Equifax 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report

Knowledge. Empowerment.

Table of contents

-

Page 1

2003 Annual Report Knowledge. Empowerment. -

Page 2

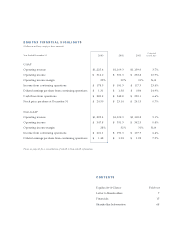

...342.5 31% $ 177.7 $ 1.28 5.1% 0.8% N/ A 6.4% 7.5% Please see page 30 for a reconciliation of GAAP to Non-GAAP information. ** See reconciliation of GAAP to Non-GAAP information at page_____. CON TEN TS Equifax At-A-Glance Letter to Shareholders Financials Shareholder Information Fold-out 7 15 68 -

Page 3

... financial health with Consumer Direct services offered at www.equifax.com. Equifax employs approximately 4,600 people in 13 countries: the United States, Canada, the United Kingdom, the Republic of Ireland, Italy, Spain, Portugal, Argentina, Brazil, Chile, El Salvador, Peru and Uruguay. Equifax... -

Page 4

Equifax is the global leader in transforming data into intelligence for businesses and individuals. The scope of our business encompasses: • A Database of Five Billion Credit Tradelines • Unique Profiles of 22 M illion Small Businesses • M ore Than 310 M illion Demographic and Lifestyle ... -

Page 5

...ON S ERV I CES Information That Empow ers businesses to evaluate prospective customers in seconds at the point of sale. One of the best ways to add new customers is to offer credit when someone is ready to buy - at the checkout counter, on the phone or online. For example, in the telecommunications... -

Page 6

...S S Information That Empow ers credit grantors to effectively manage small business risk. Small businesses are one of the primary engines of the American economy. Through the Equifax Small Business Credit Reportâ„¢, credit scores and analytic tools, lenders can open accounts and make small business... -

Page 7

...States, but also in Latin America and Europe, Equifax's market-leading, decisionmaking solutions are helping businesses answer these types of questions every day. T hrough credit scores, modeling, customer analytics and consulting services, our customers gain marketing and risk management insight in... -

Page 8

... ERV I CES Information That Empow ers businesses to maximize their marketing efforts and acquire the right customers. In today's business environment, companies need to ensure their marketing dollars target only consumers who are most likely to purchase their products and services. Take the example... -

Page 9

... combat. Equifax Credit Watchâ„¢ is the answer. This automated credit-monitoring service sends email notifications within 24 hours of any inquiries or key changes in a consumer's credit file - activities which could be an indicator of fraud, such as someone trying to open a credit account in another... -

Page 10

... Company's business structure in 2003 to include: • North America • Europe • Latin America • Consumer Direct • Marketing Services T his organization places each business closer to its customers in order to be more responsive to customer needs and alert to growth opportunities for Equifax... -

Page 11

... through electronic technology to provide real-time answers to increasingly complex questions for our customers such as: •Who is most likely to purchase this product? •How can we acquire and retain more customers? •Is this consumer or business a good risk? •What trends surface when I analyze... -

Page 12

... other markets serving smaller commercial customers. Clearly, for the economy at large and for Equifax, small business translates into opportunity. Our leadership in all aspects of our core information services business translated into extraordinary performance in 2003. North America had its best... -

Page 13

...introduced its upgraded, market-leading generic risk score, Risk Navigator . TM Additionally, late in the third quarter we released the first in a series of Consumer Direct products, starting with the United Kingdom's first online credit report. These products operate on Equifax's proven technology... -

Page 14

...ITH CREDIBILITY We know that consumers want to buy, value a wide range of choices, and seek information about these choices. Our Marketing Services business delivers world-class solutions by bringing the best buyers and the best sellers together, because Equifax has the largest storehouse of unique... -

Page 15

... be free to follow wherever that search may lead us." I am confident this search is leading Equifax toward its best and most rewarding achievements yet. Our time is now. Sincerely, T homas F. Chapman Chairman and Chief Executive Officer March 2004 12 EQ U I FA X . I N FO RM A T I O N T H A T EM... -

Page 16

... Committee John L. Clendenin Retired Chairman BellSouth Corporation, 1982 Lead Director of the Equifax Board Committees: Executive; Finance; Chairman of Governance Committee L. Phillip Humann Chairman, President and Chief Executive Officer SunTrust Banks, Inc., 1992 Committees: Compensation, Human... -

Page 17

... Ow en V. Flynn Chief Technology Officer Virgil P. Gardaya Group Executive Consumer Direct Karen H. Gaston Chief Administrative Officer John V. Healy Group Executive Marketing Services Donald T. Heroman Chief Financial Officer W illiam R. Phinney Group Executive (Retiring) Latin America Kent... -

Page 18

...Equity and Comprehensive Income Notes to Consolidated Financial Statements Report of Independent Auditors Report of Independent Public Accountants Executive Ofï¬cers and Contacts Shareholder Information 16 32 34 35 36 38 40 64 66 67 68 EQ U I FA X . I N FO RM A T I O N T H A T EM P O W ERS . 15 -

Page 19

... U.S. Information Services; 3. Record performance and market share gains in our Canadian operations; 4. Continued grow th in our Consumer Direct business; 5. Economic stabilization and recovery in Latin America; 6. Strong cash ï¬,ow from operations; and 7. Our December 2003 charge relating to our eM... -

Page 20

... our Equifax North America reporting segment and driven by volume increases across our Information Services and Consumer Direct operating segments. Information Services grow th w as fueled by 12% grow th in our U.S. consumer and commercial services business primarily due to higher volumes and market... -

Page 21

... decision to exit our commercial credit reporting business in Spain, low er personnel expense and professional service fees partially offset w ith higher royalties and data purchases expense on higher unit volumes in Equifax North America. SG&A expenses of $249.9 million declined nearly 7% over 2001... -

Page 22

... 2003 tow ard increased volumes in our marketing and consumer-related businesses w hich have a low er price per unit of online activity. Canadian operations revenue increased by $13.4 million, or 17%, due to increased volumes in consumer and decision solutions businesses. Credit M arketing Services... -

Page 23

...ï¬t in Spain and the United Kingdom. These improvements w ere partially offset by performance in our commercial line and by losses in Italy. Revenues of our Equifax Latin America segment, w hich includes results of our operations in Brazil, Argentina, Chile, Peru, Uruguay and El Salvador, operated... -

Page 24

...and identity theft, w e have an opportunity to market additional Consumer Direct products at the point of contact. Additionally, w e are noticing positive trends in customers renew ing subscriptions and ordering additional products. LIQUIDITY AND CAPITAL RESOURCES OVERVIEW Our principal sources of... -

Page 25

... $321.2 million in 2003 and 2002, respectively, for acquisitions. We acquired consumer credit ï¬les, contractual rights to territories, and customer relationships and related businesses from four Afï¬liates in the United States and one in Canada, and a small email marketing business, all for $42... -

Page 26

... use of cash w ould be the exercise by Computer Science Corporation (" CSC" ) of its option to require us to buy its credit reporting business at any time prior to 2013. The option exercise price w ill be determined by a third-party appraisal process and w ould be due in cash w ithin 180 days... -

Page 27

... or on terms acceptable to us, if at all. OFF-BALANCE SHEET TRANSACTIONS PENSION BENEFITS Other than facility leasing arrangements, we do not engage in offbalance sheet ï¬nancing activities. We have entered into a synthetic lease on our Atlanta corporate headquarters building in order to provide... -

Page 28

...ï¬t cost, depending on several factors including their relative size to our projected beneï¬t obligation and market-related value of plan assets. The discount rate w e utilize for determining future pension obligations is based on the yield associated w ith M oody's Long-Term Aa-rated Corporate... -

Page 29

... revised, SFAS 132 now enhances disclosures of relevant accounting information by providing more information about the plan assets available to ï¬nance beneï¬t payments, the obligation to pay beneï¬ts, and an entity's obligation to fund the plan. This revised version of SFAS 132 is effective for... -

Page 30

... Information Service products, such as the development of unique decision or predictive statistical models, and the sale of M arketing Service products, such as demographic data lists, data queries, and market research, is recognized upon completion, customer installation and acceptance. For sales... -

Page 31

... 31, 2003. We consider accounting for retirement plans critical to all of our operating segments because our management is required to make signiï¬cant subjective judgments about a number of actuarial assumptions, w hich include discount rates, healthcare cost trends rates, salary growth, long-term... -

Page 32

... time w ith the SEC, including but not limited to, our Annual Report on Form 10-K for the year ended December 31, 2003. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT M ARKET RISK In the normal course of our business, we are exposed to market risk, primarily from changes in foreign currency exchange... -

Page 33

.... Our exposure to market risk for changes in interest rates primarily relates to our variable rate revolving credit debt and the interest rate sw ap agreements associated w ith portions of our ï¬xed rate public debt. We attempt to achieve the low est all-in w eighted average cost of debt w hile... -

Page 34

... plus a spread from the counterparty, in exchange for a ï¬xed rate payment from us. The net settlements occur quarterly. A 1% increase in the average rate of interest on the variable rate debt outstanding under our revolving credit facilities during 2003 w ould have increased our pre-tax interest... -

Page 35

...per share (1) (2) Dividends Weighted-average common shares outstanding (diluted) 2003 $1,225.4 $ 312.0 $ 178.5 $ 11.3 $ 1.31 $ 0.080 136.7 December 31, BALANCE SHEET DATA Total assets Long-term debt Total debt Shareholders' equity Common shares outstanding OTHER INFORM ATION Stock price per share... -

Page 36

SELECTED FIN AN CIAL DATA 2002 2001 2000 1999 $1,109.3 $ 351.3 $ 191.3 $ 11.4 $ 1.38 $ 0.080 138.5 $1,139.0 $ 253.8 $ 117.3 $ 32.3 $ 0.84 $ 0.225 139.0 ... 5,000 $ 24.15 $3,288.4 5,200 $ 16.75 $2,306.9 6,500 $ 13.50 $1,869.0 7,800 EQ U I FA X . I N FO RM A T I O N T H A T EM P O W ERS . 33 -

Page 37

... (diluted): Income from continuing operations Discontinued operations Net income Shares used in computing diluted earnings per share Dividends per common share * Does not total due to rounding. See " Notes to Consolidated Financial Statements." 2003 $1,225.4 512.9 274.6 16.0 79.3 - 30.6 913.4 312... -

Page 38

... companies Proceeds from sale of businesses Proceeds from sale of assets Deferred payments on prior year acquisitions Cash used by investing activities Financing activities: Net short-term (payments) borrowings Additions to long-term debt Payments on long-term debt Treasury stock purchases Dividends... -

Page 39

... 2003 2002 $ 39.3 175.4 13.3 15.5 42.4 285.9 $ 30.5 179.8 20.8 20.9 33.6 285.6 Property and Equipment: Land, buildings and improvements Data processing equipment and furniture Less accumulated depreciation 31.6 121.7 153.3 106.3 47.0 29.3 115.9 145.2 94.6 50.6 Goodwill, net Purchased Data... -

Page 40

... 2002 Outstanding shares - 132.7 in 2003 and 135.7 in 2002 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 42.3 shares in 2003 and 38.1 shares in 2002 (Note 9) Stock held by employee beneï¬ts trusts, at cost, 5.4 shares in 2003 and 6.3 shares in 2002... -

Page 41

... 2000 Net income Other comprehensive loss Shares issued under stock plans Treasury stock purchased Spin-off of Certegy Inc. Cost of treasury stock transferred to employee beneï¬ts trust Cash dividends Income tax beneï¬t from stock plans Dividends from employee beneï¬ts trusts Balance, December 31... -

Page 42

... - 63.3 - - - - - Treasury Stock $(779.0) - - 0.5 (49.5 828.0) - - 0.8 (72.5) - - - (899.7) - - (0.8) (95.0) - - - Stock Held By Employee Beneï¬ts Trusts $(90.3) - - 0.5 89...adjustment Change in cumulative loss from cash ï¬,ow hedging transactions 2003 $164.9 65.9 (3.1) 0.5 $228.2 2002 $178.0... -

Page 43

...arketing Services information products and databases enable customers to identify a target audience for marketing purposes, and our Consumer Direct products and services provide information to consumers w hich enables them to reduce their exposure to identity fraud and to monitor their credit health... -

Page 44

... Sheets, and totaled $22.9 million at both December 31, 2003 and 2002. In conjunction w ith the divestiture of our risk management collections businesses in the U.S. and Canada in October 2000, certain of the proceeds received related to contracts to provide credit information products and services... -

Page 45

... our 2002 acquisition of Naviant, w e recorded a $10.1 million increase to goodw ill due to a reallocation of the purchase price w hich w as primarily caused by a reduction in acquired tax beneï¬ts. In our Spain commercial operations in 2002 we recognized an estimated $10.3 million loss related to... -

Page 46

... 2006. Purchased Data Files Purchased data ï¬les, as recorded on the accompanying consolidated balance sheets, represent the investment cost of acquired credit, demographic, and other related information used in our products and services. The costs are amortized on a straight-line basis primarily... -

Page 47

... and Disclosure," w e have elected to apply APB Opinion No. 25 and related interpretations in accounting for our stock option and performance share plans. Accordingly, by our use of the intrinsic value method to account for stock-based employee compensation, w e do not recognize compensation cost in... -

Page 48

... Balance Sheets" w ith a corresponding increase in long-term debt. Our maximum economic exposure to loss due to credit risk on these interest rate sw ap agreements approximates $11.1 million if all bank counterparties w ere to default. We manage this exposure by monitoring the concentration of risk... -

Page 49

... revised, SFAS 132 now enhances disclosures of relevant accounting information by providing more information about the plan assets available to ï¬nance beneï¬t payments, the obligation to pay beneï¬ts, and an entity's obligation to fund the plan. This revised version of SFAS 132 is effective for... -

Page 50

... July 7, 2001, w e completed the spin-off of our Payment Services business segment (Certegy Inc. or Certegy) through a tax-free dividend of all of our Certegy stock to our shareholders. Shareholders received a dividend of one share of Certegy stock for each tw o shares of Equifax stock ow ned. This... -

Page 51

...2001, w e acquired the credit ï¬les, customer contracts and related businesses of ï¬ve Afï¬liates located in the United States and 13 Afï¬liates in Canada, as w ell as an information services business in Uruguay. These acquisitions w ere accounted for as purchases and had a purchase price of $48... -

Page 52

... of our eM arketing business. Other assets are primarily eM arketing trade accounts receivable w hich w ere assessed for collection. Credit M arketing Services and Direct M arketing Services, which include our eM arketing business, comprise one reporting unit. As of December 31, 2003, the estimated... -

Page 53

.... The discount, and related issuance costs, will be amortized on a straight-line basis over the term of the notes. Our $200.0 million 6.5% senior unsecured notes, originally issued in 1993, matured June 2003. We borrowed $200.0 million under our revolving credit facility to retire the maturing... -

Page 54

... tax assets: Postretirement beneï¬ts Employee compensation programs Deferred revenue Depreciation Net operating loss carryforw ards of subsidiaries Foreign tax credits Valuation allow ance Other Deferred income tax liabilities: Reserves and accrued expenses Data ï¬les and other assets Pension... -

Page 55

... 31, 2003, approximately $127.0 million remained available for future purchases from prior authorizations of our Board of Directors. In 1993, w e established the Equifax Inc. Employee Stock Beneï¬ts Trust to fund various employee beneï¬t plans and compensation programs, and transferred 6.2 million... -

Page 56

... primarily a function of salary and years of service. Supplemental Retirement Plan We maintain a supplemental executive retirement program for certain key employees. The plan, w hich is unfunded, provides supplemental retirement payments based on salary and years of service. 10. EM PLOYEE BEN EFITS... -

Page 57

... the beneï¬t obligations, plan assets, and funded status of the plans are as follow s: (in millions) Change in beneï¬t obligation Beneï¬t obligation at beginning of year Service cost Interest cost Actuarial (gain) loss Plan amendments Foreign currency exchange M edicare Act of 2003 Beneï¬ts paid... -

Page 58

... in funded status) of $24.9 million. The discount rate used to calculate the USRIP pension income w as decreased from 7.25% for 2002 pension income to 6.75% for 2003. The effect of this change w as a decrease in 2003 income of $3.3 million. EQ U I FA X . I N FO RM A T I O N T H A T EM P O W ERS... -

Page 59

... future risk premiums based on historical risk premiums. $0.1 $1.9 $(0.1) $(1.7) On December 8, 2003, President Bush signed into law the M edicare Prescription Drug, Improvement and M odernization Act of 2003. Follow ing the guidance of the Financial Accounting Standards Board, the Company has... -

Page 60

...one issuer w ith the exception of Equifax Inc. common stock, and U.S. Treasury and Government Agency securities. 2003* 2002 Large-Cap equity 25% M id-Cap equity 10% Small-Cap equity 8% International equity 12% Alternative Assets 15% Venture Capital 10% Real Estate 5% Fixed Income 15% Cash minimal... -

Page 61

... Our retirement savings plans provide for annual contributions, w ithin speciï¬ed ranges, determined at the discretion of the Board of Directors for the beneï¬t of eligible employees in the form of cash or shares of common Note: CRIP asset allocation guidelines put into place during 2002, real... -

Page 62

... in North America, the United Kingdom, Agreement w ith Computer Sciences Corporation We have an agreement w ith Computer Sciences Corporation and certain of its afï¬liates, collectively, CSC, under w hich CSC-ow ned credit reporting agencies utilize our computerized credit database services. CSC... -

Page 63

... our current obligations, or pay dividends. Litigation We are a defendant in a class action lawsuit ï¬led during April 2001 in the U.S. District Court of South Carolina captioned Franklin Clark and Latanjala Denise M iller v. Equifax Inc. and Equifax Credit Information Services, Inc. This action... -

Page 64

... 2002 and $29.5 million at December 31, 2003. Additionally, SunTrust extends ï¬nancing in the form of an amortizing term loan to a leveraged real estate limited partnership which owns Equifax's Atlanta data center located in Alpharetta, Georgia. Equifax Inc. is the primary operating lease tenant in... -

Page 65

...including consumer and commercial services such as credit and ï¬nancial information, credit scoring, and credit modeling services; and Credit M arketing Services. Equifax Latin America Comprises the Argentina, Brazil, Chile, El Salvador, Peru, and Uruguay businesses. Products and services offerings... -

Page 66

...: Equifax North America $66.0 Equifax Europe 11.8 Equifax Latin America 5.5 Other - Corporate 12.0 95.3 Divested Operations - $95.3 2003 Capital Expenditures (excluding property and equipment and other assets acquired in acquisitions): Equifax North America Equifax Europe Equifax Latin America Other... -

Page 67

... IN DEPEN DEN T AUDITORS REPORT OF ERNST & YOUNG LLP, INDEPENDENT AUDITORS THE BOARD OF DIRECTORS AND SHAREHOLDERS EQUIFAX INC. We have audited the accompanying consolidated balance sheets of Equifax Inc. (the " Company" ) as of December 31, 2003 and 2002, and the related consolidated statements of... -

Page 68

... the Company other than w ith respect to such adjustments and disclosures and, accordingly, w e do not express an opinion or any other form of assurance on the 2001 consolidated ï¬nancial statements taken as a w hole. Atlanta, Georgia February 18, 2004 EQ U I FA X . I N FO RM A T I O N T H A T EM... -

Page 69

REPORT OF IN DEPEN DEN T PUBLIC ACCOUN TAN TS TO EQUIFAX INC.: We have audited the accompanying consolidated balance sheets of Equifax Inc. (a Georgia corporation) and subsidiaries as of December 31, 2001 and 2000 and the related consolidated statements of income, changes in shareholders' equity ... -

Page 70

.... Rubinger [email protected] TRANSFER AGENT AND REGISTRAR SunTrust Bank Stock Transfer Department P .O. Box 4625 Atlanta, Georgia 30302 Telephone (800) 568-3476 AUDITORS Ernst & Young LLP 600 Peachtree Street Suite 2800 Atlanta, Georgia 30308-2215 EQ U I FA X . I N FO RM A T I O N T H A T EM P O W ERS... -

Page 71

....03 18.93 Form #3201-03 Equifax, Score Pow er and Equifax Decision Pow er are registered trademarks of Equifax Inc. Equifax Credit Watch, Equifax 3-in-1 Credit Report, Equifax Small Business Credit Report, Predictive Sciences, Risk Navigator, InterConnect, Information That Empow ers are trademarks... -

Page 72

Designed and produced by Corporate Reports Inc./ Atlanta w w w.corporatereport.com -

Page 73

...They ensure that Equifax's business continues to evolve and meet the challenges of the global markets in w hich w e compete. We also extend our appreciation to the customers, consumers and shareholders w ho express their confidence in us daily as w e continue to deliver Information That Empow ers TM...