Eversource 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

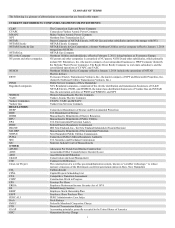

The rates established by the PURA for CL&P are comprised of the following:

An electric generation services charge (GSC), which recovers energy-related costs incurred as a result of providing electric generation

service supply to all customers that have not migrated to competitive energy suppliers. The GSC is adjusted periodically and reconciled

semi-annually in accordance with the directives of PURA.

A revenue decoupling adjustment (effective December 1, 2014) that reconciles the amounts recovered from customers, on an annual basis,

to the distribution revenue requirement approved by the PURA in its last rate case, which currently is an annual amount of $1.041 billion.

A distribution charge, which includes a fixed customer charge and a demand and/or energy charge to collect the costs of building and

expanding the infrastructure to deliver power to its destination, as well as ongoing operating costs to maintain the infrastructure.

A federally-mandated congestion charge (FMCC), which recovers any costs imposed by the FERC as part of the New England Standard

Market Design, including locational marginal pricing, locational installed capacity payments, and any costs approved by PURA to reduce

these charges. The FMCC also recovers costs associated with CL&P's system resiliency program. The FMCC is adjusted periodically and

reconciled semi-annually in accordance with the directives of PURA.

A transmission charge that recovers the cost of transporting electricity over high voltage lines from generating plants to substations,

including costs allocated by ISO-NE to maintain the wholesale electric market.

A competitive transition assessment charge (CTA), assessed to recover stranded costs associated with electric industry restructuring such as

various IPP contracts. The CTA is reconciled annually to actual costs incurred and reviewed by PURA, with any difference refunded to, or

recovered from, customers.

A systems benefits charge (SBC), established to fund expenses associated with: various hardship and low income programs; a program to

compensate municipalities for losses in property tax revenue due to decreases in the value of electric generating facilities resulting directly

from electric industry restructuring; and unfunded storage and disposal costs for spent nuclear fuel generated before 1983. The SBC is

reconciled annually to actual costs incurred and reviewed by PURA, with any difference refunded to, or recovered from, customers.

A Clean Energy Fund charge, which is used to promote investment in renewable energy sources. Amounts collected by this charge are

deposited into the Clean Energy Fund and administered by the Clean Energy Finance and Investment Authority. The Clean Energy Fund

charge is set by statute and is currently 0.1 cent per kWh.

A conservation charge, comprised of a statutory rate established to implement cost-effective energy conservation programs and market

transformation initiatives, plus a conservation adjustment mechanism charge to recover the residual energy efficiency spending associated

with the expanded energy efficiency costs directed by the Comprehensive Energy Strategy Plan for Connecticut.

As required by regulation, CL&P, jointly with UI, entered into the following contracts whereby UI will share 20 percent and CL&P will share 80

percent of the costs and benefits (CL&P's portion of these costs are either recovered from, or refunded to, customers through the FMCC charge):

Four CfDs (totaling approximately 787 MW of capacity) with three electric generation units and one demand response project, which

extend through 2026 and have terms of up to 15 years beginning in 2009. The capacity CfDs obligate both CL&P and UI to make or

receive payments on a monthly basis to or from the project and generation owners based on the difference between a set capacity price and

the capacity market prices that the project and generation owners receive in the ISO-NE capacity markets.

Three CfDs (totaling approximately 500 MW of peaking capacity) with three peaking generation units. The three peaker CfDs pay the

generation owners the difference between capacity, forward reserve and energy market revenues and a cost-of service payment stream for

30 years (including costs of plant operation and the prices that the generation owners receive for capacity and other products in the ISO-NE

markets.

Long-term commitments to purchase approximately 250 MW of wind power from a Maine wind farm and 20 MW of solar power from a

multi-site project in Connecticut. Both of these projects are expected to be operational by the end of 2016.

On December 17, 2014, PURA approved CL&P's application to amend customer rates, effective December 1, 2014, for a total distribution rate

increase of $134 million, which includes an authorized ROE of 9.02 percent for the first twelve month period and 9.17 percent thereafter. The

distribution rate increase included a revenue decoupling reconciliation mechanism effective December 1, 2014, and the recovery of 2011 and 2012

storm restoration costs and system resiliency costs. In addition, as part of the rate case, CL&P began recovering the 2013 storm costs and residual

2012 Storm Sandy costs over a seven-year period beginning December 1, 2014. As of December 31, 2014, all of CL&P's deferred storm costs have

been addressed by regulatory proceedings.

Sources and Availability of Electric Power Supply

As noted above, CL&P does not own any generation assets and purchases energy supply to serve its SS and LRS loads from a variety of competitive

sources through requests for proposals. CL&P periodically enters into full requirements contracts for the majority of SS loads for periods of up to

one year for its residential customers and small and medium commercial and industrial customers. CL&P is authorized to supply the remainder of