification of nonqualified deferred compensation plan Other Balance at December 31, 2007 1,295 9 Net loss Other comprehensive income Comprehensive loss Cash dividends declared: Common stock at $0.75 per share Preferred stock Dividends... -

Page 69

... timing of tax benefits on leveraged leases Impairment charges on goodwill Loans originated for sale, net of repayments Proceeds from sales of loans held for sale Decrease in trading securities Gain on sale of processing business, net of tax Dividends representing return on equity method investments... -

Page 70

... ACCOUNTING AND REPORTING POLICIES Nature of Operations Fifth Third Bancorp (Bancorp), an Ohio corporation, conducts its principal lending, deposit gathering, transaction processing and service advisory activities through its banking and non-banking subsidiaries from banking centers located... -

Page 71

... related deferred income tax liability, in the years in which the net investment is positive. Conforming fixed rate residential mortgage loans are typically classified as held for sale upon origination based upon management's intent to sell all the production of these loans. The Bancorp has elected... -

Page 72

... asset type (fixed-rate vs. adjustable-rate) and interest rates. Fees received for servicing loans owned by investors are based on a percentage of the outstanding monthly principal balance of such loans and are included in noninterest income in the Consolidated Statements of Income as loan payments... -

Page 73

... by credit card associations) not controlled by the Bancorp. The Bancorp purchases life insurance policies on the lives of certain directors, officers and employees and is the owner and beneficiary of the policies. The Bancorp invests in these policies, known as BOLI, to provide an efficient form of... -

Page 74

... that the decline in fair value in 2008 and related OTTI on these trust preferred debt securities was due to non-credit related factors. Therefore, upon adoption of this guidance in the second quarter of 2009, the Bancorp recognized an after-tax increase of $24 million to the opening balance of... -

Page 75

... funds, private equity funds, real estate funds, venture capital funds, offshore fund vehicles, and funds of funds. This Update creates a practical expedient to measure the fair value on the basis of the net asset value per share of the investment (or its equivalent) determined as of the reporting... -

Page 76

... $50 million of trust preferred securities. Additionally, Fifth Third Financial paid approximately $16 million to R-G Crown Real Estate, LLC to acquire land leased by Crown for certain branches. The assets and liabilities of Crown were recorded on the Bancorp's Consolidated Balance Sheets at their... -

Page 77

... and Federal Reserve Bank restricted stock holdings of $551 million and $342 million at December 31, 2009, respectively, and $545 million and $252 million at December 31, 2008, respectively, that are carried at cost, and certain mutual fund holdings and equity security holdings. For the years ended... -

Page 78

...that the OTTI charges on the trust preferred securities were due to non-credit related factors. Therefore, the Bancorp recognized an increase of $37 million to the investment balance and related unrealized losses. During the year ended December 31, 2009, OTTI recognized on available-for-sale or held... -

Page 79

... Repossessed personal property and other real estate owned 297 230 Total nonperforming assets (b) $3,244 2,006 Total 90 days past due loans and leases $567 662 (a)Represents loans modified as part of a troubled debt restructuring. During 2009, the Bancorp modified its consumer nonaccrual policy to... -

Page 80

...applying purchase accounting. Loans carried at fair value, mortgage loans held for sale and loans under revolving credit agreements are excluded from the scope of this guidance on loans acquired with deteriorated credit quality. During the years ended December 31, 2009 and 2008, the Bancorp recorded... -

Page 81

... 31, 2008 Commercial Banking $995 369 (750) 614 Branch Banking 950 707 1,657 Consumer Lending 182 33 (215) Investment Advisors 138 10 148 148 Processing Solutions (a) 205 205 7 (212) Total 2,470 1,119 (965) 2,624 5 (212) 2,417 Acquisition activity (1) (1) Sale of Processing Business Balance as of... -

Page 82

... balance. The Bancorp identifies classes of servicing assets based on financial asset type and interest rates. For the years ended December 31, 2009, 2008 and 2007, the Bancorp recognized gains of $485 million, $260 million and $79 million, respectively, on residential mortgage loan sales activity... -

Page 83

... management's best estimates for the key assumptions, which are further discussed later in this footnote. by an independent third-party. The transfers of loans to the QSPE were accounted for as sales. The QSPE issues commercial paper and uses the proceeds to fund the acquisition of commercial loans... -

Page 84

...: Automobile loans securitized Home equity loans securitized Residential mortgage loans securitized Commercial loans sold to unconsolidated QSPE Loans held for sale Total portfolio loans and leases 82 Fifth Third Bancorp (a) Excluding securitized assets that the Bancorp continues to service, but... -

Page 85

... value of the underlying mortgage principal-only trust. Foreign currency volatility occurs as the Bancorp enters into certain loans denominated in foreign currencies. Derivative instruments that the Bancorp may use to economically hedge these foreign denominated loans include foreign exchange swaps... -

Page 86

...term debt or time deposits is reported within interest expense in the Consolidated Statements of Income. 84 Fifth Third Bancorp During 2006, the Bancorp terminated certain interest rate swaps designated as fair value hedges of long-term debt. The amount equal to the cumulative fair value adjustment... -

Page 87

... gains and losses on these derivative contracts are recorded within other noninterest income in the Consolidated Statements of Income. In conjunction with the Processing Business Sale in 2009, the Bancorp received warrants and issued put options, which are accounted for as free-standing derivatives... -

Page 88

... by executing offsetting swap agreements with primary dealers. Revaluation gains and losses on interest rate, foreign exchange, commodity and other commercial customer derivative contracts are recorded as a component of corporate banking revenue in the Consolidated Statements of Income. The Bancorp... -

Page 89

...Income tax receivable Deferred tax asset Deposit with IRS Other Total 2009 $1,763 1,733 1,179 892 521 417 297 282 98 26 343 $7,551 2008 1,777 3,225 1,121 1,188 478 231 84 488 301 1,007 212 10,112 The Bancorp purchases life insurance policies on the lives of certain directors, officers and employees... -

Page 90

... was prepaid FDIC insurance totaling $223 million. Due to the increased frequency of bank failures during 2009, the Federal Deposit Insurance Corporation (FDIC) deposit insurance fund used a significant amount of its liquid assets to protect depositors of failed institutions. The FDIC's projections... -

Page 91

...of negative $16 million and additions for mark-tomarket adjustments on its hedged debt of $813 million. Parent Company Long-Term Borrowings In April 2008, the Bancorp issued $750 million of senior notes to third party investors. The senior notes bear a fixed rate of interest of 6.25% per annum. The... -

Page 92

... to sell mortgage loans Noncancelable lease obligations Capital commitments for private equity investments Capital lease obligations Capital expenditures Purchase obligations 90 Fifth Third Bancorp Commitments to extend credit Commitments to extend credit are agreements to lend, typically having... -

Page 93

...entered into a limited number of agreements for work related to banking center construction and to purchase goods or services. Contingent Liabilities Private mortgage reinsurance For certain mortgage loans originated by the Bancorp, borrowers may be required to obtain private mortgage insurance (PMI... -

Page 94

...million of commercial loans at par from the QSPE under the LAPA. Fair value adjustments of $3 million were recorded on these loans upon repurchase. There were no LAPA purchases in 2009. As of December 31, 2009 and 2008, there were no outstanding balances on the line of credit from the Bancorp to the... -

Page 95

... policies and procedures covering related party transactions to principal shareholders, directors and executives of the Bancorp. These procedures cover transactions such as employee-stock purchase loans, personal lines of credit, residential secured loans, overdrafts, letters of credit and increases... -

Page 96

... 2007 35.0 1.5 1.4 (5.0) (2.5) .1 (.5) 30.0 Tax-exempt income in the rate reconciliation table includes interest on municipal bonds, interest on tax-exempt lending, income/charges on life insurance policies held by the Bancorp, and certain gains on sales of leases. During 2009, the Bancorp notified... -

Page 97

...tax expense for 2008 and 2007. The Bancorp is in the process of filing amended state income tax returns to reflect that settlement. Statutes of Limitations remain open for tax years 2004-2009 and on a limited basis from 1998 through 2003. The Bancorp is currently addressing non-leasing items as part... -

Page 98

... traded funds: Money market funds International funds Commodity funds Total mutual & exchange traded funds Debt securities: U.S Treasury obligations U.S. Govt. agencies (c) Agency mortgage backed Corporate bonds (d) Total debt securities Total plan assets (a) (b) (c) (d) For further information... -

Page 99

...-average asset allocations by asset category for 2009 and 2008: Targeted Weighted-average asset allocation range Equity securities Bancorp common stock Total equity securities (a) 70 - 80% Total fixed income securities 20 - 25 Cash 0-5 Total (a) Includes mutual and exchange traded funds. 2009 71... -

Page 100

... included in net income Net unrealized gains on cash flow hedge derivatives Defined benefit plans: Net prior service cost Net actuarial loss Defined benefit plans, net Total 2008 Unrealized holding gains on available-for-sale securities arising during period Reclassification adjustment for net gains... -

Page 101

... of preferred shares, Series D, E Stock-based awards exercised, including treasury shares issued Restricted stock grants Shares issued in business combinations Employee stock ownership through benefit plans Shares at December 31, 2008 Issuance of common shares Common Stock Value Shares $1,295... -

Page 102

... or market conditions as defined by the plan. During 2009, the Bancorp's Board of Directors approved the use of phantom stock units as part of its compensation for executives. The phantom stock units were issued under the Bancorp's Incentive Compensation Plan. The number of phantom 100 Fifth Third... -

Page 103

... grant-date fair value of stock options granted for the years ended 2008 and 2007 was $2.87 and $7.39 per share, respectively. The total intrinsic value of options exercised was immaterial to the Bancorp's Consolidated Financial Statements in 2009. The total intrinsic value of options exercised... -

Page 104

...of credit Affordable housing investments impairment Marketing Professional services fees Intangible asset amortization Postal and courier Insurance Travel Operating lease Recruitment and education Supplies OREO expense Data processing Visa litigation reserve Other Total 102 Fifth Third Bancorp 2009... -

Page 105

... per diluted share for the years ended December 31: 2009 Average Shares Per Share Amount 2008 Average Shares Per Share Amount 2007 Average Shares Per Share Amount (in millions, except per share data) Earnings per share: Net income (loss) Dividends on preferred stock Net income (loss) available to... -

Page 106

... inputs reflect the Bancorp's own assumptions about what market participants would use to price the asset or liability. The inputs are developed based on the best information available in the circumstances, which might include the Bancorp's own financial data such as internally developed pricing... -

Page 107

... in the market for these types of securities at December 31, 2009, the Bancorp measured fair value using a discount rate based on the assumed holding period. Residential mortgage loans held for sale and held for investment For residential mortgage loans held for sale, fair value is estimated based... -

Page 108

...in the Consolidated Statements of Income as follows: ($ in millions) Interest income Corporate banking revenue Mortgage banking net revenue Other noninterest income Securities losses, net Other noninterest expense Total gains 106 Fifth Third Bancorp 2009 $11 1 (7) 20 (5) (4) $16 2008 $7 1 21 5 (23... -

Page 109

... quarter of 2008, the Bancorp transferred certain commercial, commercial mortgage and commercial construction loans from the portfolio to loans held for sale. During 2009, the Bancorp recorded $56 million in impairment adjustments on these loans. As of December 31, 2009, loans with a fair value... -

Page 110

... from banks, FHLB and FRB restricted stock, other shortterm investments, certain deposits (demand, interest checking, savings, money market and foreign office deposits), and federal funds purchased. Fair values for other time deposits, certificates of deposit $100,000 and over, and other short-term... -

Page 111

... TO CONSOLIDATED FINANCIAL STATEMENTS 28. CERTAIN REGULATORY REQUIREMENTS AND CAPITAL RATIOS The principal source of income and funds for the Bancorp (parent company) are dividends from its subsidiaries. During 2009, the amount of dividends the bank subsidiaries could pay to the Bancorp without... -

Page 112

...increase in undistributed earnings of subsidiaries 869 (1,903) Net Income (Loss) $737 (2,113) Condensed Balance Sheets (Parent Company Only) As of December 31 Assets Cash Short-term investments Loans to subsidiaries Investment in subsidiaries Goodwill Other assets Total Assets Liabilities Commercial... -

Page 113

...the corporate level by employing an FTP methodology. This methodology insulates the business segments from interest rate volatility, enabling them to focus on serving customers through loan originations and deposit taking. The FTP system assigns charge rates and credit rates to classes of assets and... -

Page 114

... loan and lease losses 23 Noninterest income: Service charges on deposits 196 Card and processing revenue 28 Mortgage banking net revenue Corporate banking revenue 357 Investment advisory revenue 7 Gain on sale of Processing Business Other noninterest income 20 Securities gains (losses), net 1 Total... -

Page 115

... income: Service charges on deposits Card and processing revenue Mortgage banking net revenue Corporate banking revenue Investment advisory revenue Other noninterest income Securities gains (losses), net Total noninterest income Noninterest expense: Salaries, wages and incentives Employee benefits... -

Page 116

...'s Form 10-K. 10-K Cross Reference Index PART I Item 1. Business 15-16, 115-121 Employees 30 Segment Information 32-36, 111-113 Average Balance Sheets 27 Analysis of Net Interest Income and Net Interest Income Changes 26-28 Investment Securities Portfolio 40-41, 75-76 Loan and Lease Portfolio... -

Page 117

... a wide variety of checking, savings and money market accounts, and credit products such as credit cards, installment loans, mortgage loans and leases. Fifth Third Bank has deposit insurance provided by the Federal Deposit Insurance Corporation (FDIC) through the Deposit Insurance Fund. Refer to... -

Page 118

... law. The federal and state laws and regulations that are applicable to banks regulate, among other matters, the scope of their business, their investments, their reserves against deposits, the timing of the availability of 116 Fifth Third Bancorp deposited funds, the amount of loans to individual... -

Page 119

...-income neighborhoods. Fifth Third Bank, Fifth Third Bank (Michigan) and Fifth Third Bank, N.A. all received a "Satisfactory" CRA rating. Because the Bancorp is an FHC, with limited exceptions, the Bancorp may not commence any new financial activities or acquire control of any companies engaged... -

Page 120

... adopted a customer information security program that has been approved by the Bancorp's Board of Directors (the "Board). The GLBA requires financial institutions to implement policies and procedures regarding the disclosure of nonpublic personal information about consumers to non-affiliated third... -

Page 121

... that restrict non-audit services that accountants may provide to their audit clients; (iii) additional corporate governance and responsibility measures, including the requirement that the chief executive officer and chief financial officer of a public company certify financial statements; (iv) the... -

Page 122

... the Federal Reserve Bank of New York is authorized to lend up to $200 billion to eligible owners of certain AAA-rated asset backed securities backed by newly and recently originated auto loans, credit card loans, student loans, and SBA-guaranteed small business loans, and commercial mortgage-backed... -

Page 123

... leased. The banking centers are located in the states of Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, North Carolina, West Virginia, Pennsylvania, Missouri, and Georgia. The Bancorp's significant owned properties are owned free from mortgages and major encumbrances. Fifth Third... -

Page 124

... 26, 2010 are listed below along with their business experience during the past 5 years: Kevin T. Kabat, 53. Chairman, President and Chief Executive Officer of the Bancorp since June 2008, June 2006 and April 2007, respectively. Previously, Mr. Kabat was Executive Vice President of the Bancorp since... -

Page 125

... to the S&P 500 Stock and the S&P Banks indices. FIFTH THIRD BANCORP VS. MARKET INDICES 5 Year Return 40.00% 20.00% 0.00% Total Return Index -20.00% -40.00% -60.00% -80.00% -100.00% 2004 2005 2006 2007 2008 2009 FITB S&P 500 (SPX) S&P Banks Index (BIX) 10 Year Return 60.00% 40... -

Page 126

... Registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on March 26, 1997. Amended and Restated Trust Agreement, dated as of March 20, 1997 of Fifth Third Capital Trust II, among Fifth Third Bancorp, as Depositor, Wilmington Trust Company, as Property Trustee, and... -

Page 127

... Statement on Form 8-A filed with the Securities and Exchange Commission on August 8, 2007. Certificate Representing 400 7.25% Trust Preferred Securities of Fifth Third Capital Trust V (liquidation amount $25 per Trust Preferred Security). Incorporated by reference to Registrant's Quarterly Report... -

Page 128

... to Purchase up to 43,617,747 shares of Common Stock. Incorporated by reference to Exhibit 4.1 of the Registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on December 31, 2008. Fifth Third Bancorp Unfunded Deferred Compensation Plan for Non-Employee Directors... -

Page 129

ANNUAL REPORT ON FORM 10-K 10.26 Peninsula Bank of Central Florida Key Employee Stock Option 10.44 Warrant dated June 30, 2009 issued by FTPS Holding, LLC to Fifth 10.27 10.28 10.29 10.30 10.31 10.32 10.33 10.34 10.35 10.36 10.37 10.38 10.39 10.40 10.41 Plan. Incorporated by ... -

Page 130

..., thereunto duly authorized. FIFTH THIRD BANCORP Registrant Kevin T. Kabat Chairman, President and CEO Principal Executive Officer February 26, 2010 Pursuant to requirements of the Securities Exchange Act of 1934, this report has been signed on February 26, 2010 by the following persons on behalf of... -

Page 131

... Federal funds sold and interest-bearing deposits in banks are combined in other short-term investments in the Consolidated Financial Statements. (b) Adjusted for accounting guidance relating to the calculation of earnings per share, which was adopted retroactively on January 1, 2009. (c) Adjusted... -

Page 132

... D. Hoover Principal Hoover and Associates, LLC Mitchel D. Livingston, Ph.D. Vice President for Student Affairs and Services University of Cincinnati Hendrik G. Meijer Co-Chairman & CEO Meijer, Inc. John J. Schiff, Jr. Chairman Cincinnati Financial Corporation & Cincinnati Insurance Company Dudley... -

Page 133

...Banking Centers ATMs Full-Time Equivalent Employees 795,068 1,309 2,358 20,998 577,387 1,307 2,341 21,476 532,672 1,227 2,211 21,683 dEPOsIt and dEbt RatIngs as OF 12/31/09 mOOdy's P-2 Baa1 standaRd & POOR's A-2 BBB FItcH F1 A- dbRs R-1 (low) A FIFtH tHIRd bancORP Short Term Senior Debt FIFtH... -

Page 134

WWW. 53 .COM