Emerson 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

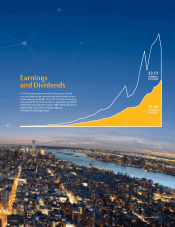

Emerson generated approximately $2.5 billion in

operating cash flow (approximately $3 billion adjusted

for income taxes paid on divestiture gains). We continued

our commitment to delivering value to shareholders

by returning $3.8 billion in cash through $2.5 billion in

share repurchase and $1.3 billion in dividends. Also,

the Board of Directors voted to raise the first quarter

2016 dividend to an annualized rate of $1.90 per share,

which would make 2016 our 60th consecutive year of

increased dividends, an impressive record that can be

matched by few corporations. We expect to generate

over $3 billion in operating cash flow in 2016, and we

intend to return $1.8 billion to $2.5 billion to shareholders.

Our performance in fiscal 2015 and shifting end market

dynamics brought into focus for the management

team and the Board that we had reached an inflection

point and serious strategic action was needed to best

serve our customers and shareholders. Throughout

the Company’s 125-year history, we have periodically

undertaken this type of strategic repositioning and

emerged stronger from it. Therefore, we began to

take the necessary steps this past June to once again

transform Emerson to adapt to what we see on the

global horizon and strengthen the company in order

to accelerate growth and value creation. In June, we

initiated the spinoff of the network power business

and the evaluation of the potential sale of the motors

and drives, power generation and remaining storage

businesses, which together represent $6.7 billion in

sales. We accomplished a portion of this task in 2015

with the divestiture of the InterMetro business, and

the remaining strategic repositioning actions are

expected to be completed in 2016. After completing

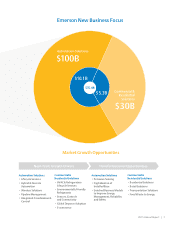

this transformation, Emerson sales will be around

$15 billion, from a peak of $25 billion in 2013. We

intend to aggressively pursue acquisitions and organic

growth programs around our core businesses in order

to accelerate growth and profitability to once again

exceed the $20 billion sales threshold.

As we complete this strategic repositioning, we will

have a highly focused portfolio with leadership positions

in stronger growth-end markets. Going forward,

our portfolio will have two core business platforms:

Automation Solutions and Commercial & Residential

David N. Farr

Chairman and

Chief Executive Officer