Eversource 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Northeast Utilities is now

2014 Annual Report

Table of contents

-

Page 1

2014 Annual Report Northeast Utilities is now -

Page 2

...323 $1.57 $36.07 $31.88 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 Total Shareholder Return (Assumes $100 invested on December 31, 2009 with all dividends reinvested) $250 $200 $150 $100 2009 Eversource Energy EEI Index S&P 500 $100 $100 $100 2010 $128 $107 $115 2011 $150 $128... -

Page 3

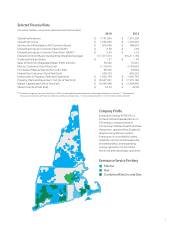

..., Massachusetts and New Hampshire, operates New England's largest energy delivery system. Eversource is committed to safety, reliability, environmental leadership and stewardship, and expanding energy options for its 3.6 million electricity and natural gas customers. Eversource Service Territory... -

Page 4

... of our business areas. The Eversource brand clearly states who we are in the New England market and gives us the opportunity to tell our customers what we stand for as a company. It represents our shared responsibility to meet our mission to deliver reliable energy and superior customer service all... -

Page 5

... partnership with Spectra Energy and National Grid on a new and unique project, Access Northeast, which will meet New England's current challenges head on. Through Access Northeast, Spectra will upgrade its existing natural gas transmission pipelines in New England and expand gas capacity to... -

Page 6

... like Boston Children's Hospital, the United Way and Special Olympics. Additionally, natural gas expansion for heating customers remains a key growth area for our business. In tandem with our work to expand capacity, we continue to answer our customers' demand to convert to natural gas. In 2014 we... -

Page 7

...Street Berlin, Connecticut 06037-1616 Telephone: (860) 665-5000 NSTAR ELECTRIC COMPANY (a Massachusetts corporation) 800 Boylston Street Boston, Massachusetts 02199 Telephone: (617) 424-2000 PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE (a New Hampshire corporation) Energy Park 780 North Commercial Street... -

Page 8

... which the following series are outstanding: 4.25% 4.78% Series Series NSTAR Electric Company, Public Service Company of New Hampshire and Western Massachusetts Electric Company each meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and each is therefore filing this... -

Page 9

... Massachusetts Electric Company, respectively. Northeast Utilities, The Connecticut Light and Power Company, NSTAR Electric Company, Public Service Company of New Hampshire, and Western Massachusetts Electric Company each separately file this combined Form 10-K. Information contained herein relating... -

Page 10

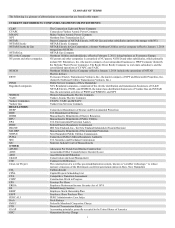

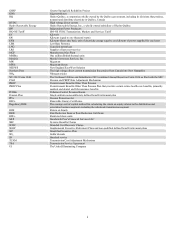

... merger with NU) NSTAR Electric Company NSTAR Electric & Gas Corporation, a former Northeast Utilities service company (effective January 1, 2014 merged into NUSCO) NSTAR Gas Company Northeast Utilities and subsidiaries, effective February 2, 2015, doing business as Eversource Energy NU parent and... -

Page 11

...Services, Inc. Megawatt Megawatt-Hours New England East-West Solution The high voltage direct current transmission line project from Canada into New Hampshire Nitrogen oxides The Northeast Utilities and Subsidiaries 2013 combined Annual Report on Form 10-K as filed with the SEC Pension and PBOP Rate... -

Page 12

NORTHEAST UTILITIES AND SUBSIDIARIES THE CONNECTICUT LIGHT AND POWER COMPANY NSTAR ELECTRIC COMPANY AND SUBSIDIARY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARY WESTERN MASSACHUSETTS ELECTRIC COMPANY 2014 FORM 10-K ANNUAL REPORT TABLE OF CONTENTS Part I Item 1. Business Page 2 15 19 20 22... -

Page 13

... THE CONNECTICUT LIGHT AND POWER COMPANY NSTAR ELECTRIC COMPANY AND SUBSIDIARY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARY WESTERN MASSACHUSETTS ELECTRIC COMPANY SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 References in this Annual Report on Form 10... -

Page 14

...of Massachusetts; and Yankee Gas Services Company (Yankee Gas), a regulated natural gas utility that serves residential, commercial and industrial customers in parts of Connecticut. CL&P, NSTAR Electric, PSNH and WMECO also serve New England customers through NU's electric transmission business. NU... -

Page 15

...distribution company. For those customers who do not choose a competitive energy supplier, under SS rates for customers with less than 500 kilowatts of demand, and LRS rates for customers with 500 kilowatts or more of demand, CL&P purchases power under standard offer contracts and passes the cost of... -

Page 16

... from, customers. A systems benefits charge (SBC), established to fund expenses associated with: various hardship and low income programs; a program to compensate municipalities for losses in property tax revenue due to decreases in the value of electric generating facilities resulting directly from... -

Page 17

...buy their power from NSTAR Electric or WMECO at basic service rates. Most large commercial and industrial customers have switched to a competitive energy supplier. The Cape Light Compact, an inter-governmental organization consisting of the 21 towns and two counties on Cape Cod and Martha's Vineyard... -

Page 18

... charge to collect costs for energy efficiency programs. Reconciling adjustment charges that recover certain DPU-approved costs as follows: pension and PBOP benefits, low income customer discounts, lost revenue and credits associated with net-metering facilities installed by customers, storms... -

Page 19

... energy efficiency programs for all customers as well as assistance programs for residential customers within certain income guidelines. An electricity consumption tax, which is a state mandated tax on energy consumption. ï,· ï,· ï,· ï,· ï,· The energy charge and SCRC rates change semi-annually... -

Page 20

... FERC approved formula rates. Transmission revenues are collected from New England customers, the majority of which are distribution customers of CL&P, NSTAR Electric, PSNH and WMECO. The transmission rates provide for the annual reconciliation of estimated to actual costs. The financial impacts of... -

Page 21

... reserves in 2013 and 2014 to recognize the potential financial impacts of the first and second complaints. The Company is unable to determine any amount related to the third complaint. The aggregate after-tax net charge to 2014 earnings resulting from the 2014 FERC orders totaled $22.4 million at... -

Page 22

... of low demand. NSTAR Gas and Yankee Gas generate revenues primarily through the sale and/or transportation of natural gas. Predominantly all residential customers in the NSTAR Gas service territory buy gas supply and delivery from NSTAR Gas while all customers may choose their gas suppliers. Retail... -

Page 23

... energy efficiency costs, attorney general consultant costs, and costs associated with low income customers. The LDAC is reset annually and provides for the recovery of certain costs applicable to both sales and transportation customers. Purchased Gas Adjustment (PGA) clause, which allows Yankee Gas... -

Page 24

... December 8, 2014, NU and Spectra Energy Corp announced an alliance with Iroquois Gas Transmission for the Access Northeast project. This alliance will provide New England natural gas distribution companies and generators with additional access to natural gas supplies from multiple, diverse receipt... -

Page 25

...which generally require fixed percentages of our energy supply to come from renewable energy sources such as solar, hydropower, landfill gas, fuel cells and other similar sources. New Hampshire's RPS provision requires increasing percentages of the electricity sold to retail customers to have direct... -

Page 26

....1 percent in 2020. NSTAR Electric and WMECO are permitted to recover any costs incurred in complying with RPS from its customers through rates. WMECO also owns renewable solar generation resources. The RECs generated from WMECO's solar units are sold to other energy suppliers, and the proceeds from... -

Page 27

... on the Company's website or that can be accessed through the website is not incorporated into and does not constitute a part of this Annual Report on Form 10-K. Printed copies of these reports may be obtained free of charge by writing to our Investor Relations Department at Northeast Utilities, 107... -

Page 28

...be completed within budget, which could have a material adverse effect on our business prospects. We are pursuing broader strategic development investment opportunities related to the construction of electric and natural gas transmission facilities, interconnections to generating resources and other... -

Page 29

...on conservation, energy efficiency and self-generation may result in a decline in electricity and natural gas sales in our service territories. If any such declines were to occur without corresponding adjustments in rates at our Regulated companies that do not currently have revenue decoupling, then... -

Page 30

...of operations, cash flow and financial condition of NU and each of its utility subsidiaries. Limits on our access to and increases in the cost of capital may adversely impact our ability to execute our business plan. We use short-term debt and the long-term capital markets as a significant source of... -

Page 31

...this Annual Report on Form 10-K. As a holding company with no revenue-generating operations, NU parent's liquidity is dependent on dividends from its subsidiaries, primarily the Regulated companies, its commercial paper program, and its ability to access the long-term debt and equity capital markets... -

Page 32

...** (kilowatts) Solar Fixed Tilt, Photovoltaic 3 2010-14 8,000 ** Claimed capability represents the direct current nameplate capacity of the plant. CL&P and NSTAR Electric do not own any electric generating plants. Natural Gas Distribution System As of December 31, 2014, Yankee Gas owned... -

Page 33

... domain. The Massachusetts restructuring legislation applicable to NSTAR Electric (described above) is also applicable to WMECO. Yankee Gas Yankee Gas holds valid franchises to sell natural gas in the areas in which Yankee Gas supplies natural gas service, which it acquired either directly or from... -

Page 34

... by the Yankee Companies and transferred to each Yankee Company's respective decommissioning trust. In June 2013, FERC approved CYAPC, YAEC and MYAPC to reduce rates in their wholesale power contracts through the application of the DOE proceeds for the benefit of customers. Changes to the terms of... -

Page 35

...* James J. Judge Thomas J. May David R. McHale Joseph R. Nolan, Jr.* Leon J. Olivier Werner J. Schweiger Age 45 57 52 59 67 54 51 66 55 Title Vice President, Controller and Chief Accounting Officer. Senior Vice President and General Counsel. Senior Vice President-Human Resources of NUSCO. Executive... -

Page 36

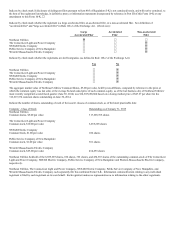

...Registrants' Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market Information and (c) Dividends NU. Our common shares are listed on the New York Stock Exchange. Effective February 19, 2015, the ticker symbol is "ES." The high and low sales prices of our common... -

Page 37

..., included in this Annual Report on Form 10-K. (e) Performance Graph The performance graph below illustrates a five-year comparison of cumulative total returns based on an initial investment of $100 in 2009 in Northeast Utilities common stock, as compared with the S&P 500 Stock Index and the EEI... -

Page 38

... below. The common shares purchased consist of open market purchases made by the Company or an independent agent. These share transactions related to the Company's Long-Term Incentive Plans. Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Approximate Dollar Value of... -

Page 39

... 2014 Revenues: (Thousands) Residential Commercial Industrial Wholesale Other and Eliminations Total Electric Natural Gas Total - Regulated Companies Other and Eliminations Total Regulated Companies - Sales: (GWh) Residential Commercial Industrial Wholesale Total Regulated Companies - Customers... -

Page 40

... in both 2014 and 2013. The net aggregate after-tax charge to earnings totaled $22.4 million and $14.3 million in 2014 and 2013, respectively. On September 16, 2014, NU and Spectra Energy Corp announced Access Northeast, a natural gas pipeline expansion project. Access Northeast will enhance... -

Page 41

... litigation received by CL&P, NSTAR Electric, PSNH and WMECO from the Yankee Companies, the absence of 2013 cash disbursements for major storm restoration costs, the decrease of approximately $130 million in Pension and PBOP Plan cash contributions, and changes in the timing of working capital items... -

Page 42

... a decrease in transmission segment state income tax expense and a higher transmission rate base as a result of an increased investment in our transmission infrastructure. These favorable impacts were partially offset by the after-tax net reserve of $22.4 million related to the 2014 FERC ROE orders... -

Page 43

...) Percentage 2014 2013 Increase Firm Natural Gas Residential Commercial Industrial Total Total, Net of Special Contracts (1) (1) 38,969 42,977 22,245 104,191 99,500 36,777 40,215 21,266 98,258 94,083 6.0% 6.9% 4.6% 6.0% 5.8% Special contracts are unique to the customers who take service under... -

Page 44

...of NU, CL&P, NSTAR Electric, PSNH and WMECO use its available capital resources to fund its respective construction expenditures, meet debt requirements, pay operating costs, including storm-related costs, pay dividends and fund other corporate obligations, such as pension contributions. The current... -

Page 45

... to customer bill credits and merger-related payments made in 2012. Partially offsetting these favorable cash flow impacts was an increase in Pension Plan cash contributions, increases in fuel inventories, and changes in traditional working capital amounts due primarily to the timing of accounts... -

Page 46

... December 8, 2014, NU and Spectra Energy Corp announced an alliance with Iroquois Gas Transmission for the Access Northeast project. This alliance will provide New England natural gas distribution companies and generators with additional access to natural gas supplies from multiple, diverse receipt... -

Page 47

...to add approximately 82,000 new natural gas heating customers over the next 10 years. Yankee Gas estimates that its portion of the plan will cost approximately $700 million over 10 years. In January 2015, PURA approved a joint settlement agreement proposed by Yankee Gas and other Connecticut natural... -

Page 48

... of formula rates for transmission service under the ISO-NE Open Access Transmission Tariff by NETOs, including CL&P, NSTAR Electric, PSNH and WMECO, was unjust and unreasonable and asserted that the rate was excessive due to changes in the capital markets. Complainants sought an order to reduce... -

Page 49

...operates: CL&P and Yankee Gas operate in Connecticut and are subject to PURA regulation; NSTAR Electric, WMECO and NSTAR Gas operate in Massachusetts and are subject to DPU regulation; and PSNH operates in New Hampshire and is subject to NHPUC regulation. In Connecticut, CL&P distribution rates were... -

Page 50

...of operations of CL&P, NSTAR Electric, PSNH and WMECO. We believe the storm restoration costs were prudent and meet the criteria for specific cost recovery in Connecticut, Massachusetts and New Hampshire, and that recovery from customers is probable through the applicable regulatory recovery process... -

Page 51

...-tax benefit of approximately $14 million. We expect a response from the DPU in the first quarter of 2015. Basic Service Bad Debt Adder: In accordance with a generic 2005 DPU order, electric utilities in Massachusetts recover the energy-related portion of bad debt costs in their Basic Service rates... -

Page 52

... an offshore wind energy facility, which was scheduled to achieve commercial operation by December 2016. As a result, and in accordance with the 2012 DPU-approved comprehensive merger settlement agreement with the DOER, NSTAR Electric will issue a request for proposal (RFP) for new Massachusetts RPS... -

Page 53

... the scheduling and costs of replacement. The Act also calls for the DPU to authorize natural gas utilities to design and offer programs to customers that will increase the availability, affordability and feasibility of natural gas service for new customers. On October 31, 2014, NSTAR Gas filed... -

Page 54

... care cost trend rates. We evaluate these assumptions at least annually and adjust them as necessary. Changes in these assumptions could have a material impact on our financial position, results of operations or cash flows. Pre-tax net periodic benefit expense (excluding SERP) for the Pension Plans... -

Page 55

...Plans' reported annual cost as a result of a change in the following assumptions by 50 basis points: (sillions of Dollars) Assumption Change NU Increase in Pension Plan Cost Increase in PBOP Plan Cost As of December 31, 2014 2013 2014 2013 Lower expected long-term rate of return Lower discount rate... -

Page 56

... contracts in rates charged to customers. These valuations are sensitive to the prices of energy and energy-related products in future years for which markets have not yet developed and assumptions are made. We use quoted market prices when available to determine fair values of financial instruments... -

Page 57

... New England and our service territories in Connecticut and Massachusetts. Weather-normalized total firm natural gas sales volumes (based on 30year average temperatures) increased 2.9 percent in 2014, as compared to 2013, due primarily to residential and commercial customer growth. Base electric... -

Page 58

... and natural gas distribution businesses were driven by the higher costs associated with the procurement of energy supply. As a result of increases in the New England wholesale energy supply market for both electricity and natural gas, the costs incurred to purchase energy on behalf of our customers... -

Page 59

... deferred transition costs ($9.9 million), an increase in interest on long-term debt ($4 million) as a result of new debt issuances in 2014 and the absence in 2014 of the favorable impact from the resolution of a Connecticut state income tax audit in 2013. Other Income, Net decreased in 2014, as... -

Page 60

...and late 2013, residential customer growth, an increase in natural gas conversions, the migration of interruptible customers switching to firm service rates and the addition of gas-fired distributed generation. The remaining increase was due primarily to higher revenues from increases related to our... -

Page 61

...term debt ($8.8 million) and lower interest on RRBs ($6.1 million). Other Income, Net increased $10.2 million in 2013, as compared to 2012, due primarily to higher gains on the NU supplemental benefit trust ($6 million) and an increase related to officer insurance policies ($1.7 million). Income Tax... -

Page 62

... energy marketers. Margin accounts exist within this diverse group, and we realize interest receipts and payments related to balances outstanding in these margin accounts. This wide customer and supplier mix generates a need for a variety of contractual structures, products and terms that, in turn... -

Page 63

... of the accompanying consolidated financial statements of Northeast Utilities and subsidiaries (NU or the Company) and of other sections of this annual report. NU's internal controls over financial reporting were audited by Deloitte & Touche LLP. Management is responsible for establishing and... -

Page 64

... statement schedules and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to... -

Page 65

... Receivables, Net Unbilled Revenues Taxes Receivable Fuel, Materials and Supplies Regulatory Assets Prepayments and Other Current Assets Total Current Assets Property, Plant and Equipment, Net Deferred Debits and Other Assets: Regulatory Assets Goodwill Marketable Securities Other Long-Term Assets... -

Page 66

..., Except Share Information) Operating Revenues Operating Expenses: Purchased Power, Fuel and Transmission Operations and Maintenance Depreciation Amortization of Regulatory Assets, Net Amortization of Rate Reduction Bonds Energy Efficiency Programs Taxes Other Than Income Taxes Total Operating... -

Page 67

... Share Information) Balance as of January 1, 2012 Net Income Shares Issued in Connection with NSTAR Merger Other Equity Impacts of Merger with NSTAR Dividends on Common Shares - $1.32 Per Share Dividends on Preferred Stock Issuance of Common Shares, $5 Par Value Long-Term Incentive Plan Activity... -

Page 68

... of Marketable Securities Purchases of Marketable Securities Other Investing Activities Net Cash Flows Used in Investing Activities Financing Activities: Cash Dividends on Common Shares Cash Dividends on Preferred Stock Increase/(Decrease) in Short-Term Debt Issuance of Long-Term Debt Retirements of... -

Page 69

... Yankee Gas and NSTAR Gas. NU provides energy delivery service to approximately 3.6 million electric and natural gas customers through these six regulated utilities in Connecticut, Massachusetts and New Hampshire. On February 2, 2015, NU, CL&P, NSTAR Electric, PSNH and WMECO commenced doing business... -

Page 70

... of both CL&P and NSTAR Electric that grant preferred stockholders the right to elect a majority of the CL&P and NSTAR Electric Board of Directors, respectively, should certain conditions exist, such as if preferred dividends are in arrears for a specified amount of time. The Net Income reported in... -

Page 71

... Benefits and Postretirement Benefits Other Than Pensions," Note 13, "Fair Value of Financial Instruments," and Note 21, "Merger of NU and NSTAR," to the financial statements. I. Derivative Accounting Many of the Regulated companies' contracts for the purchase and sale of energy or energy-related... -

Page 72

... companies' retail revenues relate to the recovery of costs incurred for the sale of electricity and natural gas purchased on behalf of customers. These energy supply costs are recovered from customers in rates through cost tracking mechanisms. Energy purchases are recorded in Purchased Power, Fuel... -

Page 73

...CL&P, NSTAR Electric, PSNH and WMECO each have a retail transmission cost tracking mechanism as part of their rates, which allows the electric distribution companies to charge their retail customers for transmission costs on a timely basis. L. Operating Expenses Costs related to fuel and natural gas... -

Page 74

...-cash transaction. Refer to Note 21, "Merger of NU and NSTAR," for further information. Q. Related Parties NUSCO, NU's service company, provides centralized accounting, administrative, engineering, financial, information technology, legal, operational, planning, purchasing, and other services to NU... -

Page 75

...in the discount rate assumption. For further information on the funded status liability and related regulatory assets of the Pension, SERP and PBOP plans, see Note 9A, "Employee Benefits - Pension Benefits and Postretirement Benefits Other Than Pensions." CL&P, NSTAR Electric, PSNH and WMECO recover... -

Page 76

... charges are recorded on all material regulatory tracker mechanisms. CL&P, NSTAR Electric, PSNH and WMECO each recover the costs associated with the procurement of energy, transmission related costs from FERC-approved transmission tariffs, energy efficiency programs, low income assistance programs... -

Page 77

... Power Contracts: NSTAR Electric's balance represents the contract termination liability related to certain purchase power contract buy out agreements that were executed in 2004. The contracts' termination payments occur through September 2016 and are collected from customers through NSTAR Electric... -

Page 78

...the member companies, including CL&P, NSTAR Electric, PSNH, and WMECO, for the benefit of their respective customers. CL&P's refund obligation to customers of $65.4 million was recorded as an offset to the deferred storm restoration costs regulatory asset, as directed by PURA. NSTAR Electric's, PSNH... -

Page 79

...qualify for accrual accounting under the applicable accounting guidance. The costs and benefits of derivative contracts that meet the definition of normal are recognized in Operating Expenses or Operating Revenues on the statements of income, as applicable, as electricity or natural gas is delivered... -

Page 80

... NYMEX future contracts in order to reduce variability associated with the purchase price of approximately 8.8 million and 9.1 million MMBtu of natural gas, respectively. The following table presents the current change in fair value, primarily recovered through rates from customers, associated with... -

Page 81

... contracts classified as Level 2 in the fair value hierarchy, resulting in a total net gain of $1 million. MARKETABLE SECURITIES 5. NU maintains trusts to fund certain non-qualified executive benefits and WMECO maintains a spent nuclear fuel trust to fund WMECO's prior period spent nuclear fuel... -

Page 82

...-than-temporary impairments or credit losses for NU or WMECO. Factors considered in determining whether a credit loss exists include the duration and severity of the impairment, adverse conditions specifically affecting the issuer, and the payment history, ratings and rating changes of the security... -

Page 83

... trades and benchmark yields. Other fixed income securities are valued using pricing models, quoted prices of securities with similar characteristics, and discounted cash flows. 6. ASSET RETIREMENT OBLIGATIONS NU, including CL&P, NSTAR Electric, PSNH and WMECO, recognizes a liability for the fair... -

Page 84

program. The commercial paper program allows NU parent to issue commercial paper as a form of short-term debt. Effective July 23, 2014, NU parent, CL&P, PSNH, WMECO, NSTAR Gas and Yankee Gas extended the expiration date of their joint revolving credit facility for one additional year to September 6,... -

Page 85

... due 2017 5.500% due 2040 2.375% due 2022 Variable Rate due 2016 (5) 4.400% due 2044 (4) Total Debentures Bonds: 7.375% Tax Exempt Sewage Facility Revenue Bonds, due 2015 Total Bonds Less Amounts due Within One Year Unamortized Premiums and Discounts, Net NSTAR Electric Long-Term Debt PSNH (sillions... -

Page 86

... under the NU commercial paper program. As the debt issuances refinanced short-term debt, the short-term debt was classified as Long-Term Debt as of December 31, 2014. Amount relates to the purchase price adjustment required to record the NSTAR long-term debt at fair value on the date of the merger... -

Page 87

... 12, 2015, NSTAR Gas filed an application with the DPU requesting authorization to issue up to $100 million in long-term debt for the period ending December 31, 2015. Spent Nuclear Fuel Obligation: Under the Nuclear Waste Policy Act of 1982, CL&P and WMECO must pay the DOE for the costs of disposal... -

Page 88

... transferred to the applicable company's balance sheets. This change had no impact on the income statement or net assets of NSTAR Electric or NU. For the year ended December 31, 2014, the NUSCO and NSTAR pension and SERP plans are accounted for under the multiple-employer approach, with each company... -

Page 89

... annually in proportion to the investment return expected to be earned during the year. For the years ended December 31, 2013 and 2012 (prior to the service company merger), the net periodic pension expense recorded at NSTAR Electric represented the full cost of the plan with a portion of the costs... -

Page 90

... the statements of income. Capitalized pension amounts relate to employees working on capital projects and are included in Property, Plant and Equipment, Net. Intercompany allocations are not included in the CL&P, NSTAR Electric, PSNH and WMECO net periodic benefit expense amounts. Pension and SERP... -

Page 91

... transferred to the applicable company's balance sheets. This change had no impact on the income statement or net assets of NSTAR Electric or NU. For the year ended December 31, 2014, the NUSCO and NSTAR PBOP Plans are accounted for under the multiple-employer approach, with each company's balance... -

Page 92

... assumptions were used in calculating the PBOP Plans' year end funded status: PBOP As of December 31, 2013 Discount Rate Health Care Cost Trend Rate 2014 4.22 % 6.50 % 4.78 % 7.00 % 5.10 % PBOP Expense: NU charges net periodic postretirement benefits expense to its subsidiaries based on the... -

Page 93

... PBOP 2015 2016 $ 244.5 58.7 $ 253.6 59.7 2017 $ 268.9 60.6 2018 2019 2020-2024 $ 273.4 61.3 $ 285.4 62.0 $ 1,591.1 318.8 Contributions: NU contributed $171.6 million to the Pension Plans in 2014, of which $101 million was contributed by NSTAR Electric. Based on the current status... -

Page 94

... with fixed income futures. The assets of the Pension Plans include a 401(h) account that has been allocated to provide health and welfare postretirement benefits under the PBOP Plans. Effective January 1, 2013, the NSTAR Pension Plan assets were transferred into the NUSCO Pension Plan master trust... -

Page 95

... WMECO are allocated a portion of the NUSCO Pension and PBOP Plan assets. NSTAR Electric is entitled to a portion of the NSTAR Pension and PBOP Plan assets. The Company values assets based on observable inputs when available. Equity securities, exchange traded funds and futures contracts classified... -

Page 96

... the allocation of costs associated with shares issued or sold to NU's service company employees and officers that support CL&P, NSTAR Electric, PSNH and WMECO. Upon consummation of the merger with NSTAR, the NSTAR 1997 Share Incentive Plan and the NSTAR 2007 Long-Term Incentive Plan were assumed by... -

Page 97

... based upon a modified performance period through the date of the merger, in accordance with the terms of the program, and were fully distributed in 2013. The total compensation expense and associated future income tax benefit recognized by NU, CL&P, NSTAR Electric, PSNH and WMECO for share-based... -

Page 98

...current and past company officers of NU, including CL&P, PSNH and WMECO. These benefits are accounted for on an accrual basis and expensed over the service lives of the employees. The actuarially-determined liability for these benefits, which is included in Other Long-Term Liabilities on the balance... -

Page 99

.../Reserve Adjustments Other, Net Income Tax Expense Effective Tax Rate (1) $ 1,295.4 453.4 (5.6) (3.9) (3.5) 42.5 (8.0) (2.9) (3.7) 468.3 36.2% $ 1,220.6 427.2 (7.4) (4.1) (3.7) 27.6 (8.0) (4.3) (0.4) 426.9 35.0% $ 808.0 282.8 (10.8) (3.9) (3.8) 4.4 (6.4) 7.6 5.0 274.9 34.0% $ $ $ NSTAR... -

Page 100

... the applicable regulatory commissions and relevant accounting authoritative literature. The tax effects of temporary differences that give rise to the net accumulated deferred income tax obligations are as follows: NU (sillions of Dollars) As of December 31, 2014 2013 Deferred Tax Assets: Employee... -

Page 101

... to reflect the amounts expired. Further, the Company decreased its valuation allowance reserve for state credits by $19.2 million at CL&P, net of tax, to reflect an update for expired state credits and latest estimate of usage. For 2014, state credit and state loss carryforwards have been partially... -

Page 102

... Connecticut Massachusetts New Hampshire 2014 2011 - 2014 2011 - 2014 2011 - 2014 Tax Years NU estimates that during the next twelve months, differences of a non-timing nature could be resolved, resulting in a zero to $2 million decrease in unrecognized tax benefits by NU. These estimated changes... -

Page 103

... by several factors, including new information concerning either the level of contamination at the site, the extent of NU, CL&P, NSTAR Electric, PSNH and WMECO's responsibility or the extent of remediation required, recently enacted laws and regulations or a change in cost estimates due to certain... -

Page 104

... NSTAR Electric's and WMECO's environmental reserves impact Net Income. B. Long-Term Contractual Arrangements Estimated Future Annual Costs: The estimated future annual costs of significant long-term contractual arrangements as of December 31, 2014 are as follows: NU (sillions of Dollars) 2015 2016... -

Page 105

... fuel. The Yankee Companies collect decommissioning and closure costs through wholesale, FERC-approved rates charged under power purchase agreements with several New England utilities, including CL&P, NSTAR Electric, PSNH and WMECO. These companies in turn recover these costs from their customers... -

Page 106

...to reduce rates in their wholesale power contracts through the application of the DOE proceeds for the benefit of customers. Changes to the terms of the wholesale power contracts became effective on July 1, 2013. In accordance with the FERC order, CL&P, NSTAR Electric, PSNH and WMECO began receiving... -

Page 107

...DPU order, electric utilities in Massachusetts recover the energy-related portion of bad debt costs in their Basic Service rates. In 2007, NSTAR Electric filed its 2006 Basic Service reconciliation with the DPU proposing an adjustment related to the increase of its Basic Service bad debt charge-offs... -

Page 108

... options. Certain lease agreements contain payments impacted by the commercial paper rate plus a credit spread or the consumer price index. Operating lease rental payments charged to expense are as follows: (sillions of Dollars) NU (1) CL&P NSTAR Electric PSNH WMECO 2014 2013 2012 (1) $ 14.3 16... -

Page 109

... cash flow projections. The fair value of long-term debt securities is based upon pricing models that incorporate quoted market prices for those issues or similar issues adjusted for market conditions, credit ratings of the respective companies and treasury benchmark yields. The fair values provided... -

Page 110

... (1) Income Tax Expense These amounts are included in the computation of net periodic Pension, SERP and PBOP costs. See Note 9A, "Employee Benefits - Pension Benefits and Postretirement Benefits Other Than Pensions," for further information. As of December 31, 2014, it is estimated that a pre-tax... -

Page 111

....8 5.0 10.0 8.0 10.0 5.0 5.2 5.0 8.0 10.0 15.0 10.0 116.2 18.0 25.0 43.0 (3.6) 155.6 NSTAR Electric 4.25 % Series 4.78 % Series Total NSTAR Electric Fair Value Adjustment due to Merger with NSTAR Total NU - Preferred Stock of Subsidiaries $ $ 103.625 102.80 18.0 $ 25.0 43.0 $ (3.6) 155.6 $ 99 -

Page 112

... Stock of Subsidiaries (sillions of Dollars) Balance as of January 1, 2012 Net Income Purchase Price of NSTAR (1) Other Equity Impacts of Merger with NSTAR (2) Dividends on Common Shares Dividends on Preferred Stock Issuance of Common Shares Contributions to NPT Other Transactions, Net Net Income... -

Page 113

... and 2012. Revenues from the sale of electricity and natural gas primarily are derived from residential, commercial and industrial customers and are not dependent on any single customer. The Electric Distribution reportable segment includes the generation activities of PSNH and WMECO. The remainder... -

Page 114

... subsidiaries became wholly-owned subsidiaries of NU. NSTAR was a holding company engaged through its subsidiaries in the energy delivery business serving electric and natural gas distribution customers in Massachusetts. As part of the merger, NSTAR shareholders received 1.312 NU common shares for... -

Page 115

... with accounting guidance for business combinations, the portion of the fair value of these awards attributable to service provided prior to the merger was included in the purchase price as it represented consideration transferred in the merger. See Note 9C, "Employee Benefits - Share-Based Payments... -

Page 116

... pre-tax financial impacts of the Connecticut and Massachusetts merger settlement agreements that were recognized in 2012 by NU, CL&P, NSTAR Electric, and WMECO are summarized as follows: (sillions of Dollars) Customer Rate Credits Storm Costs Deferral Reduction Establishment of Energy Efficiency... -

Page 117

... $ $ $ $ NSTAR Electric 2014 Operating Revenues Operating Income Net Income Operating Revenues Operating Income Net Income $ 666.2 118.4 ... 26.8 2013 $ $ $ $ WMECO 2014 Operating Revenues Operating Income Net Income Operating Revenues Operating Income Net Income $ 137.4 34.7 18.1 125... -

Page 118

..., change management procedures, access controls, data migration strategies and reconciliations, application interface testing and other standard application controls. There have been no other changes in internal controls over financial reporting for NU, CL&P, NSTAR Electric, PSNH and WMECO during... -

Page 119

...III Item 10. Directors, Executive Officers and Corporate Governance The information in Item 10 is provided as of February 18, 2015, except where otherwise indicated. Certain information required by this Item 10 is omitted for NSTAR Electric, PSNH and WMECO pursuant to Instruction I(2)(c) to Form 10... -

Page 120

... WMECO The information required by this Item 14 for CL&P, NSTAR Electric, PSNH and WMECO has been omitted from this report but is set forth in the Annual Report on Form 10-K for 2014 filed with the SEC on a combined basis with NU on February 25, 2015. Such report is also available at the Investors... -

Page 121

... of this Annual Report on Form 10-K are set forth under Item 8, "Financial Statements and Supplementary Data." 2. Schedules I. Financial Information of Registrant: Northeast Utilities (Parent) Balance Sheets as of December 31, 2014 and 2013 Northeast Utilities (Parent) Statements of Income for the... -

Page 122

... to this Annual Report on Form 10-K, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneysin-fact and agents, and each of them, full power and authority to do and perform each and... -

Page 123

... /s/ William C. Van Faasen William C. Van Faasen /s/ Frederica M. Williams Frederica M. Williams /s/ Dennis R. Wraase Dennis R. Wraase Trustee February 25, 2015 Trustee February 25, 2015 Trustee February 25, 2015 Trustee February 25, 2015 Trustee February 25, 2015 Trustee February 25... -

Page 124

... First Amendment to Credit Agreement, dated September 6, 2013, by and among NU, CL&P, NSTAR Gas, NSTAR LLC, PSNH, WMECO, Yankee Gas Services Company and the Banks named therein, pursuant to which Bank of America, N.A. serves as Administrative Agent (Exhibit 4.1, NU Current Report on Form 8-K filed... -

Page 125

...Form of Service Contract between each of NU, CL&P and WMECO and Northeast Utilities Service Company (NUSCO) dated as of January 1, 2014. (Exhibit 10.1, NU Form 10-K filed on February 25, 2014, File No. 001-05324) Agreements among New England Utilities with respect to the Hydro-Quebec interconnection... -

Page 126

... 19, 2004 between Boston Edison, ComElectric and Northeast Energy Associates L. P. (Exhibit 10.22, 2005 NSTAR Form 10-K filed February 21, 2006, File No. 001-14768) Second Restated NEPOOL Agreement among NSTAR Electric and various other electric utilities operating in New England, dated August 16... -

Page 127

... Executive Retirement Agreement between Boston Edison Company and Thomas J. May dated March 13, 1999, regarding Key Executive Benefit Plan and Supplemental Executive Retirement Plan (Exhibit 10.3, 1999 NSTAR Form 10-K/A filed September 9, 2000, File No. 001-14768) Amended and Restated Change... -

Page 128

... MDTE Order approving Rate Settlement Agreement dated December 31, 2005 (Exhibit 99.2, NSTAR Current Report on Form 8-K filed January 4, 2006, File No. 001-14768) NU and WMECO 10.1 Lease and Agreement by and between WMECO and Bank of New England, N.A., with BNE Realty Leasing Corporation of North... -

Page 129

... other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant's other certifying officer and I are responsible for... -

Page 130

Exhibit 31.1 CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, James J. Judge, certify that: 1. I have reviewed this Annual Report on Form 10-K of Northeast Utilities (the registrant); 2. Based on my knowledge, this report does not contain any untrue statement of a material... -

Page 131

... connection with this Annual Report on Form 10-K of Northeast Utilities (the registrant) for the period ending December 31, 2014 as filed with the Securities and Exchange Commission (the Report), we, Thomas J. May, Chairman, President and Chief Executive Officer of the registrant, and James J. Judge... -

Page 132

[THIS PAGE LEFT BLANK INTENTIONALLY.] -

Page 133

[THIS PAGE LEFT BLANK INTENTIONALLY.] -

Page 134

... *Lead Trustee Eversource Energy Executive Officers Thomas J. May Chairman of the Board, President and Chief Executive Officer James J. Judge Executive Vice President and Chief Financial Officer David R. McHale Executive Vice President and Chief Administrative Officer Leon J. Olivier Executive Vice... -

Page 135

....01 $40.60 Common Share Dividend Payment Dates Last business day of March, June, September and December. Common Share Information The common shares of Eversource Energy are listed on the New York Stock Exchange. The ticker symbol is "ES." The high and low daily prices and dividends paid for the past... -

Page 136

002CSN4A56