Electrolux 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

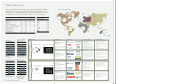

1%

Net sales by geographical area

Latin America 3%

Europe 48%

Africa 1%

Oceania 4%

Net sales in 2003

in the 10 largest countries

SEKm

USA 44,469

Germany 10,777

UK 6,610

France 6,525

Italy 6,027

Australia 4,727

Canada 4,703

Sweden 4,307

Spain 3,306

Brazil 2,575

Total 94,026

This is Electrolux

Net sales and

operating margin*

*Excluding items affecting comparability.

2003 2003

Key data 2003 2002 EUR USD

SEKm, EURm, USDm, unless otherwise stated

Net sales 124,077 133,150 13,590 15,356

Operating income 7,175 7,731 786 888

Margin, % 5.8 5.8

Income after financial items 7,006 7,545 767 867

Net income per share, SEK, EUR, USD 15.25 15.60 1.67 1.89

Dividend per share, SEK, EUR, USD 6.501) 6.00 0.72 0.90

Return on equity, % 17.3 17.2

Return on net assets, % 23.9 22.1

Value creation 3,449 3,461 378 427

Net debt/equity ratio 0.00 0.05

Average number of employees 77,140 81,971

1) Proposed by the Board of Directors.

Consumer Durables

Market position Key brands Performance in 2003 Strategic prioritiesBusiness areas

With sales of SEK 124.1 billion, Electrolux is the world’s largest producer of appliances

and equipment for kitchen, cleaning and outdoor use, such as refrigerators, cookers,

washing machines, chainsaws, lawn mowers and garden tractors. Electrolux is also one

of the largest producers in the world of similar equipment for professional users.

Professional Products

SEKm

140,000

130,000

120,000

110,000

100,000

90,000

%

7.5

6.0

4.5

3.0

1.5

0

Net sales

Operating margin

99 00 01 02 03

Operating income and

return on net assets*

SEKm

10,000

8,000

6,000

4,000

2,000

0

%

25

20

15

10

5

0

Operating income

Return on net assets

99 00 01 02 03

Net income and

dividend per share*

Net Income

SEK

20

16

12

8

4

0

Dividend

SEK

7.5

6.0

4.5

3.0

1.5

0

Net income per share

Dividend per share

1) Dividend proposed by

the Board of Directors.

99 00 01 02 031)

Income after financial

items and return on

equity*

SEKm

10,000

8,000

6,000

4,000

2,000

0

%

25

20

15

10

5

0

Income after financial items

Return on equity

99 00 01 02 03

01 02 03

Net sales Operating margin

North America 40%

Asia 4%

SEKm

125,000

100,000

75,000

50,000

25,000

0

%

7.5

6.0

4.5

3.0

1.5

0

Net sales and operating margin

Share of total Group sales

Europe

39%

North

America 36%

Rest

of the

world

10%

• Strong sales growth and higher

income in USD for appliances in

North America

• Continued positive trend for

sales volume and income within

appliances in Europe

• Continued negative income for

appliances outside Europe and

North America, but improvement

in fourth quarter

• Strong sales growth and higher

income in USD for consumer out-

door products in North America

• Weaker demand and somewhat

lower sales in Europe, improved

operating income

• Continued weak market

conditions in food-service

equipment and laundry

systems

• Overall lower income,

unchanged margin

• Divestment of compressor

operation

• Increased demand for chainsaws

and garden equipment, decline

for diamond tools

• Increased income, margin

remained at high level

• Increase investments in product

development and the Electrolux

brand

• Relocate production facilities, e.g,

new plants in Eastern Europe, Asia

and Mexico

• Increase purchases from low-cost

countries

• Launch new high-end products in

US under Electrolux brand

• Leverage synergies with Professional

Outdoor Products

• Create Electrolux-branded product

offering

• Roll-out up-market product range

under Husqvarna brand in US

• Focus on core areas within food

service and laundry systems

• Establish sales organization for

food service in US

• Launch new product concepts

• Maintain profitable position within

chainsaws

• Continue to grow commercial lawn

and garden business

• Improve cost structure within

diamond tools

Indoor products

White goods: Market leader in

Europe and Australia, third largest

producer in US

Floor-care products: World leader,

largest producer in Europe, second

largest in US

Outdoor products

World’s largest producer of garden

tractors, lawn mowers and other

portable petrol-driven garden

equipment

Outdoor products

Chainsaws: World’s largest

producer

Diamond tools: One of the world’s

largest producers of diamond

tools and related equipment for

the construction and stone

industries

Indoor products

Food-service equipment: Market

leader in Europe, third largest

producer in the world

Laundry equipment: One of the

world’s leading producers

Share of total Group sales

Indoor

products

6%

Outdoor

products 9%

01 02 03

Net sales Operating margin

SEKm

30,000

24,000

18,000

12,000

6,000

0

%

12.5

10.0

7.5

5.0

2.5

0

Net sales and operating margin