Eli Lilly 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

LETTER TO SHAREHOLDERS

To Our Shareholders

For Eli Lilly and Company, 2008 was a year of transition

and transformation.

Our solid fi nancial performance, driven by volume-

based sales growth, improved gross margins, and better

productivity, allowed us to make important investments

to advance our pipeline of promising molecules, to

resolve much of the uncertainty surrounding product liti-

gation, and to complete several strategic business develop-

ment transactions, including the acquisition of ImClone

Systems—the largest acquisition in Lilly history.

Transformation is not optional. The economic down-

turn only added to the challenges facing the pharmaceuti-

cal industry—including pressure on pricing and access,

a drought in research, and regulatory uncertainty. At the

same time, we have unprecedented opportunities to ad-

dress unmet patient needs. Lilly enters 2009 with more

molecules in clinical development than ever before—and

an unwavering commitment to deliver improved out-

comes for individual patients.

This has also been a year of transition. I succeeded

Sidney Taurel as CEO in April and as chairman on Janu-

ary 1, 2009. In my new responsibilities, I retain a pro-

found sense of optimism about Lilly’s future—grounded

in a realistic assessment of the challenges we face and the

diffi cult nature of the task ahead.

REVIEW OF 2008

Sales and fi nancial results

Throughout 2008, we advanced Lilly’s transformation

by executing on our operational and strategic priorities.

Reported sales grew 9 percent, driven primarily by a

5 percent increase in volume. For the fi rst time, we sur-

passed $20 billion in revenue, with eight products—and

our Elanco animal health business—exceeding $1 billion

in annual sales. According to data from IMS Health, Lilly

has moved into the top 10 companies in worldwide phar-

maceutical sales.

As a result of certain signifi cant charges, we reported

a net loss of $2.07 billion, or $1.89 per share, for 2008,

compared with 2007 net income of $2.95 billion and

earnings per share of $2.71. The company recorded total

charges of $4.73 billion related to the acquisition of

ImClone Systems, and $1.42 billion related to Zyprexa®

investigations by the United States Attorney for the East-

ern District of Pennsylvania (EDPA) and multiple states—

which I’ll discuss below. On a pro forma non-GAAP basis,

excluding signifi cant items totaling $5.91 per share, earn-

ings rose 14 percent to $4.02 per share.

Strong volume sales, coupled with discipline on

expenses and continued productivity gains, allowed us

to generate over $7 billion in operating cash fl ow. These

results give us the benefi t of a strong fi nancial position

just when we need it most—to make the necessary invest-

ments in our pipeline and in the company’s broader trans-

formation. We aim to sustain solid operating performance

as we prepare for the full impact of patent expirations

beginning in late 2011, a period we call “Years YZ.”

Commercial and regulatory overview

In 2008, we experienced three quarters of double-digit,

volume-driven sales growth that was broad-based across

many brands and regions. Unfortunately, in the fourth

quarter we saw a slowdown in total sales growth and vol-

ume growth. In addition, as the dollar strengthened late in

the year, exchange rates turned from a benefi t to a drag on

our sales line.

For the full year, products launched this decade—

Alimta®, Byetta®, Cialis®, Cymbalta®, Forteo®, Strattera®,

Symbyax®, Xigris®, and Yentreve™—collectively grew

22 percent on a reported basis, to $7.31 billion, and

accounted for 36 percent of total sales, compared with

32 percent of total sales in 2007. (For individual product

performance, please see page 15.)

In 2008, we set the stage for continued growth in our

marketed products with the approval and launch of new

indications and line extensions. These included: Alimta for

fi rst-line treatment of non-squamous non-small cell lung

cancer in the U.S. and Europe; Cymbalta for fi bromyalgia

in the U.S. and for generalized anxiety disorder in Europe;

Cialis for once-daily use in the U.S.; and the Humalog

KwikPen™ in the U.S., Japan, and select international mar-

kets. Zypadhera™—a long-acting formulation of Zyprexa—

received fi nal approval in Europe late last year, and we are

currently launching in the fi rst several markets.

In addition, we submitted, among others: Alimta for

the maintenance treatment of non-squamous non-small

cell lung cancer in the U.S. and Europe; Cialis for pulmo-

nary arterial hypertension in the U.S., Europe, and Japan;

and Byetta for monotherapy in the U.S.

As this report went to press, we received good

news in Europe on prasugrel, the antiplatelet agent we

0

$1,000

$2,000

$3,000

$4,000

$5,000

Zyprexa

Cymbalta

Humalog

Gemzar

Cialis

Alimta

Animal Health

Evista

Humulin

Forteo

Strattera

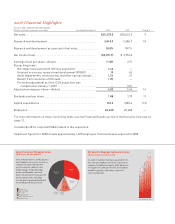

Eight Products Exceed $1 Billion

in Net Sales

($ millions)

Eight products and one product

line—Zyprexa, Cymbalta, Humalog,

Gemzar, Cialis, Alimta, Animal

Health, Evista, and Humulin—

exceeded $1 billion in 2008.

At $1.15 billion in sales, Alimta

reached “blockbuster” status in

its fifth year on the market.

$1,720

$1,736

$4,696

$2,697

$1,445

$1,155

$1,063

$1,076

$1,093

$779

$580