Eversource 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Northeast Utilities

1999 ANNUAL REPORT

BUILDING ON CORE BUSINESS

Table of contents

-

Page 1

Northeast Utilities 1999 ANNUAL REPORT BU ILDING ON CORE BUSINESS -

Page 2

...7 To Our Shareholders Regulated Businesses Competitive Businesses Northeast Utilities Trustees and Officers Management's Discussion and Analysis Company Report Report of Independent Public Accountants Consolidated Financial Statements Notes to Consolidated Financial Statements and related schedules... -

Page 3

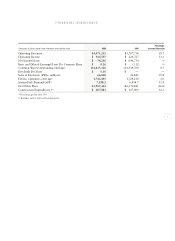

... statistical data) 1999 1998 Percentage Increase/(Decrease) Operating Revenues Operating Income Net Income/(Loss) Basic and Diluted Earnings/(Loss) Per Common Share Common Shares Outstanding (Average) Dividends Per Share Sales of Electricity (kWh - millions) Electric Customers (Average) System... -

Page 4

... with the announcement of our merger with Consolidated Edison, Inc. The combined company will be among the largest electric and natural gas distribution companies in the United States (as measured by number of customers). FINANCIAL NU earned $34.2 million in 1999, compared with a loss of $146... -

Page 5

... of New Hampshire will require that we auction Public Service Company of New Hampshire's (PSNH) generating assets, which we anticipate will happen some time in 2000. The Seabrook nuclear power plant must be auctioned prior to December 31, 2003. I want to thank all the NU employees who worked hard... -

Page 6

...the senior management team began the process of reviewing all environmental events and near misses to demonstrate our commitment to the people of NU, those who 4 regulate us, and the communities in which we do business. NEW HAMPSHIRE SETTLEMENT In August, PSNH and the state of New Hampshire filed... -

Page 7

...the Northeast. The enterprise value of the new company (market value of debt and equity) will be about $19 billion, providing the financial resources needed to grow and prosper in the future. The combined company will be headquartered in New York City. NU's operating companies (CL&P, WMECO, PSNH and... -

Page 8

... of its customers. In 2000, programs that promote economic growth, advance energy efficiency and strengthen community vitality will be among its top priorities, demonstrating once again that Connecticut Light and Power is "The Energy of Connecticut." President, Retail Business Group President, CL&P -

Page 9

...in our Connecticut, Massachusetts and New Hampshire service areas. Our regulated portfolio of companies began to expand its market reach with the announcement that Yankee Energy System, Inc. (YES) of Meriden, Connecticut, agreed to merge with NU. The Yankee merger strengthens NU in signiï¬cant ways... -

Page 10

... generation, and contracts PSNH has for additional supply, provide an ample and diverse supply of energy - the foundation for continued economic growth and prosperity in New Hampshire. Along with a dedication to providing high-quality, reliable electric service, PSNH is committed to promoting the... -

Page 11

...&P became the ï¬rst electric utility in the nation to sponsor a statewide Main Street program, the six Main Street communities have attracted more than 70 new businesses which have created nearly 600 new jobs. Sharing its expertise, knowledge, equipment and personnel, CL&P in 1999 took the lead in... -

Page 12

... meters to the University of Massachusetts for its research project to measure the efficiency of the school's 20 electric vehicles, supporting the Regional Employment Board's Summer Jobs Program, and reaching out to the community to share information about WMECO's residential discount rate and... -

Page 13

...to PSNH's service territory - the company has actively supported the growth of businesses already located in the state. These efforts have ranged from funding an export marketing grant program allowing small New Hampshire companies to enter or expand into international markets, to assisting business... -

Page 14

... Gas Services Company (Yankee Gas), the largest natural gas distribution company in Connecticut, serves more than 185,000 customers in 69 cities and towns. YES' other operating subsidiaries support its core business and promote the growth and expansion of its energy-related services. Yankee Energy... -

Page 15

... customers 8 million kilowatt-hours of electricity annually. Similar programs for commercial and industrial customers are expected to save over 18 million kilowatt-hours of electricity annually. YES - A STRATEGIC FIT In June 1999, NU and Yankee Energy System, Inc. (YES) agreed to a merger... -

Page 16

...order processing, meter reading, billing, payment processing, credit and collections and accounting functions. • Introduction of Energy Key Commercial Financing, a unique loan program for energy efï¬cient plant and equipment upgrades to commercial and industrial businesses located in southern New... -

Page 17

... electric generation services. In 1999, Select Energy contracted with 79 municipalities in Massachusetts to provide power and energy efï¬ciency services. Select Energy is also registered to sell natural gas through all of the major local distribution companies in the state. In Rhode Island... -

Page 18

... Northeast Generation Services Company - to provide business and institutional customers with wholesale and retail energy supply, energy-related services, and power facilities management and operation. Select Energy's retail portfolio includes energy supply (electricity, natural gas and other fuels... -

Page 19

... 170 locations throughout New England, and chose Select Energy to supply electricity for most of its stores, distribution centers and offices located in Massachusetts and Rhode Island (only stores in municipal electric territories are excluded). Shaw's keeps a close eye on energy management, because... -

Page 20

...of hydroelectric and pumped storage generating assets through CL&P's and WMECO's auctions. These assets include our Northï¬eld Mountain hydroelectric facility, which will have its power output marketed by Select Energy. Also formed in 1999, Northeast Generation Services Company (NGS) leveraged many... -

Page 21

... utility with over 5 million electric customers and will serve 1.4 million gas customers and 2,000 steam customers in urban and suburban communities with a population of more than 13 million. The new combined company will have a strong regional foundation with the size, financial resources... -

Page 22

... 8 Raymond L. Golden President-Retail Business Group John H. Forsgren Assistant Treasurer-Finance Independent Consultant Executive Vice President and Chief Financial Ofï¬cer Cheryl W. Grisé Senior Vice President, Secretary and General Counsel David R. McHale Vice President and Treasurer -

Page 23

...offer service tariffs and agreements in Connecticut and by receiving ï¬nal approval of a restructuring plan in Massachusetts. The auction of substantially all of the fossil and hydroelectric generation assets owned by The Connecticut Light and Power Company (CL&P) and Western Massachusetts Electric... -

Page 24

... with Con Edison. The merger will return to NU Connecticut's largest natural gas distribution system, as well as several unregulated businesses involved in energy services, collections and other areas. The Yankee merger received ï¬nal DPUC approval in December 1999 and Securities and Exchange... -

Page 25

... issues in New Hampshire and the announced merger with Con Edison. During 1999, NU system securities received several upgrades from three credit rating agencies. CL&P's and WMECO's senior secured bonds achieved investment grade ratings for the ï¬rst time since early 1997 and PSNH's bonds were... -

Page 26

...and distribution charge, a generation charge and a transition charge. For those customers who do not or are unable to choose another competitive electric generation supplier, CL&P will supply standard offer or generation service at an average rate of $0.04813 per kilowatt-hour (kWh) through December... -

Page 27

... supply that was previously provided by CL&P and WMECO. For the most part, the prices are fixed by contract and applicable to actual volumes. NUCLEAR GENERATION 25 The energy marketing and brokering business is intensely competitive, with many companies with larger ï¬nancial resources than NU... -

Page 28

... Energy Corporation (NAEC) after approval of the Settlement Agreement. The Settlement Agreement with the state of New Hampshire requires divestiture prior to December 31, 2003. YANKEE COMPANIES The staff of the SEC has questioned certain of the current accounting practices of the electric utility... -

Page 29

... CL&P employed energy price risk management instruments to protect itself against the risk of rising fuel prices, thereby limiting fuel costs and protecting its proï¬t margins. These risks were created by the sale of long-term ï¬xed-price electricity sales contracts to wholesale customers. In 1999... -

Page 30

... from CL&P's rate base. Wholesale revenues decreased by $32 million primarily as a result of the terminated contract with the Connecticut Municipal Electric Energy Cooperative (CMEEC). Other revenues decreased $50 million due to lower billings to outside companies for reimbursable costs and price... -

Page 31

... February 1999 CL&P rate decision ($115.3 million). OTHER INCOME/(LOSS), NET Other income/(loss), net decreased in 1999, primarily due to the PSNH settlement with the New Hampshire Electric Cooperative ($6.2 million) and the loss on the CL&P assignment of marketbased contracts to Select Energy ($15... -

Page 32

COMPANY REPORT REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS 30 The accompanying consolidated financial statements of Northeast Utilities and subsidiaries and other sections of this annual report were prepared by the company. These financial statements, which were audited by Arthur Andersen LLP, were ... -

Page 33

CONSOLIDATED STATEMENTS OF INCOME For the Years Ended December 31, (Thousands of Dollars, except share information) 1999 1998 1997 Operating Revenues Operating Expenses: Operation - Fuel, purchased and net interchange power Other Maintenance Depreciation Amortization of regulatory assets, net ... -

Page 34

... for depreciation Unamortized PSNH acquisition costs Construction work in progress Nuclear fuel, net Total net utility plant Other Property and Investments: Nuclear decommissioning trusts, at market Investments in regional nuclear generating companies, at equity Other, at cost Current Assets: Cash... -

Page 35

... outstanding in 1999 and 137,031,264 shares issued and 130,954,740 shares outstanding in 1998 Capital surplus, paid in Deferred contribution plan - employee stock ownership plan Retained earnings Accumulated other comprehensive income Total common shareholders' equity Preferred stock not subject... -

Page 36

... Surplus, Paid In Deferred Contribution Plan - ESOP Retained Earnings (a) Accumulated... stock ...NU common dividends. At December 31, 1999, retained earnings available for the payment of dividends totaled $158.5 million. The accompanying notes are an integral part of these financial statements... -

Page 37

...of demand-side-management costs, net Amortization/(deferral) of recoverable energy costs Nuclear unrecoverable costs Gain on sale of utility plant Net other (uses)/sources of cash Changes in working capital: Receivables and unbilled revenues, net Fuel, materials and supplies Accounts payable Accrued... -

Page 38

...-2006 8.38% to 8.58% 2013-2018 Adjustable Rate and 5.90% 2020 Adjustable Rate 2021-2022 5.85% to 7.65% and Adjustable Rate 2028 5.85% to 5.95% 2031 Adjustable Rate Total Pollution Control Notes and Other Notes Fees and interest due for spent nuclear fuel disposal costs Other Total Other Long-Term... -

Page 39

... (PCRBs) with bond insurance secured by the first mortgage bonds and a liquidity facility. Concurrent with the issuance of PSNH's Series A and B first mortgage bonds, PSNH entered into financing arrangements with the Business Finance Authority (BFA) of the state of New Hampshire. Pursuant to these... -

Page 40

... of PSNH acquisition costs Investment tax credit amortization State income taxes, net of federal benefit Nondeductible penalties Adjustment for prior years' taxes Employee stock ownership plan Dividends received deduction Adjustment to tax asset valuation allowance Merger related expenditures... -

Page 41

... company for NU's unregulated energy service companies. Northeast Generation Company (NGC) was formed to acquire generating facilities. Northeast Generation Services Company (NGS) was formed to provide services to the electric generation market as well as to large commercial and industrial customers... -

Page 42

... T LY O W N E D ELECTRIC UTILITY PLANT Regional Nuclear Generating Companies: CL&P, PSNH and WMECO own common stock in four regional nuclear companies (Yankee Companies). The NU system's ownership interests in the Yankee Companies at December 31, 1999 and 1998, which are accounted for on the equity... -

Page 43

...38.4 million and $57.5 million, respectively. CL&P: Through December 31, 1999, CL&P had an energy adjustment clause under which fuel prices above or below base-rate levels were charged to or credited to customers. At December 31, 1999 and 1998, recoverable energy costs included $62.6 million and $78... -

Page 44

... SFAS No. 92, "Regulated Enterprises - Accounting for Phase-In Plans." The costs will be fully recovered from PSNH's customers by May 2001. L. UNRECOVERED CONTRACTUAL OBLIGATIONS Under the terms of contracts with the Yankee Companies, the shareholder-sponsored companies are responsible for their... -

Page 45

... agreement as of December 31, 1999. In addition, NU provides credit assurance in the form of guarantees, letters of credit, performance guarantees and other assurances for the financial performance obligations of certain of its unregulated subsidiaries. NU currently has authorization from the SEC... -

Page 46

... was credited to utility plant, was $54.4 million in 1999, $44.1 million in 1998 and $22.5 million in 1997. Currently, the NU system companies annually fund an amount at least equal to that which will satisfy the requirements of the Employee Retirement Income Security Act and Internal Revenue Code... -

Page 47

...in calculating the plans' year end funded status: At December 31, Pension Benefits 1999 1998 Postretirement Benefits 1999 1998 Discount rate Compensation/progression rate Health care cost trend rate(a) (a) 7.75% 4.75 N/A 7.00% 4.25 N/A 7.75% 4.75 5.57 7.00% 4.25 5.22 The annual per capita cost... -

Page 48

... options, to be made to eligible employees and board members. The exercise price of stock options, as set at the time of grant, is generally equal to the fair market value per share at the date of grant. Under the Northeast Utilities Incentive Plan (Incentive Plan), the number of shares which may be... -

Page 49

... 31, 1998, WMECO had sold accounts receivable of $20 million to a third-party purchaser. Connecticut: During 1999, restructuring orders were issued by the DPUC which required CL&P to discontinue the application of SFAS No. 71 to the generation portion of its business and allowed for the recovery of... -

Page 50

... stranded costs through the net proceeds of generation asset sales and through billing a transition charge to retail customers. New Hampshire: In August 1999, NU, PSNH and the state of New Hampshire signed a Settlement Agreement intended to settle a number of pending regulatory and court proceedings... -

Page 51

...company expects any payments to the NUGs as result of these renegotiations to be recovered from the company's customers. Hydro-Quebec: Along with other New England utilities, CL&P, PSNH, WMECO, and HWP have entered into agreements to support transmission and terminal facilities to import electricity... -

Page 52

... 2004 Total H. NEW ENGLAND POWER POOL (NEPOOL) GENERATION PRICING 50 $1,271 638 573 499 101 $3,082 In 1999, CL&P divested substantially all of its fossil and hydroelectric generation assets and agreed to transfer the rights and obligations related to the long-term negotiated energy contracts to an... -

Page 53

... the quoted market price for those issues or similar issues. Adjustable rate securities are assumed to have a fair value equal to their carrying value. The carrying amounts of the NU system's ï¬nancial instruments and the estimated fair values are as follows: At December 31, 1999 Carrying Amount... -

Page 54

... and Con Edison common stock. NU shareholders also have the right to receive an additional $1 per share if a deï¬nitive agreement to sell its interests (other than that now held by PSNH) in Millstone 2 and 3 is entered into and recommended by the Utility Operations and Management Unit of the DPUC... -

Page 55

... CONSOLIDATED GENERATION STATISTICS (UNAUDITED) 1999 1998 1997 1996 1995 Source of Electric Energy: (kWh-millions) Nuclear - Steam(b) Fossil - Steam Hydro - Conventional Hydro - Pumped Storage Internal Combustion Energy Used for Pumping Net Generation Purchased and Net Interchange Company Use... -

Page 56

... (Average) 131,415,126 Dividends Per Share $ 0.10 Market Price - High $ 22 Market Price - Low $13 9/16 Market Price - Closing (end of year) $20 9/16 Book Value Per Share (end of year) $15.80 Rate of Return Earned on Average Common Equity (%) 1.6 Market-to-Book Ratio (end of year) 1.3 54 $(1.12... -

Page 57

... Total Electric Other Total Sales: (kWh - millions) Residential Commercial Industrial Other Utilities Streetlighting and Railroads Non-Franchised Sales Total Customers: (average) Residential Commercial Industrial Other Total Average Annual Use Per Residential Customer (kWh) Average Annual Bill Per... -

Page 58

...NORTHEAST UTILITIES SERVICE COMPANY OFFICERS ELECTRIC & GAS OPERATING COMPANY OFFICERS CL&P - The Connecticut Light and Power Company HWP - Holyoke Water Power Company PSNH - Public Service Company of New Hampshire WMECO - Western Massachusetts Electric Company Yankee - Yankee Gas Services Company... -

Page 59

...TRANSFER AGENTS AND REGISTRARS The Connecticut Light and Power Company Holyoke Water Power Company Public Service Company of New Hampshire Western Massachusetts Electric Company North Atlantic Energy Corporation Yankee Energy System, Inc. NONUTILITY SUBSIDIARIES Northeast Utilities Service Company... -

Page 60

Northeast Utilities P.O. Box 270 Hartford, Connecticut 06141-0270 1-800-286-5000 www.nu.com