Emerson 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

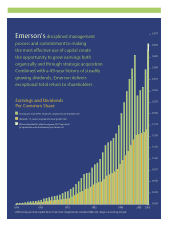

Emerson’s disciplined management

process and commitment to making

the most effective use of capital create

the opportunity to grow earnings both

organically and through strategic acquisition.

Combined with a 49-year history of steadily

growing dividends, Emerson delivers

exceptional total return to shareholders.

1956 1965 1975 1985 1995 2002* 2005

$3.75

$3.50

$3.25

$3.00

$2.75

$2.50

$2.25

$2.00

$1.75

$1.50

$1.25

$1.00

$0.75

$0.50

$0.25

$0.00

Earnings and Dividends

Per Common Share

Earnings per share (EPS): 10 percent compound annual growth rate

Dividends: 11 percent compound annual growth rate

EPS excluding the $63 million tax expense ($0.15 per share)

for repatriation under the American Jobs Creation Act

*2002 earnings per share is before the $2.23 per share charge from the cumulative effect of a change in accounting principle.