Eversource 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

conditions) and reliability must run contracts. The FMCC charge is adjusted periodically and reconciled semi-annually in

accordance with the directives of PURA. Expense/revenue reconciliation amounts are recovered in subsequent rates.

SBC charge, established to fund expenses for the public education outreach program, costs associated with various hardship

and low income programs, a program to compensate municipalities for losses in property tax revenue due to decreases in the

value of electric generating facilities resulting directly from electric industry restructuring, displaced worker protection costs,

unfunded storage and disposal costs for spent nuclear fuel generated before January 1, 2000, and decommissioning fund

contributions. Any element of the SBC charge may be revised by PURA as the need arises. The SBC charge is reconciled

annually to actual costs incurred, with any difference refunded to, or recovered from, customers.

CTA charge, which pays the principal and interest on RRBs as well as the reasonable and necessary costs related to the

RRBs financing. The CTA charge is also assessed to recover stranded costs associated with electric industry restructuring as

well as various IPP contracts that were not funded with the proceeds of the RRBs. The CTA charge is reconciled annually to

actual costs incurred, with any difference refunded to, or recovered from, customers.

The Renewable Energy Investment Fund charge, which is used to promote investment in renewable energy sources. Funds

collected by this charge are deposited into the Renewable Energy Investment Fund and administered by Connecticut

Innovations, Incorporated. The Renewable Energy Investment Fund charge is set by statute and is currently 0.1 cent per

kWh.

C&LM charge, established to implement cost-effective energy conservation programs and market transformation initiatives.

Transmission adjustment clause, which reconciles on a semi-annual basis the transmission revenues billed to customers

against the transmission costs of acquiring such services, to recover all of its transmission expenses on a timely basis.

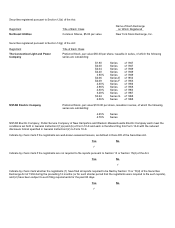

CL&P, jointly with UI, has entered into four CfDs for a total of approximately 787 MW of capacity consisting of three generation projects

and one demand response project. The capacity CfDs extend through 2026 and obligate the utilities to pay the difference between a

set price and the value that the projects receive in the ISO-NE markets. The contracts have terms of up to 15 years beginning in 2009

and are subject to a sharing agreement with UI, whereby UI will have a 20 percent share of the costs and benefits of these contracts.

CL&P's portion of the costs and benefits of these contracts will be paid by or refunded to CL&P's customers.

CL&P, jointly with UI, has entered into three CfDs (each having a 80 percent to 20 percent sharing mechanism as described above),

with developers of peaking generation units approved by the PURA (Peaker CfDs). These units have a total of approximately 500 MW

of peaking capacity. The Peaker CfDs pay the developer the difference between capacity, forward reserve and energy market

revenues and a cost-of-service payment stream for 30 years. The ultimate cost or benefit to CL&P under these contracts will depend

on the costs of plant construction and operation and the prices that the projects receive for capacity and other products in the ISO-NE

markets. CL&P's portion of the amounts paid or received under the Peaker CfDs will be recoverable from or refunded to CL&P's

customers.

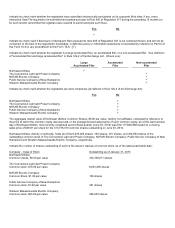

On June 30, 2010, PURA issued a final order in CL&P’s most recent retail distribution rate case approving distribution rates and

establishing CL&P’s authorized distribution regulatory ROE at 9.4 percent.

On March 13, 2012, NU and NSTAR reached a comprehensive settlement agreement with both the Connecticut Attorney General and

the Connecticut Office of Consumer Counsel related to the Merger. The settlement agreement covered a variety of matters, including a

CL&P base distribution rate freeze until December 1, 2014. The settlement agreement also provided for a $25 million rate credit to

CL&P customers and the establishment of a $15 million fund for energy efficiency and other initiatives to be disbursed at the direction of

the DEEP. CL&P also agreed to forego rate recovery of $40 million of deferred storm costs associated with restoration activities

following Tropical Storm Irene and the October 2011 snowstorm. On April 2, 2012, the PURA approved the settlement agreement and

the Merger.

Sources and Availability of Electric Power Supply

As noted above, CL&P does not own any generation assets and purchases energy to serve its SS and LRS loads from a variety of

competitive sources through periodic requests for proposals. CL&P enters into supply contracts for SS periodically for periods of up to

three years to mitigate the risks associated with energy price volatility for its residential and small and medium load commercial and

industrial customers. CL&P enters into supply contracts for LRS for larger commercial and industrial customers every three months.

Currently, CL&P has contracts in place with various suppliers for all of its SS loads for the first half of 2013, and 70 percent of expected

load for the second half of 2013. CL&P intends to purchase 10 percent of the SS load for the second half of 2013. None of the SS load

for 2014 has been procured. CL&P’s contracts for its LRS loads extend through the second quarter of 2013, and CL&P intends to

purchase 10 percent of the LRS load for the third quarter of 2013.