Exxon 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Exxon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

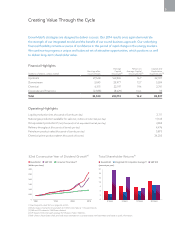

Financial Highlights

(millions of dollars, unless noted)

Earnings after

Income Taxes

Average

Capital

Employed

(1)

Return on

Average Capital

Employed (%)

(1)

Capital and

Exploration

Expenditures

(1)

Upstream 2 7, 5 4 8 164,965 16.7 32,727

Downstream 3,045 23,977 12.7 3,034

Chemical 4,315 22,197 19.4 2,741

Corporate and Financing (2,388)(8,029)N.A. 35

Total 32,520 203,110 16.2 38,537

Operating Highlights

Liquids production (net, thousands of barrels per day) 2,111

Natural gas production available for sale (net, millions of cubic feet per day) 11,145

Oil-equivalent production

(2)

(net, thousands of oil-equivalent barrels per day) 3,969

Refinery throughput (thousands of barrels per day) 4,476

Petroleum product sales (thousands of barrels per day) 5,875

Chemical prime product sales

(1)

(thousands of tonnes) 24,235

32nd Consecutive Year of Dividend Growth(3)

(dollars per share)

ExxonMobil S&P 500 Consumer Price Index(4)

(1) See Frequently Used Terms on pages 44 and 45.

(2) Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels.

(3) S&P and CPI indexed to 1982 Exxon dividend.

(4) CPI based on historical yearly average from Bureau of Labor Statistics.

(5) BP, Chevron, Royal Dutch Shell, and Total values estimated on a consistent basis with ExxonMobil and based on public information.

Eric Whetstone • Whetstone Design

EDITOR

Nick Berthiaux • Investor Relations

Exxon Mobil Corporation, Irving, TX

Carol Zuber-Mallison • ZM Graphics, Inc.

studio/cell: 214-906-4162 • fax: 817-924-7784

ATTENTION: OWNER VERSION

APPROVED BY

Feb. 10, 2015

FILE INFO

LAST FILE CHANGE MADE BY

C S05A 14XOM-

DividendGrowth.ai

IN F&O ON PAGE

IN SAR ON PAGE

Includes link file

3.00

2.50

2.00

1.50

1.00

0.50

01994 20041982

2014

21

18

15

12

9

6

3

0

Total Shareholder Returns(1)

(percent per year)

ExxonMobil S&P 500Integrated Oil Competitor Average(5)

20 Years

10 Years5 Years3 Years

Eric Whetstone • Whetstone Design

EDITOR

Nick Berthiaux • Investor Relations

Exxon Mobil Corporation, Irving, TX

Carol Zuber-Mallison • ZM Graphics, Inc.

studio/cell: 214-906-4162 • fax: 817-924-7784

ATTENTION: OWNER VERSION

APPROVED BY

Feb. 10, 2015

FILE INFO

LAST FILE CHANGE MADE BY

C S05B 14XOM-

ShrhldrReturns.ai

IN F&O ON PAGE

IN SAR ON PAGE

Includes link file

ExxonMobil’s strategies are designed to deliver success. Our 2014 results once again demonstrate

the strength of our integrated model and the benefit of our sound business approach. Our underlying

financial flexibility remains a source of confidence in this period of rapid change in the energy markets.

We continue to progress a unique and balanced set of attractive opportunities, which positions us well

to deliver long-term shareholder value.

Creating Value Through the Cycle

5