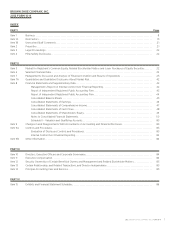

Famous Footwear 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Famous Footwear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16 2012 BROWN SHOE COMPANY, INC. FORM 10-K

We rely on foreign sources of production, which subjects our business to risks associated with international trade.

We rely on foreign sourcing for our footwear products primarily through third-party manufacturing facilities located in

China. At times, we are the exclusive customer of these third-party manufacturing facilities. As is common in the industry,

we do not have any long-term contracts with our third-party foreign manufacturers. Foreign sourcing is subject to

numerous risks, including trade relations, disease outbreaks, work stoppages, transportation delays, political instability,

foreign currency fluctuations, variable economic conditions, expropriation, nationalization, natural disasters, terrorist acts

and military conflict and changes in governmental regulations (including the U.S. Foreign Corrupt Practices Act and climate

change legislation). At the same time, potential changes in Chinese manufacturing preferences, including, but not limited

to the following, pose additional risk and uncertainty:

• Manufacturing capacity in China may shift from footwear to other industries with manufacturing margins that are

perceived to be higher.

• Growth in domestic footwear consumption in China could lead to a signicant decrease in factory space available

for the manufacture of footwear to be exported.

• Currently, many footwear manufacturers in China are facing labor shortages as migrant workers seek better wages

and working conditions in other industries and vocations.

As a result of these risks, there can be no assurance that we will not experience reductions in the available production

capacity, increases in our manufacturing costs, late deliveries or terminations of our supplier relationships. Furthermore

these risks are compounded by the lack of diversification in the geographic location of our foreign sourcing and

manufacturing. With almost all of our supply originating in China, a substantial portion of our supply could be at risk in

the event of any negative development related to China.

Although we believe we could find alternative manufacturing sources for the products that we currently source from

China through other third-party manufacturing facilities in China or other countries, we may not be able to locate

alternative manufacturers on terms as favorable as our current terms, including pricing, payment terms, manufacturing

capacity, quality standards and lead times for delivery. In addition, there is substantial competition in the footwear

industry for quality footwear manufacturers. Accordingly, our future results will partly depend on our ability to maintain

positive working relationships with, and oer competitive terms to, our foreign manufacturers. If supply issues cause us

to be unable to provide products consistent with our standards or manufacture our footwear in a cost and time ecient

manner, our customers may cancel orders, refuse to accept deliveries or demand reductions in purchase prices, any of

which could have a material adverse eect on our business and results of operations.

Customer concentration and other trends in customer behavior may lead to a reduction in or loss of sales.

Our wholesale customers include national chains, department stores, independent retailers, mass merchandisers, online

retailers and catalogs. Several of our customers operate multiple department store divisions. Furthermore, we often

sell multiple types of licensed, branded and private-label footwear to these same national chains, department stores,

independent retailers, mass merchandisers, online retailers and catalogs. While we believe purchasing decisions in many

cases are made independently by the buyers and merchandisers of each of the customers, a decision by a significant

customer to decrease the amount of footwear products purchased from us could have a material adverse eect on our

business, financial condition or results of operations.

In addition, with the growing trend toward retail trade consolidation, we and our wholesale customers increasingly

depend upon a reduced number of key retailers whose bargaining strength is growing. This consolidation may result in the

following adverse consequences:

• Our wholesale customers may seek more favorable terms for their purchases of our products, which could limit our

ability to raise prices, recoup cost increases or achieve our profit goals.

• The number of stores that carry our products could decline, thereby exposing us to a greater concentration of accounts

receivable risk and negatively impacting our brand visibility.

We also face the following risks with respect to our customers:

• Our customers could develop in-house brands or utilize a higher mix of private label footwear products, which would

negatively impact our sales.

• As we sell our products to customers and extend credit based on an evaluation of each customer’s nancial condition,

the financial diculties of a customer could cause us to stop doing business with that customer, reduce our business

with that customer or be unable to collect from that customer.

• If any of our major wholesale customers experiences a signicant downturn in its business or fails to remain committed

to our products or brands, then these customers may reduce or discontinue purchases from us.

• Retailers are directly sourcing more of their products directly from manufacturers overseas and reducing their reliance

on wholesalers, which could have a material adverse eect on our business and results of operations.