Federal Express 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 Federal Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

MANAGEMENT’S DISCUSSION AND ANALYSIS

FedEx SupplyChain Systems, formerly included in the FedEx Services

reporting segment, was realigned to become part of the FedEx Express

reporting segment. Prior year amounts have not been reclassified

to conform to the current year segment presentation because these

reclassifications are immaterial.

The FedEx Services segment provides direct and indirect support to

our transportation businesses, and we allocate all of the net operat-

ing costs of the FedEx Services segment (including the net operating

results of FedEx Office) to reflect the full cost of operating our

transportation businesses in the results of those segments. Within

the FedEx Services segment allocation, the net operating results of

FedEx Office are allocated to FedEx Express and FedEx Ground. The

allocations of net operating costs are based on metrics such as relative

revenues or estimated services provided. We believe these allocations

approximate the net cost of providing these functions. We review and

evaluate the performance of our transportation segments based on

operating income (inclusive of FedEx Services segment allocations).

For the FedEx Services segment, performance is evaluated based on

the impact of its total allocated net operating costs on our transporta-

tion segments.

The operating expenses line item “Intercompany charges” on the

accompanying unaudited financial summaries of our transportation

segments reflects the allocations from the FedEx Services segment to

the respective transportation segments. The “Intercompany charges”

caption also includes charges and credits for administrative services

provided between operating companies and certain other costs such

as corporate management fees related to services received for general

corporate oversight, including executive officers and certain legal and

finance functions. We believe these allocations approximate the net

cost of providing these functions.

Effective August 1, 2009, approximately 3,600 employees (predomi-

nantly from the FedEx Freight segment) were transferred to entities

within the FedEx Services segment. This internal reorganization further

centralized most customer support functions, such as sales, customer

service and information technology, into our shared services organiza-

tions. While the reorganization had no impact on the net operating

results of any of our transportation segments, the net intercompany

charges to our FedEx Freight segment increased significantly with cor-

responding decreases to other expense captions, such as salaries and

employee benefits. The impact of this internal reorganization to the

expense captions in our other segments was immaterial.

OTHER INTERSEGMENT TRANSACTIONS

Certain FedEx operating companies provide transportation and related

services for other FedEx companies outside their reportable segment.

Billings for such services are based on negotiated rates, which we

believe approximate fair value, and are reflected as revenues of the

billing segment. These rates are adjusted from time to time based

on market conditions. Such intersegment revenues and expenses are

eliminated in our consolidated results and are not separately identified

in the following segment information, because the amounts are

not material.

FEDEX EXPRESS SEGMENT

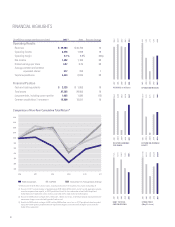

The following tables compare revenues, operating expenses, operat-

ing expenses as a percent of revenue, operating income and operating

margin (dollars in millions) for the years ended May 31:

Percent Change

2011 2010 2009

2011

2010

/ 2010

2009

/

Revenues:

Package:

U.S. overnight box $ 6,128 $ 5,602 $ 6,074 9(8)

U.S. overnight envelope 1,736 1,640 1,855 6(12)

U.S. deferred 2,805 2,589 2,789 8(7)

Total U.S. domestic

package revenue 10,669 9,831 10,718 9(8)

International priority 8,228 7,087 6,978 16 2

International domestic(1) 653 578 565 13 2

Total package revenue 19,550 17,496 18,261 12 (4)

Freight:

U.S. 2,188 1,980 2,165 11 (9)

International priority 1,722 1,303 1,104 32 18

International airfreight 283 251 369 13 (32)

Total freight revenue 4,193 3,534 3,638 19 (3)

Other(2) 838 525 465 60 13

Total revenues 24,581 21,555 22,364 14 (4)

Operating expenses:

Salaries and employee

benefits 9,183 8,402 8,217 92

Purchased transportaion 1,573 1,177 1,112 34 6

Rentals and landing fees 1,672 1,577 1,613 6(2)

Depreciation and

amortization 1,059 1,016 961 46

Fuel 3,553 2,651 3,281 34 (19)

Maintenance and repairs 1,353 1,131 1,351 20 (16)

Impairment and other

charges –– 260(3) –NM

Intercompany charges 2,043 1,940 2,103 5(8)

Other 2,917(4) 2,534 2,672 15 (5)

Total operating

expenses 23,353 20,428 21,570 14 (5)

Operating income $ 1,228 $ 1,127 $ 794 942

Operating margin 5.0% 5.2% 3.6% (20)bp 160bp

(1) International domestic revenues include our international intra–country domestic express

operations.

(2) Other revenues include FedEx Trade Networks and, beginning in the second quarter of 2010,

FedEx SupplyChain Systems.

(3) Represents charges associated with aircraft–related asset impairments and other charges

primarily associated with aircraft–related lease and contract termination costs and employee

severance.

(4) Includes a $66 million legal reserve associated with the ATA Airlines lawsuit.