Exxon 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Exxon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We delivered solid financial and operating results despite

challenging and volatile economic and geopolitical conditions,

as highlighted by earnings of $32.5 billion and an industry-leading

return on capital employed of 16.2 percent.

ExxonMobil is dedicated to generating long-term shareholder value. We recognize the nature and risk of the commodities

we produce and have positioned our businesses to be successful throughout the business cycle. We provide industry

leadership and innovative technologies to meet the world’s greatest challenge – supplying the energy needed to improve

and sustain the lives of billions of people while protecting the environment for future generations. Our business approach

enables us to maintain strong financial results throughout a cyclical business environment and remain the partner of

choice for resource owners across the energy value chain. As you will read in the coming pages, our success is achieved

through our operational excellence, project execution capabilities, and the application of new technologies, underpinned

by strong financial flexibility, investment discipline, and a world-class workforce.

Results from 2014 reflect our continued ability to capitalize on the strength of our integrated businesses and the talents

of the 75,000 men and women who work for ExxonMobil. Our people are committed to the highest standards of business

conduct and integrity in the pursuit of premier results.

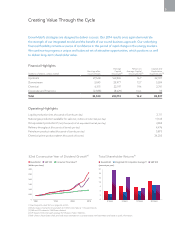

We delivered solid financial and operating results despite challenging and volatile economic and geopolitical conditions,

as highlighted by earnings of $32.5 billion and an industry-leading return on average capital employed of 16.2 percent.

Production of 4 million oil-equivalent barrels per day was in line with our plans as we added new volumes from project

start-ups and work programs. We invested in attractive opportunities with capital and exploration expenditures of

$38.5 billion. Cash flow from operations remained strong, enabling us to achieve shareholder distributions of $23.6 billion

in the form of dividends and share purchases to reduce shares outstanding. Over the past five years, ExxonMobil has

distributed an industry-leading $128 billion to shareholders, while maintaining a strong balance sheet.

In achieving these results, we maintain an unwavering

commitment to operational excellence and effective risk

management that delivered strong environmental results

and best-ever safety performance in 2014. We know that

effective management of risk is an imperative to achieving

our vision that Nobody Gets Hurt.

We continue to successfully advance major resource development projects in the Upstream. ExxonMobil remains on target

to grow production to 4.3 million oil-equivalent barrels per day by 2017, while maximizing profitability derived from resource

quality, volume mix, improved fiscal terms, and reduced exposure to lower-margin barrels.

Over the past year, we completed eight new major projects with more than 250 thousand oil-equivalent barrels per day

of working interest production capacity. Our liquefied natural gas project in Papua New Guinea represents one of several

significant achievements and underscores ExxonMobil’s expertise in major project development. The facilities were completed

ahead of schedule and ramped up to full operational capacity in just three months. The benefits from the project have

the potential to transform the country’s economy, boosting GDP and revenues for social and economic programs. Other

successful projects completed this year include Arkutun-Dagi in Russia; Cold Lake Nabiye Expansion in Canada; Lucius in the

Gulf of Mexico; and Cravo-Lirio-Orquidea-Violeta (CLOV) in Angola.

In the United States, ExxonMobil is increasing development activities to grow higher-margin liquids production across the

Permian, the Bakken, and the Ardmore/Marietta plays. We continue to add attractive acreage to our portfolio and implement

advanced technologies to improve well productivity and capture cost efficiencies.

New project start-ups such as Banyu Urip in Indonesia; Kearl Expansion in Canada; and Hadrian South in the Gulf of Mexico

will add significant volume in 2015. We also anticipate new production in the Gulf of Mexico, the United Arab Emirates,

Australia, Kazakhstan, and Canada in 2016 and 2017.

As we look beyond 2017, ExxonMobil has a deep and diverse portfolio of opportunities around the world, and a total resource

base of more than 92 billion oil-equivalent barrels. We have unparalleled optionality to select and invest in only the most

attractive resource development projects.

In the Downstream and Chemical businesses, we continue to capture significant benefits by diversifying feedstocks through

our flexible and integrated system, driving operational efficiencies, expanding logistics capabilities, and maximizing sales of

higher-value lubricant, diesel, and chemical products.

To Our Shareholders

EXXONMOBIL 2014 SUMMARY ANNUAL REPORT

2