Eversource 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CEO’s Message

Dear Shareholder,

The year was defi ned by the successful closing of the Northeast Utilities and NSTAR merger. We successfully negotiated

multi-year merger settlement agreements with Connecticut and Massachusetts regulators, ensuring continued high quality

service to our customers and strong value for our shareholders.

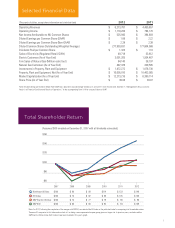

In 2012, a year when utility stocks signifi cantly lagged the broader market, we provided our shareholders with a total return

of 12.1 percent, about six times better than the 2.1 percent average total return for the 51 companies included in the Edison

Electric Institute Index. We raised our common dividend twice in 2012—a 6.8 percent increase in the fi rst quarter was

followed by a 16.8 percent increase after the merger closed in the second quarter. More recently, we announced another

increase in February 2013. Our annualized dividend rate is now $1.47 per share, compared with $1.10 per share in 2011.

We expect fi scal discipline and execution of our strategic business plan will enable us to grow earnings per share by 6 to 9

percent annually for several years; our earnings per share in 2012 was $2.28, excluding merger expenses. We expect our

dividend to keep pace with earnings growth.

As a result of improved regulatory diversity, a stronger balance sheet and improved cash fl ows, Northeast Utilities’ credit

rating at Standard & Poors was raised to A-. This rating is among the highest in the industry; in fact, only one family of

companies in the industry has a higher credit rating. Likewise, timely and effective refi nancing is expected to result in

annualized interest cost savings of approximately $30 million, savings that benefi t customers and shareholders.

As one company, we are capturing cost savings by implementing a

shared services operating model, with customers at the center of

our work. To that end, in 2012, the operational performance of our

distribution, transmission and generation systems was on target, and,

in many instances, exceeded the stretch goals we had established for

operations managers.

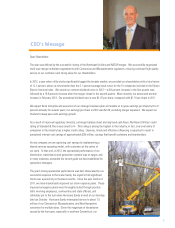

The year’s strong operational performance was best showcased by our

successful response to Hurricane Sandy, the region’s third signifi cant

storm over a period of just fourteen months. Since the epic storms of

2011, we have dramatically improved our storm response plans. These

improved emergency plans were thoroughly tested through practice

drills involving employees, communities and state offi cials, and

ultimately put to the test when Hurricane Sandy arrived at our doorstep

late last October. Hurricane Sandy interrupted service to about 1.5

million of our Connecticut, Massachusetts, and New Hampshire

customers for multiple days. Given the magnitude of devastation

caused by the hurricane, especially in southern Connecticut, our

3