Federal Express 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Federal Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FedEx Corporation

11

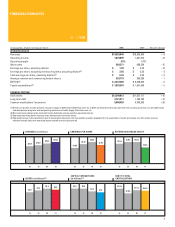

Revenues

Total package revenue increased 5% for 2001, principally due to

increases in yields and IP volumes, partially offset by a decrease

in other revenue. Total package yield increased 5% as a result of

our continued yield management strategy, which includes limiting

growth of less profitable business and recovering the higher cost

of fuel through a fuel surcharge. The February 2001 domestic rate

increases also contributed to the higher yield.

While the IP volume growth rate was 8% for 2001, this rate was

significantly impacted by weakness in the Asian economy in the

last half of the year. Average daily volumes for that region have

slowed from a 26% year-over-year growth rate in the first quarter

of 2001 to a 1% year-over-year decline in the fourth quarter of

2001. For the year, FedEx Express experienced IP average daily

volume growth rates of 24% and 12% in the European and Asian

markets, respectively. In the U.S., average daily domestic pack-

age volume declined 1% year over year due to the economic soft-

ness experienced in the last half of 2001.

Total freight revenue increased slightly in 2001 due to significantly

improved yields in U.S. freight, partially offset by declines in

domestic freight volume and international freight volume and yield.

Other revenue included Canadian domestic revenue, charter

services, logistics services, sales of hushkits and other. As

expected, revenue from hushkit sales, which has continued to

decline over the past few years, was negligible in 2001.

In 2000, total package revenue for FedEx Express increased 8%,

principally due to increases in international package volume and

yield. List price increases, including an average 2.8% domestic

rate increase in March 1999, the fuel surcharges implemented in

the second half of the year, an ongoing yield management pro-

gram and a slight increase in average weight per package, all

contributed to the increases in yields in 2000. While growth in

U.S. domestic package volume was lower than anticipated, the

higher-yielding IP services experienced strong growth, par-

ticularly in Asia and Europe. Total freight revenue increased

in 2000 due to higher average daily pounds and improved yields

in U.S. freight, offset by declines in international freight pounds.

Operating Income

Excluding the fourth quarter charges related to aircraft, FedEx

Express operating income increased 6% in 2001, despite the

slowdown in revenue growth. Increased fuel expense reflects

a 17% increase in average jet fuel price per gallon, which con-

tributed to a negative impact of approximately $150 million,

including the results of jet fuel hedging contracts entered into to

mitigate some of the increased jet fuel costs. The effect of higher

fuel costs on operating income was fully offset by a 4% fuel sur-

charge, in effect since April 1, 2000. Operating income was favor-

ably affected by reduced variable compensation and pension

costs, coupled with intensified cost controls over discretionary

spending. The decrease in maintenance and repairs expense pri-

marily reflects fewer aircraft engine maintenance events due to

the timing of scheduled maintenance and favorable negotiated

rates with vendors.

Operating income increased 3% in 2000 despite higher fuel costs

and costs associated with the corporate realignment and reor-

ganization of the sales, marketing and information technology

functions. A 48% increase in average fuel price per gallon had a

negative impact of approximately $260 million on 2000 fuel costs,

including the results of jet fuel hedging contracts entered into to

mitigate some of the increased jet fuel costs. Fuel surcharges

implemented during 2000 partially offset the increase in 2000 fuel

costs. Maintenance and repairs increased in 2000 due to the tim-

ing of scheduled maintenance and a greater number of routine

cycle checks resulting from fleet usage and certain Federal

Aviation Administration directives.

Operating income in 1999 was negatively impacted by $81 million

in strike contingency costs and weakness in Asian markets.

Year-over-year comparisons were also affected by declining con-

tributions from sales of hushkits. Operating profit from these

sales declined $40 million in 2001 and $50 million in 2000.

Outlook

For 2002, U.S. domestic package volumes are expected to decline

slightly. We believe that IP package volumes will grow at approxi-

mately the same rate as 2001. New services, including the U.S.

Postal Service agreements, are expected to increase revenues

in 2002.

Operating margin for this segment is expected to decrease in

2002 (excluding the 2001 charges related to aircraft programs), as

increased pension and health care costs, costs associated with

new services and annual wage increases are not expected to be

completely offset by suspension of variable compensation pro-

grams and reductions in discretionary spending.