Federal Express 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Federal Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

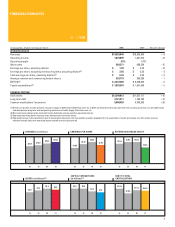

MESSAGE FROM THE CFO

FedEx Corporation’s financial performance improved significantly

during the first half of fiscal year 2001 as our new go-to-market

strategies generated volume and yield growth at FedEx Express

and FedEx Ground. The second half of the year was more finan-

cially challenging, however, as our package business was

severely impacted by a rapidly slowing economy, particularly in

the high-tech and durable goods sectors. Despite these adverse

economic conditions, we made considerable progress toward

our financial goal of becoming cash flow positive. In fact, exclud-

ing the costs associated with our acquisition of American

Freightways, we attained net cash flow positive status last year

as we pursued the following strategies:

Portfolio Expansion

The acquisition of American Freightways and the formation of

FedEx Freight expanded and enhanced our already formidable

arsenal of supply chain solutions. Teamed with Viking Freight,

the largest Western regional less-than-truckload carrier,

American Freightways provides the perfect extension of our

increasingly popular less-than-truckload offering to virtually all

U.S. ZIP codes.

Yield Improvement

We continued to execute good yield management strategies in

FY01 even with a weakening economy and a slowdown in volume

growth. Package and freight yields improved as we continued

to manage our rate levels, customer diversity and volume and

freight mix. Since our yields, especially at FedEx Express, are not

quite as high as our primary competitor, we still have substantial

opportunity to leverage our industry-leading service offerings

and powerful and trusted brand to grow yields, revenues and

margins as the economy improves.

Cost Containment

We are proud that we were able to contain costs last year while

still providing the best service in the industry. Cost reduction

programs included a freeze on most hiring, substantially reduc-

ing bonus incentive compensation related to profitability and

a comprehensive reduction in discretionary expenses at all

operating companies. These steps will remain in place until our

profitability returns to acceptable levels.

Capital Discipline

For the third year in a row, we managed to lower our capital

expenditures as both a percentage of revenue and on an

absolute basis, while at the same time expanding our network

and improving service. Because of the sluggish growth of the

economy this past year, we thoroughly reviewed our long-term

capacity needs. As a result, we adjusted our aircraft programs to

better match capacity to customer demand as well as maximize

profitability now and in the future.

The outlook for FY02 is certainly challenging, but we will con-

tinue our efforts to penetrate the small- and medium-sized

customer base, develop our new alliance with the U.S. Postal

Service, expand our FedEx Home Delivery service and promote

our new FedEx Freight network. All the while, we will remain

focused on cost containment and capital expenditure discipline

in order to achieve positive cash flow. With the unmatched serv-

ice of dedicated employees and contractors worldwide, we will

continue to successfully overcome the challenges of today’s envi-

ronment and position our company for future growth and superior

margins, returns and cash flows as the economy recovers.

Alan B. Graf, Jr.

Executive Vice President and Chief Financial Officer