Energy Transfer 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Energy Transfer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

subsequently transferred its interest in the Midcontinent Express pipeline to Regency Energy Partners LP

(“Regency”). As of December 31, 2010, we held a 0.1% interest in the Midcontinent Express pipeline.

Recent Developments and Current Growth Projects

In October 2010, we announced plans to construct the Chisholm pipeline in the Eagle Ford Shale, the initial

phase of which will consist of approximately 83 miles of 20-inch pipeline, extending from DeWitt County, Texas

to our La Grange Processing Plant in Fayette County, Texas. The Chisholm pipeline will have an initial capacity

of 100 MMcf/d, with anticipated capacity expansion exceeding 300 MMcf/d. The project will utilize existing

processing capacity at our La Grange Plant. After processing, the residue volumes will be transported on our

Oasis pipeline system. The initial phase of this pipeline is expected to be in service by the second quarter of

2011.

In February 2011, we announced that we had entered into multiple long-term agreements with shippers to

provide additional transportation services from the Eagle Ford Shale in South Texas. To facilitate these

agreements, we will construct a natural gas pipeline, the Rich Eagle Ford Mainline (“REM”), a processing plant

and additional facilities at an approximate cost of $300 million. The REM will be approximately 160 miles of

30-inch pipeline and will have capacity of 400 MMcf/d, with the ability to expand capacity to 800 MMcf/d. The

REM will originate in Dimmitt County, Texas and extend to ETP’s Chisholm Pipeline and is expected to be in

service by the fourth quarter of 2011.

As a result of these projects and other initiatives, we expect to spend between $775 million and $885 million in

2011 on internal growth projects that we expect will provide us with incremental revenues and cash flows in the

years to come.

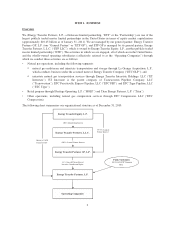

Segment Overview

Our segments and business are as described below. See Note 13 to our consolidated financial statements for

additional financial information about our segments.

Intrastate Transportation and Storage Segment

Through our intrastate transportation and storage segment, we own and operate approximately 7,700 miles of

natural gas transportation pipelines and three natural gas storage facilities located in the state of Texas.

Through ETC OLP, we own the largest intrastate pipeline system in the United States with interconnects to

Texas markets and to major consumption areas throughout the United States. Our intrastate transportation and

storage segment focuses on the transportation of natural gas to major markets from various prolific natural gas

producing areas through connections with other pipeline systems as well as through our Oasis pipeline, our East

Texas pipeline, our natural gas pipeline and storage assets that are referred to as the Energy Transfer Fuel System

(“ET Fuel System”), and our HPL System, which are described below.

Our intrastate transportation and storage segment accounted for approximately 49%, 56% and 65% of our total

consolidated operating income for the years ended December 31, 2010, 2009 and 2008, respectively. Our

intrastate transportation and storage segment’s results are determined primarily by the amount of capacity our

customers reserve as well as the actual volume of natural gas that flows through the transportation pipelines.

Under transportation contracts, our customers are charged (i) a demand fee, which is a fixed fee for the

reservation of an agreed amount of capacity on the transportation pipeline for a specified period of time and

which obligates the customer to pay even if the customer does not transport natural gas on the respective

pipeline, (ii) a transportation fee, which is based on the actual throughput of natural gas by the customer, (iii) fuel

retention based on a percentage of gas transported on the pipeline, or (iv) a combination of the three, generally

payable monthly.

We also generate revenues and margin from the sale of natural gas to electric utilities, independent power plants,

local distribution companies, industrial end-users and other marketing companies on our HPL System. Generally,

4