Federal Express 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Federal Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FedEx Corporation

9

cash flow, continue strict controls over discretionary spending

and implement other measures to reduce commitments for lift

capacity in excess of our needs (see “FedEx Express – Outlook”).

Cash incentive programs for 2002 have been substantially

reduced for most employees, including all members of senior

management, and these programs will begin to pay out only if we

exceed our 2002 financial targets. However, anticipated reduc-

tions in 2002 incentive costs are expected to be offset by higher

pension expense resulting from changes in discount rates and

unrealized market declines in pension assets.

Despite the near-term economic outlook, we continue to believe

that we are well positioned for long-term growth. In January 2001,

FedEx Express entered into a business alliance with the U.S.

Postal Service, which is expected to generate revenue of approx-

imately $7 billion over seven years and is consistent with our

goals of improving margins, cash flows and returns. The alliance

consists of two service agreements. In the first nonexclusive

agreement, FedEx Express will install drop boxes at U.S. Post

Offices, and in the second agreement, FedEx Express will provide

airport-to-airport transportation of Priority, Express and First

Class Mail. On June 18, 2001, we officially launched the national

rollout of FedEx Drop Boxes at post offices throughout the coun-

try, implementing the first of these service agreements. FedEx

Express is scheduled to begin the agreement for air transporta-

tion in late August 2001. In 2002, we will also continue the busi-

ness alliance in Europe with La Poste, established in 2001.

The acquisition of American Freightways substantially enhanced

our overall transportation portfolio by enabling us to offer a

regional LTL service virtually everywhere in the United States.

During 2002, we will focus on increasing volumes and yields in

our core high-quality next- and second-day regional freight serv-

ices. In addition, we will continue to expand our FedEx Home

Delivery network and will continue to pursue new service and

business opportunities, such as those mentioned above, in sup-

port of our long-term growth goals.

Actual results for 2002 will depend upon a number of factors,

including the extent and duration of the current economic down-

turn, our ability to match capacity with volume levels and our abil-

ity to effectively implement our new service and growth initiatives.

See “Forward-Looking Statements” for a more complete descrip-

tion of potential risks and uncertainties that could affect our

future performance.

Recent Accounting Pronouncements

We adopted Statement of Financial Accounting Standards

No. (“SFAS”) 133, “Accounting for Derivative Instruments and

Hedging Activities” (as amended by SFAS 137 and SFAS 138) at

the beginning of 2002. The adoption of this Statement will not

have a material effect on our financial position or results of oper-

ations for 2002. Because of our previously mentioned fourth quar-

ter 2001 actions regarding jet fuel hedging contracts, none of the

jet fuel hedging contracts held at May 31, 2001 qualify for hedge

accounting treatment. However, our usual jet fuel hedging pro-

gram does qualify for cash flow hedge accounting treatment

under which changes in the fair market value of these contracts

are recorded to Accumulated Other Comprehensive Income.

During July 2001, SFAS 142, “Goodwill and Other Intangible

Assets” was issued by the Financial Accounting Standards

Board. Under SFAS 142, goodwill amortization ceases when the

new standard is adopted. The new rules also require an initial

goodwill impairment assessment in the year of adoption and

annual impairment tests thereafter. We are permitted under the

rules to adopt this Statement effective June 1, 2001 or defer

adoption until June 1, 2002. Once adopted, goodwill amortization

of approximately $36 million on an annualized basis will cease.

We have not yet determined if any impairment charges will result

from the adoption of this Statement. At this time, we anticipate

the adoption of these rules, effective as of June 1, 2001.

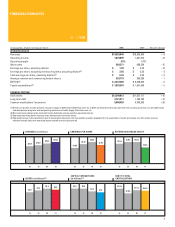

REPORTABLE SEGMENTS

The formation of FedEx Services, effective June 1, 2000, changed

the way certain costs are captured and allocated between our

operating segments. For example, salaries, wages and benefits,

depreciation and other costs for the sales, marketing and infor-

mation technology departments previously incurred at FedEx

Express and FedEx Ground are now allocated to these operating

segments and are included in the line item “Intercompany

charges” on the accompanying financial summaries of our

reportable segments. Consequently, certain segment expense

data presented is not comparable to prior periods. We believe the

total amounts allocated to the business segments reasonably

reflect the cost of providing such services.