Emerson 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“ A legacy of

performance...” “ The world today faces several fundamental

challenges that impact every individual and

every business. Emerson has long monitored

these challenges and opportunities, and we

stand prepared to help the world meet them.”

David N. Farr

Chairman, Chief Executive Officer, and President

“What’s next ...”

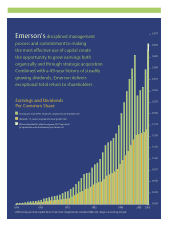

cash flow allowed us to return significant cash to

shareholders in the form of share repurchases. Emerson

repurchased approximately 10 million shares during

2005, which means that between dividend payments

and share repurchases, Emerson returned more than

62 percent of 2005 operating cash flow to shareholders.

This slightly exceeded the stated target of returning

50 to 60 percent of operating cash flow to shareholders.

The company’s strong cash position also allows

us to make strategic acquisitions that strengthen

existing businesses and generate long-term

returns for shareholders. Process Management and

Industrial Automation purchased companies that

bring complementary product offerings and expand

Emerson’s offering of key technologies to the industrial

marketplace. Network Power acquired businesses that

serve the telecom and data center markets, and an

acquisition in the consumer storage business continues

the drive to build a billion dollar storage business. In

total these acquisitions are expected to add approximately

$500 million of revenue to Emerson in 2006.

Investment in leading technologies remains one of

Emerson’s top priorities — it allows us to create best-

in-class products and solutions to meet customers’

toughest challenges, anywhere in the world. Emerson’s

engineering and development investment in 2005

was $634 million, which includes customer solution

engineering. This investment encompasses a global

approach that has allowed us to increase engineering

and development headcount by 20 percent since 2003

while the associated costs as a percent of sales have

been held flat. This approach continues to increase

innovative capacity, evidenced by the 31 percent of

2005 sales that were generated by new products.

2 E M E R S O N 2 0 0 5