Eli Lilly 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIALS

11

release of the HHS Task Force Report on Importation,

which concludes that the safety and possible savings of

an importation scheme are questionable.

As a result of the passage of the MMA, aged and dis-

abled patients jointly eligible for Medicare and Medicaid

will receive their prescription drug benefi ts through the

Medicare program, instead of Medicaid, on January 1,

2006. This may relieve some state budget pressures but

is unlikely to result in reduced pricing pressures at the

state level. A majority of states have begun to implement

supplemental rebates and restricted formularies in their

Medicaid programs, and these programs are expected

to continue in the post-MMA environment. Several states

are also attempting to extend discounted Medicaid prices

to non-Medicaid patients. Additionally, notwithstand-

ing the federal law prohibiting drug importation, nine

states have implemented importation schemes for their

citizens, usually involving a website that links patients

to selected Canadian pharmacies. One state has such

a program for its state employees. In the absence of

federal action to curtail state activities, more states are

expected to launch importation efforts. As a result, we

expect pressures on pharmaceutical pricing to continue.

International operations are also generally subject

to extensive price and market regulations, and there

are many proposals for additional cost-containment

measures, including proposals that would directly or

indirectly impose additional price controls or reduce the

value of our intellectual property protection.

OPERATING RESULTS—2004

Sales

Our worldwide sales for 2004 increased 10 percent,

to $13.86 billion, due primarily to the increased global

sales of Strattera, Gemzar, Forteo, Zyprexa, Evista, Hu-

matrope, and Cialis, and sales related to the launches of

Alimta and Cymbalta. Sales in the U.S. increased 6 per-

cent, to $7.67 billion. Sales outside the U.S. increased

15 percent, to $6.19 billion. Worldwide sales refl ected a

volume increase of 5 percent, with global selling prices

contributing 2 percent and an increase due to favorable

changes in exchange rates contributing 3 percent.

Zyprexa, our top-selling product, is a treatment for

schizophrenia, bipolar mania, and bipolar maintenance.

Zyprexa sales in the U.S. decreased 8 percent in 2004

due to a decline in underlying demand from continued

competitive pressures. Zyprexa sales outside the U.S.

increased 22 percent, driven by volume growth in a

number of major markets outside the U.S. International

Zyprexa sales growth also benefi ted from the impact

of foreign exchange rates. Excluding the impact of

exchange rates, sales of Zyprexa outside the U.S. in-

creased by 13 percent in 2004. While we expect Zyprexa

sales in the U.S. to decline in 2005, we believe the ero-

sion will start to slow sometime in 2005. In addition, we

continue to expect double-digit growth of Zyprexa sales

outside the U.S. As a result, we expect a slight decline

in our 2005 worldwide Zyprexa sales.

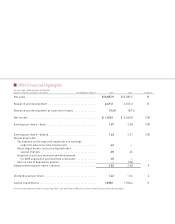

The following table summarizes our net sales activity in 2004:

Year Ended Year Ended Percent

December 31, 2004 December 31, 2003 Change

Product U.S.1 Outside U.S. Total Total from 2003

(Dollars in millions)

Zyprexa . . . . . . . . . . . . . . . . . . . . . . $2,422.2 $1,997.6 $ 4,419.8 $ 4,276.9 3

Gemzar . . . . . . . . . . . . . . . . . . . . . . 565.1 649.3 1,214.4 1,021.7 19

Humalog® . . . . . . . . . . . . . . . . . . . . 685.4 416.2 1,101.6 1,021.3 8

Evista. . . . . . . . . . . . . . . . . . . . . . . . 667.9 344.8 1,012.7 922.1 10

Humulin® . . . . . . . . . . . . . . . . . . . . 422.7 575.0 997.7 1,060.4 (6)

Animal health products. . . . . . . . . 338.9 459.8 798.7 726.6 10

Strattera . . . . . . . . . . . . . . . . . . . . . 656.4 10.3 666.7 370.3 80

Fluoxetine products. . . . . . . . . . . . 327.3 231.7 559.0 645.1 (13)

Anti-infectives . . . . . . . . . . . . . . . . 110.2 367.8 478.0 489.9 (2)

Actos® . . . . . . . . . . . . . . . . . . . . . . . 340.4 112.5 452.9 431.2 5

Humatrope . . . . . . . . . . . . . . . . . . . 204.8 225.5 430.3 370.9 16

ReoPro®. . . . . . . . . . . . . . . . . . . . . . 175.4 187.4 362.8 364.4 0

Forteo . . . . . . . . . . . . . . . . . . . . . . . 198.0 40.6 238.6 65.3 NM

Xigris® . . . . . . . . . . . . . . . . . . . . . . . 123.3 78.5 201.8 160.4 26

Alimta . . . . . . . . . . . . . . . . . . . . . . . 121.8 20.8 142.6 — NM

Cialis2. . . . . . . . . . . . . . . . . . . . . . . . 1.4 129.2 130.6 73.5 78

Cymbalta. . . . . . . . . . . . . . . . . . . . . 92.7 1.2 93.9 — NM

Symbyax . . . . . . . . . . . . . . . . . . . . . 70.1 0.1 70.2 — NM

Other pharmaceutical products. . 144.5 341.1 485.6 582.5 (17)

Total net sales . . . . . . . . . . . . . . $7,668.5 $6,189.4 $13,857.9 $12,582.5 10

NM—Not meaningful

1 U.S. sales include sales in Puerto Rico.

2 Cialis sales shown in the table above represent results in the territories in which we market Cialis exclusively. The remaining sales relate to the joint-

venture territories of Lilly ICOS LLC (North America, excluding Puerto Rico, and Europe). Our share of the joint-venture-territory sales, net of expenses,

is reported in net other income in our consolidated income statement.