Emerson 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

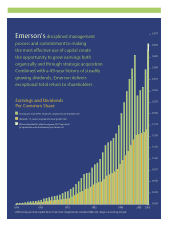

Emerson had an

outstanding year in 2005, as we delivered the second

consecutive year of double-digit growth in sales and

earnings per share. Sales were a record $17.3 billion,

up 11 percent from $15.6 billion in 2004. The growth

was led by strength in the industrial and technology

markets we serve and was also the result of Emerson’s

continued focus on eight key growth initiatives,

which as a group increased by 15 percent in 2005.

Earnings per share increased 19 percent to $3.55 for

2005, excluding the tax impact of repatriating foreign

earnings under the American Jobs Creation Act (AJCA).

Reported earnings per share were $3.40, a 14 percent

increase from the $2.98 per share in 2004.

Emerson’s cash flow performance in 2005

demonstrates the company’s strong commitment

to capital efficiency as a means of creating value for

shareholders. Operating cash flow was $2.2 billion

in 2005, a slight decrease compared with last year’s

record cash flow. Free cash flow (operating cash flow

less capital expenditures) in 2005 was $1.7 billion, an

8 percent decrease from 2004 as we made strategic

capital investments throughout the company. Free

cash flow was higher than net income for the fifth

consecutive year, a testament to Emerson’s continued

high quality of earnings and efficient working capital

management. Return on total capital excluding the

AJCA impact increased to 16.1% (15.5% including

the impact of AJCA) from 14.2% in 2004, the

fourth consecutive annual improvement.

Emerson’s commitment to generating returns

for shareholders continues with 2005 marking the

49th consecutive year of increased dividends. Dividends

in 2005 were $1.66 per share, and in November 2005

the board of directors increased the dividend to an

annualized rate of $1.78 per share. Additionally, strong

“ A legacy of

performance...”

Dear Shareholders,