Eli Lilly 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

CHAIRMAN’S LETTER

Sidney Taurel

Chairman of the Board, President,

and Chief Executive Offi cer

“Fair Balance”

To Our Shareholders

Clearly, for the pharmaceutical industry as a whole, the

tough sledding of the past few years intensifi ed in 2004.

Many companies are struggling with signifi cant business

challenges including looming patent expirations, sputter-

ing R&D output, and, in one case, a major product recall.

In addition to these operational troubles, the industry ran

into further problems in the external policy environment,

as concerns about product safety and allegations that

some companies had concealed important clinical data

brought new calls for more stringent regulation.

Almost as troubling to me as the negative events

themselves is the way in which they have come to domi-

nate virtually every discussion of the industry, whether in

media coverage or policy debates. Neither investors nor

legislators can make good decisions in an environment

where everything is portrayed in stark black and white.

What is needed is a greater sense of reasonable propor-

tion in public dialogue—the ethic newspapers used to call

“fair balance.”

Applying this to Lilly’s record for the year, it seems to

me that, while we had some undeniable setbacks, we also

had some remarkable achievements in both our business

results and our public interactions. Taken together, these

accomplishments point to genuine progress not only for

our company, but, in some measure, for our industry too.

We had our share of bad news, and I won’t gloss over

it in any way. Most disappointing for our shareholders,

certainly, was the fall in our share value—19 percent for

the 12-month period. In part, this decline was a sector ef-

fect, driven by the events I just noted. The pharmaceutical

industry has traditionally traded at a 20 percent or more

premium to the S&P 500, but by the end of 2004 it trailed

that index by 15 to 20 percent. Lilly’s stock was also held

down as investors waited to see the outcome of a chal-

lenge to our U.S. Zyprexa® patent. The trial was concluded

in February 2004 and, at this writing, we are awaiting a

ruling from the trial court.

A second disappointment—and another key factor

affecting our share price—was weaker-than-expected sales

for Zyprexa in the U.S., showing an 8 percent decline.

This sales erosion was driven by concerns about potential

weight gain and hyperglycemia and amplifi ed by intense

advertising by trial lawyers targeting Zyprexa patients.

Genuine progress in a diffi cult year

Disappointing though they were, these setbacks

should not obscure the many positive highlights for Lilly

in 2004.

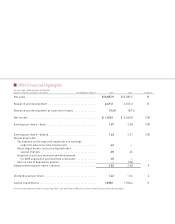

In our fi nancial performance, we saw total sales grow

10 percent over the prior year—at the high end for our in-

dustry. Our eight new products contributed to that result,

accounting for 11 percent of Lilly’s total sales. And we

expect that share to roughly double in 2005. Moreover,

we managed to beat investors’ expectations for earnings

for the year, delivering adjusted earnings per share of

$2.82. (For a reconciliation of our adjusted EPS per share

to the reported EPS of $1.66, please see page 1.)

Most signifi cantly, we continued to run counter to

the industry trend by delivering breakthrough innovation

at a record pace—a total of eight new drugs since late

2001, thereby doubling our portfolio of promoted prod-

ucts. In 2004, Lilly launched fi ve new products plus six

new indications or formulations in several key markets.

Three of these new products were fi rst-in-class: Symbyax™

for bipolar depression, Alimta® for mesothelioma, and

Yentreve® for stress urinary incontinence in Europe. The

other two—Cialis® for erectile dysfunction in the U.S. and