Eversource 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

By remaining faithful to our core mission to safely deliver reliable

energy and superior customer service, Eversource has been able to

consistently provide significant value to our customers, communities

and shareholders.

We have been thoughtful and innovative when it comes to meeting

our customers’ evolving needs, delivering top-quartile reliability and

addressing New England’s energy challenges. Our approach of

smart system investments, customer service excellence and

conservative financial management has enhanced our customer

service, provided strong leadership in the industry, and delivered a

very attractive level of earnings and dividend growth.

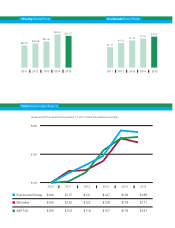

In 2015, we reported recurring earnings of $2.81 per share,

compared with recurring earnings of $2.65 in 2014, an increase of

six percent driven largely by higher retail electric and transmission

revenue, and effective cost discipline. That growth is consistent with

our longer term projected annual earnings per share growth rate of

five to seven percent, which is one of the most attractive growth

rates in the electric utility industry.

Our earnings growth also supports solid dividend growth for our

shareholders. In 2015, we raised our common dividend by 6.4

percent to an annualized rate of $1.67 per share, and in February

2016 we announced a 6.6 percent increase in the common dividend

to an annualized rate of $1.78 per share.

Strong earnings and dividend growth have benefited our share price.

Over the past five years, Eversource has provided a cumulative total

return to our shareholders of 89 percent, which compares favorably

to a 71 percent total five-year return for the Edison Electric Institute

Index and an 81 percent total return for the S&P 500.

We are achieving these returns while at the same time effectively

managing our financial and operating risks. In April, Standard and

Poor's Ratings Services raised its corporate credit rating for the

Eversource family of companies to “A” with a stable outlook, the top

rating among our electric utility peers. Also in 2015, Moody’s

Investor Services and Fitch Ratings raised the outlook on multiple

Eversource operating subsidiaries to “positive” from “stable.” Strong

credit ratings lower interest costs, benefiting both customers and

shareholders.

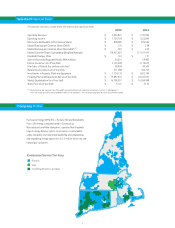

Our strong financial performance has been a direct result of our

outstanding operating performance, highlighted by our best year

ever for electric reliability. Since 2011, Eversource’s frequency of

electric service interruptions, and the amount of time it takes to

restore customers’ power when outages occur, have both decreased

by about 40 percent. We have established an improved

enterprise-wide organizational model for our operations team, and

have successfully implemented a state-of-the-art electric

distribution management platform. This platform automates the

control and operation of our grid using self-healing technology,

enhances customer communication, and enables a consistent

customer experience across all three states. We continue to invest

heavily in our electric distribution system, with capital expenditures

totaling a record $783 million in 2015, up nearly 8 percent from

2014 levels. That level of investment, coupled with our ongoing

implementation of best practices and procedures, is driving our

performance steadily higher within the top quartile of our industry.

This performance was particularly impressive during arguably one of

the worst winters in history. Record-breaking snowstorm after

snowstorm in early 2015 battered Boston, Cape Cod and the island

of Martha’s Vineyard, as well as parts of Connecticut and New

Hampshire. Our dedicated team of employees and “one company”

coordination across all three states served to create an exceptional

storm response.

Shareholder Letter