Electrolux 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acceleration…

Annual Report 2005

Table of contents

-

Page 1

Acceleration... Annual Report 2005 -

Page 2

...performance for appliances in North America • Mix improved on basis of greater number of product launches • The Electrolux share rose by 36%, with a high of SEK 210, corresponding to a market capitalization of more than SEK 70 billion Reports in 2006 Consolidated results Annual Report Form 20... -

Page 3

... as refrigerators, cookers, washing machines. Electrolux is also one of the largest producers in the world of similar equipment for professional users. Share of total Group sales Net sales and operating margin* SEKm 125,000 Europe 34% Professional products 5% Asia/Pacific 7% Latin America 4% North... -

Page 4

... company. The Board proposes that the AGM in April, 2006 authorize distribution of the shares in Husqvarna to the Electrolux shareholders (see pages 22 and 41). Net sales for Outdoor Products in 2005 amounted to SEK 28,768m. Share of total Group sales Professional products Consumer 8% products... -

Page 5

..., marketing and brand building, combined with low costs for production, purchasing and distribution. This is how we're going to keep building Electrolux. The spin-off of our Outdoor Products operation - which the Board proposes to distribute to Electrolux shareholders under the name of Husqvarna... -

Page 6

... Changing consumer preferences create new opportunities Virtually all households in Western Europe and North America have a refrigerator, a cooker and a washing machine. When a product reaches the end of its useful life, it is immediately replaced by a new appliance. Demand for the Group's products... -

Page 7

... of product categories in Europe % 100 80 60 Western Europe 40 Eastern Europe Virtually all households in Europe have a refrigerator, a cooker and a washing machine, so that replacement buying accounts for most purchases of these appliances. There is a good potential for new sales of freezers... -

Page 8

...low-cost countries and are also purchasing more components there. In time, production costs for the major producers will essentially be at the same level. This will stimulate a shift of competitive focus to product development, marketing and brand-building. 4 Electrolux Annual Report 2005 % 10 20... -

Page 9

... share of mid-range products will decline, although it will remain significant for many years. Companies that build strong brands and focus on design and innovation can achieve very good profitability in all segments. Retail structure in Europe % 70 60 50 40 30 20 The Netherlands Germany Austria... -

Page 10

-

Page 11

..." sums up our product offering. We have to continuously think of and understand the end-user, in everything from product development and marketing to production logistics and service. That is how we create value for our customers - and thereby for our shareholders. Electrolux Annual Report 2005 7 -

Page 12

...product management, development, design and marketing. We continuously monitor major and minor global consumer trends and combine them with our model of various consumer needs. This enables each new product to be aimed at a specific target group, with a relevant message that reflects consumer values... -

Page 13

... execution 8. Range management 9. Phase-out 1. Strategic market plan: Identification of the areas to focus on. New business opportunities arise as consumer behavior changes. 2. Identification of consumer opportunities: Consumers are grouped according to their different needs. Each new product is... -

Page 14

... to be used. Electrolux is already the Group's leading brand in many markets, such as Asia, Eastern Europe and Latin America. A brand is strong when it is well-known, associated with quality, innovation and value, and has the trust and loyalty of consumers. A strong brand enables higher prices and... -

Page 15

... a new global communications platform - "Thinking of you". This theme highlights the strong focus on user needs that guides Electrolux product development. Awards to Electrolux design In recent years, Electrolux has won a number of international awards for good design. The iF Product Design Award... -

Page 16

... Spiral Flame Burner Work on consumer insight showed that many consumers in China want a cooker that saves both time and gas. Electrolux created the Spiral Flame Burner, which after only one year has taken a substantial share of the Chinese market for high-end gas cookers. Electrolux ICON Wine... -

Page 17

...of 2005. It offers an attractive appearance, perfect grilling results and quality craftsmanship. Electrolux ICON Dishwasher The noise level is so low that it is virtually unnoticeable. This unit can wash 14 settings, thanks to flexible interior fittings. Electrolux Screenfridge A refrigerator with... -

Page 18

..., Sweden. During the year, new plants were opened in Juarez, Mexico (refrigerators), Siewerz, Poland (tumble-dryers), Zarow, Poland (dishwashers) and Rayong, Thailand (professional washing machines). In 2005 a global program for more efficient production was launched at all major Group plants... -

Page 19

...reducing the number of suppliers, standardizing components and increasing purchases from lowcost countries. Corresponding reviews of potential savings will be implemented in another 15 areas. Mexico • Refrigerators Hungary • Refrigerators/freezers machines Russia • Washing Poland * • Tumble... -

Page 20

... entire laundry cycle. ELSBoka A user-friendly booking system that the property owner can use to display messages to tenants. Electrolux Compass Control The new, user-friendly way to select the correct washing and drying programs for Electrolux professional washing machines. The program is stored... -

Page 21

... hot and cold food. Electrolux AIR-O-SYSTEM This new system features an oven, a freezer and a cooler as well as a cabinet for plates and handling equipment that enables fast, simple transfer between the units. The AIR-O-SYSTEM makes the flow of work in a professional kitchen more efficient. Molteni... -

Page 22

..., and building the Electrolux brand as the global leader in our industry. Managing under-performers We have divested or changed the business model for units that could be considered as non-core operations or in which profitability was too low. Instead of continuing production of air-conditioners in... -

Page 23

... focus, good ï¬nancial strength, strong brands and leading market positions. A proposal for spinning off Outdoor Products will be presented to the shareholders at the Annual General Meeting in April. We expect that the new company, called Husqvarna, will be listed on the Stockholm Stock Exchange... -

Page 24

... will be totally focused on indoor products for consumers and professional users. The new Electrolux will have annual sales of more than SEK 100 billion, and about 60,000 employees world-wide. We will continue to be one of the most important companies on the Stockholm Stock Exchange. But even more... -

Page 25

...the North American market in 2006 by developing new distribution channels for food-service equipment. The success of our floor-care operation in the higher price segments will continue, among other things on the basis of higher volumes for cyclone vacuum cleaners. There will be no change in the rate... -

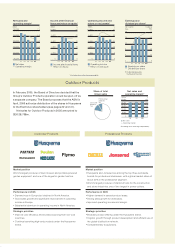

Page 26

... for high-end electrically powered products in Europe. • Partner and McCulloch for petroldriven products in Europe. • Poulan Pro and Weed Eater in the US. Professional Products • Husqvarna, which accounts for the largest share of sales, complemented by Jonsered in specific markets. • Dimas... -

Page 27

... Business area Indoor Products Business area Outdoor Products Distribution of funds to shareholders Spin-off of Outdoor Products Other facts Parent Company Notes to the financial statements Definitions Page 24 25 28 29 31 32 33 34 38 41 41 43 46 48 83 Key data 1) SEKm 2005 Change 2004 Net sales... -

Page 28

... in exchange rates Changes in volume/price/mix Total -0.2 3.2 4.3 7.3 -2.0 -4.0 3.2 -2.8 Excluding items affecting comparability, operating income for Indoor Products improved by 2,4% to SEK 4,645m (4,537). The improvement is due mainly to a strong performance by appliances in North America... -

Page 29

... 4,452 -1,193 3,259 3,258 1 3,259 10.92 10.91 298.3 298.6 Note 5 Note 6 Note 7 Notes 3, 4, 8 Note 9 Note 9 Note 10 -1,452 1,763 1,763 0 1,763 Earnings per share, SEK After dilution Average number of shares, million After dilution Note 20 6.05 6.01 291.4 293.2 Electrolux Annual Report 2005 25 -

Page 30

... exchange risk in Note 2, Financial risk management, on page 55. SEKm 2005 2004 Restructuring provisions and write-downs Appliances and outdoor products, Europe Appliances plant in Nuremberg, Germany Refrigerator plant in Greenville, USA Vacuum-cleaner plant in Västervik, Sweden Floor-care... -

Page 31

... 700 employees and the cost is estimated at approximately SEK 40m. During the year, the vacuum-cleaner plant in Västervik, Sweden, and the cooker plant in Reims, France, were closed. Production at the refrigerator plant in Greenville, USA, was gradually moved to the new plant in Juarez, Mexico. The... -

Page 32

.... The change in working capital is mainly driven by growth in sales and higher provisions for restructuring as well as changes in exchange rates. Borrowings At year-end, the Group's borrowings amounted to SEK 8,914m (9,843), of which SEK 5,257m (3,940) referred to long-term borrowings with average... -

Page 33

... holders of the Parent Company Share capital Other paid-in capital Other reserves Retained earnings Minority interests Total equity Non-current liabilities Long-term borrowings Derivatives Deferred tax liabilities Provisions for pensions and other post-employment benefits Other provisions Total... -

Page 34

... Credit risk related to financial and commercial activities The Board of Directors of Electrolux has approved a financial policy and a credit policy for the Group in order to manage and control these risks. Each business sector has specific financial and credit policies approved by the sector board... -

Page 35

...period Repurchase and sale of shares Redemption of shares Cancellation of shares Dividend SEK 6.50 per share Share-based payment Acquisition of minority Total transactions with shareholders Closing balance, December 31, 2004 Effects of changes in accounting principles Opening balance January 1, 2005... -

Page 36

...to 1.7% (1.7) of net sales. R&D projects during the year referred mainly to new products and design projects within appliances, including development of new platforms. Major projects included new products within cookers and washing machines in Europe and North America. Electrolux Annual Report 2005 -

Page 37

...operations and investments Financing Change in short-term investments Change in short-term loans New long-term borrowings Amortization of long-term loans Dividend Redemption and repurchase of shares Cash flow from financing Total cash flow Cash and cash equivalents at beginning of year Exchange-rate... -

Page 38

...product development and brand-building The Indoor Products business area includes products for consumers as well as professional users. Indoor products for consumers comprise mainly major appliances, i.e., refrigerators, freezers, cookers, dryers, washing machines, dishwashers, room air-conditioners... -

Page 39

.... New product launches included the new Electrolux ICON Professional appliances series in the US, the M2 Insight cooker in Europe, the TwinClean vacuum cleaner in several regions and the cooker Revolux in Brazil. Early in 2006, a new communications platform for Electrolux was introduced in order to... -

Page 40

... product mix. Quick facts Consumer Durables, Latin America Products Key brands Location of major plants Major competitors Major appliances Electrolux Brazil Brazil Whirlpool Arno, Lavorwash, Mallory Floor-care products Electrolux Major appliances Electrolux, Frigidaire USA, Canada, Mexico... -

Page 41

... the year, the Group has changed its business model in India and divested its Indian appliance operation, which had a positive impact on operating income for the region. Quick facts Consumer Durables, Asia/Pacific Products Key brands Location of major plants Major competitors Food-service equipment... -

Page 42

... Outdoor Products Leading position in USA and Europe. Market position Chainsaws Husqvarna and Jonsered are among the top three worldwide brands for professional chainsaws, with a global market share of about 40% in the professional segment. Operations refer mainly to North America. Global market... -

Page 43

Report by the Board of Directors for 2005 Quick facts Consumer Outdoor Products Products Key brands Location of major plants Major competitors Europe Jonsered, Husqvarna, Flymo, Partner, McCulloch Husqvarna, Poulan, Poulan Pro, Weed Eater Sweden, United Kingdom GGP, Bosch, Stihl Group sales of... -

Page 44

Report by the Board of Directors for 2005 Operations by business area 1) SEKm 2005 Change, % 2004 Indoor Products Europe Net sales Operating income Margin, % North America Net sales Operating income Margin, % Latin America Net sales Operating income Margin, % Asia/Pacific Net sales Operating ... -

Page 45

... world leaders in outdoor products both for the consumer market and for professional users. The Board proposes that the Annual General Meeting to be held on April 24, 2006, shall decide to distribute all shares in the parent company Husqvarna AB to the shareholders in Electrolux. In accordance with... -

Page 46

... In 2005, Electrolux did not repurchase any shares. In the course of the year, senior managers purchased 1,785,161 B-shares from Electrolux under the terms of the employee stock option programs for a total of SEK 306m, corresponding to an average Number of shares price of SEK 171.40 per share. In... -

Page 47

... Electrolux share price. They have been designed to align management incentives with shareholder interests. For a detailed description of all programs and related costs, see Note 22 on page 68 and Note 27 on page 73. Performance-based share program In 2004, the Group introduced an annual long-term... -

Page 48

Report by the Board of Directors for 2005 Cost of compliance Approximately 16 million Electrolux products sold every year are covered by the WEEE Directive. These products include large and small household appliances as well as floor-care equipment. Electrolux incurs costs for managing and ... -

Page 49

... The average number of employees decreased to 69,523 in 2005, mainly as a result of divestments and structural changes. Salaries and remuneration in 2005 amounted to SEK 17,033m (17,014), of which SEK 1,877m (2,028) refers to Sweden. See also Note 22 on page 68. Electrolux Annual Report 2005 45 -

Page 50

... companies operating on commission basis for AB Electrolux. Net sales for the Parent Company in 2005 amounted to SEK 6,392m (6,802), of which SEK 3,558m (3,949) referred to sales to Group companies and SEK 2,834m (2,853) to external customers. After appropriations of SEK 12m (-6) and taxes of SEK... -

Page 51

... of brands Other Cash flow from investments Cash flow from operations and investments Financing Change in short-term loans Change in long-term loans Dividend Redemption and repurchase of shares Cash flow from financing Total cash flow Liquid funds at beginning of year Liquid funds at year-end Change... -

Page 52

...Electrolux loses control. At year-end 2005, the Group comprised 355 (358) operating units, and 281 (276) companies. Associated companies Associates are all companies over which the Group has significant influence but not control, generally accompanying a shareholding of 48 Electrolux Annual Report... -

Page 53

...) basically follow the internal management of the Group, which are the basis for identifying the predominant source and nature of risks and differing rates of return facing the entity, and are based on the different business models for end-customers, indoor and outdoor users. The secondary segments... -

Page 54

... brand worldwide. All other trademarks are amortized over their useful lives, estimated to 10 years. Product development expenses Electrolux capitalizes certain development expenses for new products provided that the level of certainty of their future economic benefits and useful life is high... -

Page 55

...of time value of money is material, the amount recognized is the present value of the estimated expenditures. Provisions for warranty are recognized at the date of sale of the products covered by the warranty and are calculated based on historical data for similar products. Electrolux Annual Report... -

Page 56

...'s fair value at grant date is recognized over the vesting period (3 years). In addition, the Group provides for employer contributions expected to be paid in connection with the share-based compensation programs. The costs are charged to the income statement over 52 Electrolux Annual Report 2005 -

Page 57

... opening balance, January 1, 2005 Closing balance after transition Opening balance after transition New accounting principles as from 2005 Financial instruments On January 1, 2005, the Group implemented the new accounting standard IAS 32, Financial Instruments: Disclosure and Presentation... -

Page 58

... year-end was SEK 683m. Pensions and other post-employment benefits Electrolux sponsors defined benefit pension plans for some of its employees in certain countries. The pension calculations are based on assumptions about expected return on assets, discount rates and future salary increases. Changes... -

Page 59

... WEEE Directive was enforced as from August 2005, which means that the Group has only limited experience of the effects. The Board of Directors of Electrolux has approved a financial policy as well as a credit policy for the Group to manage and control these risks. Each business sector has specific... -

Page 60

... been changed by the end of year 2005 and as from January 1, 2006, the benchmark for the long-term loan portfolio is an average interest-fixing period of six months. Group Treasury can choose to deviate from this benchmark on the basis of a risk mandate established by the Board of Directors. However... -

Page 61

...Europe; North America; Latin America and Asia/Pacific, while professional products are reported separately. Operation within appliances comprise mainly major appliances, i.e., refrigerators, freezers, cookers, dryers, washing machines, dishwashers, room air-conditioners and microwave ovens. Business... -

Page 62

... The Group's business segments operate mainly in four geographical areas of the world; Europe, North America, Latin America and Asia/ Pacific. Sales by market are presented below and show the Group's consolidated sales by geographical market, regardless of where the goods were produced. Sales, by... -

Page 63

... the Board of Directors on page 26. Note 8 Leasing At December 31, 2005, the Electrolux Group's financial leases, recognized as tangible assets, consist of: 2005 2004 Note 5 Other operating income Group 2005 2004 Parent Company 2005 2004 Gain on sale of Tangible fixed assets Operations and shares... -

Page 64

... to changes in tax rates. The deferred tax assets in the Parent Company amounted to SEK 0m (120) and relate to temporary differences. The Group accounts include deferred tax liabilities of SEK 227m (230) related to untaxed reserves in the Parent Company. Theoretical and actual tax rates Group % 2005... -

Page 65

.... Deferred tax liabilities amounted to SEK 1,417m, whereof 183m will be utilized within 12 months. Note 11 Intangible assets Group Product Goodwill development Software Other Total Parent Company Brands, etc. Acquisition costs Opening balance, Jan. 1, 2004 Acquired during the year Development... -

Page 66

...change in the key assumptions on which the cash-generating unit's recoverable amounts are based would not cause their carrying amounts to exceed their recoverable amounts. Goodwill Electrolux brand Weighted discount rate, % Indoor Products Europe North America Asia/Pacific Outdoor Products North... -

Page 67

...1,128 762 4,547 Shares in subsidiaries Participations in other companies Long-term receivables in subsidiaries Long-term holdings in securities 1) Other long-term receivables Pension assets 2) Total changed of value in equity is SEK 24m. 2) Pension assets are related to Sweden. - - - 455 1,009 353... -

Page 68

... bank facilities and capital-market programs such as commercial-paper programs. At year-end 2005, the average interest-fixing period for long-term borrowings was 1.4 years (1.3). The calculation of the average interest-fixing period includes the effect of interest-rate derivatives used to manage the... -

Page 69

... financing amounting to SEK 625m (745) are included in the item Other receivables in the Group's balance sheet. The Group's customer financing activities are performed in order to provide sales support and are directed mainly to independent retailers in the US and in Scandinavia. The majority of the... -

Page 70

... to SEK -304m (-76). At year-end 2005, unrealized exchange-rate gains on forward contracts amounted to SEK 22m (-20), all of which will mature in 2006. Derivatives at market value 2005 Assets Liabilities 2004 Assets Liabilities Derivative financial instruments The tables present the fair value and... -

Page 71

... is a weighted average number of shares outstanding during the year, after repurchase of own shares. On December 31, 2005, the share capital comprised 9,502,275 A-shares, par value SEK 5 299,418,033 B-shares, par value SEK 5 Total 48 1,497 1,545 Note 21 Untaxed reserves, Parent Company Dec. 31... -

Page 72

... is reported in the table above. The Parent Company comprises the Group's head office as well as a number of units and plants, and employs approximately half of the Group's employees in Sweden. Pensions and other post-employment benefits The Group sponsors pension plans in many of the countries in... -

Page 73

...certain countries (US). These plans are listed below as Other post-employment benefits. The Group's major deï¬ned beneï¬t plans cover employees in the US, UK, Switzerland, Germany and Sweden. The German plan is unfunded and the plans in the US, UK, Switzerland and Sweden are funded. A small number... -

Page 74

... to the Group's model for value creation. If no value was created, no options were issued. The options can be used to purchase Electrolux B-shares at a strike price that is 15% higher than the average closing price of the Electrolux B-shares on the Stockholm Stock Exchange during a limited period... -

Page 75

... target value is subsequently converted into a number of shares. The number of shares is based on a share price of SEK 152.90 for 2004 and SEK 146.40 for 2005, calculated as the average closing price of the Electrolux B-share on the Stockholm Stock Exchange during a period of ten trading days before... -

Page 76

... given as part of the Group's normal course of business. There was no indication at year-end that payment will be required in connection with any contractual guarantees. Electrolux has, jointly with the state-owned company AB Swede- Note 24 Other liabilities Group 2005 2004 Parent Company 2005 2004... -

Page 77

... salary, and the program is capped. In 2004, Electrolux introduced a new performance-based longterm incentive program that replaced the option program for less than 200 senior managers of the Group. The performance share program is linked to targets for the Group's value creation over a three-year... -

Page 78

... long-term incentives through benefits linked to the company´s share price. They have been designed to align management incentives with shareholder interests. In 2004 and 2005 the Group introduced performance-related share programs based on targets established by the Board of Directors. Previously... -

Page 79

... plan. The retirement benefit is payable for life or a shorter period of not less than 5 years. The participant determines the payment period at the time of retirement. For members of Group Management employed outside of Sweden, varying pension terms and conditions apply, depending upon the country... -

Page 80

...; Manson Tool, Sweden; and e2 Home, Sweden. Market value for Atlas Eléctrica is according to stock market rate at December 31, 2005, about SEK 28m (24). Although the participation in Atlas Eléctrica is only 18.9 % it is still included amongst associated companies since Electrolux has a significant... -

Page 81

... Sweden Husqvarna AB Electrolux Laundry Systems Sweden AB Electrolux HemProdukter AB Electrolux Professional AB Electrolux Floor Care and Light Appliances AB Switzerland Electrolux Holding AG Electrolux AG United Kingdom Electrolux Plc Husqvarna UK Ltd Electrolux Professional Ltd USA Electrolux Home... -

Page 82

... are for the Group mainly professional fees, severence payments, different types of costs for clean-up and dismantling of factories (excluding environmental costs regulated by a Government authority) and lease agreements. Pensions and other post-employment benefits Accounting for pensions and other... -

Page 83

... FSP addresses accounting by commercial users and producers of electrical and electronic equipment, in connection with Directive 2002/96/EC on Waste Electrical and Electronic Equipment (WEEE) issued by the European Union (EU) on February 13, 2003. This Directive requires EU-member countries to adopt... -

Page 84

... operations according to US GAAP Net income per share in SEK according to US GAAP, basic Number of shares, basic 1) Net income per share in SEK according to US GAAP, diluted Number of shares, diluted 1) 1) Weighted average number of shares outstanding through the year, after repurchase of own shares... -

Page 85

... rules stated in IFRS 1, First Time Adoption of International Accounting Standards, and the transition effects have been recorded through an adjustment to opening retained earnings as per January 1, 2004. This date has been determined as Electrolux date of transition to IFRS. Comparative figures for... -

Page 86

...-term liquid investments with a maturity of more than three months. Previous periods have been restated. Cash and cash equivalents, as compared to the old liquid funds measure, decreased by SEK 4,395m as of January 1, 2004 and SEK 1,027m as of December 31, 2004. 82 Electrolux Annual Report 2005 -

Page 87

... and tax rates. A higher return on net assets than the weighted average cost of capital implies that the Group or the unit creates value. Electrolux Value Creation model Other key ratios Organic growth Sales growth, adjusted for acquisitions, divestments and changes in exchange rates. EBITDA... -

Page 88

...2,900m and the book value of the shares in Husqvarna AB to Husqvarna AB, including the underlying group of companies, mainly as set out on page 41 in the annual report, is expected to represent approximately SEK 4,700m of the equity of the Group as per December 31, 2005, including the effects of the... -

Page 89

...the shareholders of AB Electrolux. Corporate identity number 556009-4178 We have audited the annual accounts, the consolidated accounts, included in pages 23-84, the accounting records and the administration of the Board of Directors and the President of AB Electrolux for the year 2005. The Board of... -

Page 90

... assets Working capital Trade receivable Inventories Accounts payable Equity Interest-bearing liabilities Data per share, SEK 2) 3) Earnings per share Earnings per share according to US GAAP Equity Dividend Trading price of B-shares at year-end Key ratios Value creation Return on equity, % Return on... -

Page 91

..., the average number of shares amounted to 298,314,025 and at year-end 291,180,908. 2005: After repurchase of own shares, the average number of shares amounted to 291,400,000 and at year-end 293,099,069. 4) 2005: Proposed by the Board. 5) Net sales are annualized. Electrolux Annual Report 2005 87 -

Page 92

...affecting comparability, which amounted to SEK -3,020m in 2005 and SEK -1,960m in 2004. Net sales, by business area Indoor Products Europe North America Latin America Asia/Pacific Professional Products Total Indoor Products 2005 2004 2005 2004 2005 2004 2005 2004 2005 2004 2005 2004 Q1 Q2 Q3 Q4... -

Page 93

...stated Operating income, by business area Indoor Products Europe 2005 Margin, % 2004 Margin, % North America 2005 Margin, % 2004 Margin, % Latin America 2005 Margin, % 2004 Margin, % Asia/Pacific 2005 Margin, % 2004 Margin, % Professional Products 2005... 4,807 4.0 Electrolux Annual Report 2005 89 -

Page 94

... IT Board Tax Board Business Sector Boards Brand Leadership Group Global Product Councils Purchasing Board Human Resources Executive Board Major external regulations affecting governance of Electrolux: • Swedish Companies Act • Listing agreement with Stockholm Stock Exchange • Swedish Code of... -

Page 95

Corporate Governance Report 2005 Major shareholders 1) Share capital, % Voting rights, % The names of the committee members and the shareholders they represent were announced in a press release on September 23, 2005. No change of the composition of the Nomination Committee has been made as of ... -

Page 96

Corporate Governance Report 2005 The Board of Directors The main task of the Electrolux Board of Directors is to manage the Group's affairs in such a way as to satisfy the owners that their interests in a good long-term return on capital are being met in the best possible way. The Board's work is ... -

Page 97

... the decision to close the plant for washing machines and dishwashers in Nuremberg, Germany, and additional restructuring within white goods and outdoor products in Europe as well as the divestment of the Group's appliance operation in India. The Group's auditors participated in the Board meeting in... -

Page 98

... CEO has no major shareholdings nor is he a part-owner in companies that have significant business relations with Electrolux. External auditors At the Annual General Meeting in 2002, PricewaterhouseCoopers (PwC) was appointed external auditors for a four-year period until the Annual General Meeting... -

Page 99

... regarding business objectives, risks and control activities. Communicating on a timely basis throughout the Group contributes to ensuring that the right business decisions are made. Fixed salary Variable salary Pension cost Long-term incentive 2) Total 2) Target value of Share Program 2005. 8,447... -

Page 100

... of sector boards. A number of internal boards and councils have been established within the Group for specific areas such as risk management, treasury, audit, IT, tax, brands, products, purchasing and human resources. A Disclosure Committee was established by Electrolux at the start of 2005. This... -

Page 101

... communicated to the market on a timely basis. The Disclosure Committee comprises the Head of Group Staff Legal Affairs, the Chief Financial Officer, the Head of Group Staff Communications and Branding, and the Head of Investor Relations and Financial Information. Electrolux Annual Report 2005... -

Page 102

... AB and The Association of Exchange-listed Companies. Previous positions: Business commentator at Finanstidningen, 1999-2001, Managing editor of the business desk section at Sydsvenska Dagbladet, 1992-1999, and Business controller at Ratos AB, 1989-1992. Holdings in AB Electrolux: 0 shares. Related... -

Page 103

Board of Directors and Auditors Peggy Bruzelius Michael Treschow Tom Johnstone Karel Vuursteen Marcus Wallenberg Ulf Carlsson Louis...Milian Thoralfsson Gunilla Brandt Annika Ã-gren Hans StrÃ¥berg For more information about the Board of Directors, see page 91. Electrolux Annual Report 2005 99 -

Page 104

... Appliances Europe as of 2004. Board Member of First Swedish National Pension Fund and The Bank of Sweden Tercentenary Foundation. Holdings in AB Electrolux: 2,024 B-shares, 90,000 options. Lars Göran Johansson Head of Group Staff Communications and Branding Born 1954, M. Econ. In Group Management... -

Page 105

Group Management Harry de Vos Hans Stråberg Fredrik Rystedt Cecilia Vieweg Lars Göran Johansson Keith R. McLoughlin Detlef Münchow Magnus Yngen Johan Bygge For more information about the Group's organization and structure, see page 94. Bengt Andersson Electrolux Annual Report 2005 ... -

Page 106

... a good corporate citizen Governments and local communities Electrolux Retailers and customers Understand retailer/customer needs, build long-term partnerships for joint value creation Suppliers Work closely with suppliers for joint value creation through cost reductions and accelerated product... -

Page 107

... and water at production sites, and to achieve high use-rates for purchased material and components. Management systems in production The Electrolux Environmental Management System is a vital tool for achieving and maintaining high standards in manufacturing. Group Management has stipulated that... -

Page 108

... the result of the Group's environmental work. Manufacturing data covers 90% of the majority-owned production facilities worldwide. Direct material balance 2005 2004 2003 2002 2001 Due diligence in acquisition process In connection with acquisitions of companies and plants, an assessment is made... -

Page 109

... and global warming potential (GWP) in refrigerants and insulating gases used in the Group's products. 90 80 70 2001 2002 2003 2004 2005 Environmental legislation Electrolux is subject to government regulation in all countries in which it conducts its operations. The Group continuously monitors... -

Page 110

... national recycling systems in several EU countries where such systems are not yet in place. Cost of compliance Approximately 16 million Electrolux products sold every year are covered by the WEEE Directive. These products include large and small household appliances as well as floor-care equipment... -

Page 111

... such as child and forced labor, health and safety, workers rights and environmental compliance. External third-party monitoring The process of reviewing internal Code of Conduct performance continued in 2005. All production units in Asia and Latin America have been audited on-site by third party... -

Page 112

... well as related management practices. Health and safety is also an important part of the external third-party monitoring program in Electrolux factories in Asia and Latin America. finished products. The Group has a comprehensive system for collecting information on all safety-related incidents and... -

Page 113

... sold by Electrolux in order to cover the costs Key facts Share listings 1): Stockholm, London Number of shares: 308,920,308 Number of shares after repurchase: 293,099,069 High and low for B-shares, 2005: SEK 210-141 Market capitalization at year-end: SEK 63.9 billion Beta value 2): 0.93 GICS code... -

Page 114

...-related share programs were introduced, based on targets for value creation within the Group over a three-year period. Under these programs, Electrolux B-shares will be distributed to the participants at the end of the period on the basis of the targets achieved. The Board of Directors will present... -

Page 115

... the average number of shares after buy-backs. 9) Market capitalization, excluding buy-backs, plus net borrowings and minority interests, divided by operating income. 10) Trading price in relation to earnings per share after full dilution. Total return of Electrolux B-shares on the Stockholm Stock... -

Page 116

...competition and price pressure within major appliances are particularly apparent for refrigerators and freezers world wide, for floor-care products in the United States and in Europe, for small appliances generally and for consumer outdoor products in Europe. Electrolux faces strong competitors, who... -

Page 117

..., employee relations, product safety and exchange controls. Electrolux expects that sales to, as well as manufacturing in, and sourcing from, emerging markets, particularly in China, Southeast Asia, Eastern Europe and Mexico, will continue to be an increasing portion of its total operations. Changes... -

Page 118

..., to production to marketing and sales. Operational failures in its value chain processes could result in quality problems or potential product, labor safety, regulatory or environmental risks. Such risks are particularly present in relation to Electrolux production facilities which are located all... -

Page 119

... AB (being the parent of the Outdoor Products group) and some of their respective subsidiaries have entered into a Master Separation Agreement and related agreements (the "Separation Agreements"). The Board of Electrolux has proposed that the Annual General Meeting to be held in April of this year... -

Page 120

... limited to the following; consumer demand and market conditions in the geographical areas and industries in which Electrolux operates, effects of currency fluctuations, competitive pressures to reduce prices, significant loss of business from major retailers, the success in developing new products... -

Page 121

... Stock Exchange. The record day for receipt of shares in Husqvarna and the listing on the Stockholm Stock Exchange is scheduled for the first half of June, 2006. As soon as the record date has been decided upon, it will be communicated in a separate press release. Electrolux Annual Report 2005... -

Page 122

AB Electrolux (publ) Mailing address SE-105 45 Stockholm, Sweden Visiting address S:t Göransgatan 143, Stockholm Telephone: +46 8 738 60 00 Telefax: +46 8 738 74 61 Website: www.electrolux.com 5991414-09/4