Electrolux 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“We are increasing our investments

in new, innovative products and building

Electrolux into a leading global brand.

That’s the way to achieve sustainable,

profitable growth and to create value for

shareholders and other stakeholders.”

AB Electrolux

Mailing address

SE-105 45 Stockholm, Sweden

Visiting address

S:t Göransgatan 143, Stockholm

Telephone

+46 8 738 60 00

Telefax

+46 8 656 44 78

Website

www.electrolux.com

Contents

1 Report by the President and CEO

18 Summary of 2003

21 Business areas

27 Report by the Board of Directors for 2003,

including financial statements

46 Notes to the financial statements

72 Eleven-year review

74 Quarterly figures

77 Definitions

78 Governance for Corporate Sustainability

88 Board of Directors

90 Group Management

92 Electrolux shares

95 Annual General Meeting

Factors affecting forward-looking statements

This report contains “forward-looking” statements within the meaning of

the US Private Securities Litigation Reform Act of 1995. Such statements

include, among others, the financial goals and targets of Electrolux for

future periods and future business and financial plans. These statements

are based on current expectations and are subject to risks and uncertain-

ties that could cause actual results to differ materially due to a variety of

factors. These factors include, but may not be limited to the following;

consumer demand and market conditions in the geographical areas and

industries in which Electrolux operates, effects of currency fluctuations,

competitive pressures to reduce prices, significant loss of business from

major retailers, the success in developing new products and marketing

initiatives, developments in product liability litigation, progress in achiev-

ing operational and capital efficiency goals, the success in identifying

growth opportunities and acquisition candidates and the integration

of these opportunities with existing businesses, progress in achieving

structural and supply-chain reorganization goals.

Financial reports in 2004

Consolidated results February 12

Annual report Early April

Form 20-F June

Quarterly report, 1st quarter April 21

Quarterly report, 2nd quarter July 16

Quarterly report, 3rd quarter October 20

The above reports are available on request from

AB

Electrolux, Investor Relations and Financial Information,

SE-105 45 Stockholm, Sweden.

Financial information from Electrolux is also available on

the Group’s website, www.electrolux.com/ir

Contact

Åsa Stenqvist Tel. +46 8 738 64 94

Vice President, Investor Relations

and Financial Information

Investor Relations Tel. +46 8 738 60 03

Fax +46 8 738 70 90

Annual Report 2003

Electrolux Annual Report 2003 www.electrolux.com/annualreport2003

5991413-74/0

Table of contents

-

Page 1

... 21 Business areas 27 Report by the Board of Directors for 2003, including ï¬nancial statements 46 Notes to the ï¬nancial statements 72 Eleven-year review 74 Quarterly ï¬gures 77 Deï¬nitions 78 Governance for Corporate Sustainability 88 Board of Directors 90 Group Management 92 Electrolux shares... -

Page 2

...Value creation 3,449 Net debt/equity ratio 0.00 Average number of employees 77,140 1) Proposed by the Board of Directors. 133,150 7,731 5.8 7,545 15.60 6.00 17.2 22.1 3,461 0.05 81,971 13,590 786 767 1.67 0.72 15,356 888 867 1.89 0.90 378 427 USA Germany UK France Italy Australia Canada Sweden... -

Page 3

... traditional European and American competitors are moving more of their production to low-cost countries. Within the retailing sector, a similar globalization is under way as the big chains enter new markets. Electrolux is one of the few truly global companies in the industries in which we operate... -

Page 4

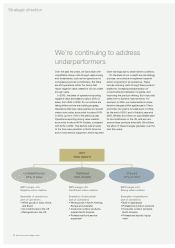

... balance sheet • Strong cash flow • Continued costcutting • Consolidation/ relocation of production Increase investments in: • Product development • Brand-building A consumer-insight and customer-driven company achieving sustainable, profitable growth 2 Electrolux Annual Report 2003 -

Page 5

...have a strong balance sheet. At year-end our net debt/equity ratio was zero. We apply a model for value creation internally in order to drive and evaluate operations. The model links operating income and asset efficiency with the cost of the capital employed in operations. Electrolux has covered its... -

Page 6

... strong value creation accounted for about 45% of sales, compared with 50% in 2002. This decline refers mainly to the floor-care operation in North America and to food-service equipment, which reported lower earnings due to weak market conditions. On the basis of our in-depth annual strategy process... -

Page 7

...-driven company that creates more value. We have to move fast and dare to do things differently, which requires more emphasis on developing and strengthening leadership and on ensuring key competence in the Group. That is why we assign high strategic priority to talent management - processes and... -

Page 8

...% by 2004 - 2005 Product area Refrigerators Cookers Ovens Washing machines Dishwashers Total reduction 46 17 platforms 41 27 structures 32 10 cavities 13 6 platforms 4 1 platform Year-end 2003 33 33 25 10 2 We are steadily consolidating the number of product platforms, which in Europe will be more... -

Page 9

... are related directly to our core businesses and should therefore make a more positive contribution to profitability. Investments in Eastern Europe, Mexico and Asia New plant in Hungary Product Annual capacity Investment Refrigerators/ freezers 560,000 SEK 600m New plant in Russia Washing machines... -

Page 10

Product development The Electrolux Icon fridge/freezer. Understanding consumer needs is the basis for our product development. 8 Electrolux Annual Report 2003 -

Page 11

... 1% to about 2% of sales over the next few years. In order to make sure we get good returns on these investments we have improved our product creation process. This will result in greater precision, shorter lead times and shorter product cycles. Our need-based market segmentation model is now the... -

Page 12

... for quieter operation. The Ultra Silencer features the lowest noise level on the market, and has achieved high sales as well as good profitability. Market communication for the Ultra Silencer focuses on its low noise level. The commercial has won several prizes. 10 Electrolux Annual Report 2003 -

Page 13

...are committed to building deep understanding of consumer needs into all our products and services. To make sure that this happens on a consistent basis, we have a list of special consumer questions that must be answered in order for all investment request approvals. Electrolux Annual Report 2003 11 -

Page 14

... exclusive range of appliances under the Electrolux brand will be launched in North America during the first half of 2004. These will be the first appliances to be single-branded with Electrolux since the Group acquired the rights to the brand in this market in 2000. 12 Electrolux Annual Report 2003 -

Page 15

... that are built by hand to customer specifications. New riders from Husqvarna The new Husqvarna riders are designed for users who want the very best. The ProFlex 21 features a high level of comfort, including servo steering for easier, more precise operation. Electrolux Annual Report 2003 13 -

Page 16

Brand-building Customers are willing to pay more for brands they know and trust. The Electrolux Automower. 14 Electrolux Annual Report 2003 -

Page 17

... in market communication from about 1% of sales to about 2%. With more consolidated activities we will also obtain a better yield on the money we spend. Building Electrolux brand equity will be part of the variable salary for sector heads as of 2004. The Electrolux brand's share of Group sales Goal... -

Page 18

... washing machine. I'll show you the exact time I'll be done. So you're free to go sample that fresh air stuff you've heard so much about. www.electrolux.com Electrolux-branded floor-care products introduced in US Electrolux returned to the North American vacuum-cleaner market at the end of 2003... -

Page 19

...bonus systems Pricing • Focus on total cost to serve customers • Clear and consistent pricing structure • Win-win approach Talent management Strengthen leadership Secure key competences Improve coaching skills Increase mobility between functions and countries Electrolux Annual Report 2003... -

Page 20

... Return on net assets, % Return on net assets improved to 23.9% from 22.1% in 2002, despite lower operating income. Income after financial items, SEKm Return on equity, % Income after financial items decreased by 7% and return on equity remained unchanged at 17%. 18 Electrolux Annual Report 2003 -

Page 21

... for both operations. Appliances and floor-care products in Europe also performed well. In addition, Professional Outdoor Products showed continued good growth, and margin improved slightly from the high level of the previous year. On the other hand, floor-care products in North America showed... -

Page 22

... USD for appliances and consumer outdoor products in North America • Continued positive trend in sales volume and income for appliances and floor-care products in Europe • Strong performance for Professional Outdoor Products, margin remained at high level Major negative factors in 2003 • Weak... -

Page 23

... Europe and North America • Increased investments in new products and in building the Electrolux brand Consumer Durables comprise mainly white goods, i.e., refrigerators, freezers, cookers, dryers, washing machines, dishwashers, room air-conditioners and microwave ovens, as well as floor-care... -

Page 24

... Products Location of Key brands major plants Major competitors White goods Electrolux, AEG, Zanussi*, REX* Italy, Hungary, Sweden, Germany BoschSiemens, Whirlpool, Merloni Floor-care products Electrolux, AEG Hungary, BoschSweden Siemens, Miele, Philips, Dyson UK, Italy GGP Garden equipment... -

Page 25

... washing machines for other markets in South East Asia. Quick facts Products Key brands Location of major plants Major competitors White goods Electrolux, Frigidaire* USA, Canada Whirlpool, General Electric, Maytag Hoover, Bissel, Royal Toro, Murray, MTD Floor-care products Garden equipment... -

Page 26

...refer mainly to North America. Global market share of 5-10%. Electrolux is one of the world's largest producers of diamond tools and related equipment for the construction and stone industries. Lawn and garden equipment Power cutters and diamond tools Share of total Group sales 15% Net sales SEKm... -

Page 27

... in the previous year. Operating income improved somewhat and margin was largely unchanged. Quick facts Products Location of Key brands major plants Major competitors Laundry equipment Professional chainsaws and lawn and garden equipment Husqvarna, Jonsered Sweden, USA USA, Sweden, Greece Stihl... -

Page 28

... 15.7 657 14,429 North America SEKm, unless otherwise stated Professional Outdoor Products 2003 2002 2001 SEKm, unless otherwise stated 2003 2002 2001 Net sales Operating income Operating margin, % Net assets Return on net assets, % Capital expenditure Average number of employees 32,247 1,583... -

Page 29

....60) per share • Good growth and higher income in USD for appliances and outdoor products within Consumer Durables, North America • Solid performance by appliances and other operations within Consumer Durables, Europe, in a competitive environment • Board proposes raising dividend to SEK 6.50... -

Page 30

...SEK 4,778m (5,095) • Net income per share declined by 2.2% to SEK 15.25 (15.60) Net sales Net sales for the Electrolux Group in 2003 amounted to SEK 124,077m, as against SEK 133,150m in the previous year. The decline refers mainly to changes in exchange rates. Changes in net sales % 2003 2002 2001... -

Page 31

... risk management, on page 50. Net sales and expenses, by currency Share of Share of net sales, expenses, % % Average exchange rate 2003 Average exchange rate 2002 Currency SEK USD EUR GBP Other Total 3 37 33 5 22 100 8 39 36 3 14 100 - 8.08 9.13 13.25 - - 9.72 9.15 14.58 - Electrolux Annual... -

Page 32

... SEK 1,492m. SEKm Major appliances, Rest of the world Major appliances, North America Major appliances, Europe Total major appliances Compressors Total 1) SEK 567m of the total cost referred to write-downs of assets. Structural changes Evaluation of vacuum-cleaner plant in Sweden In February 2004... -

Page 33

...Change 2001 Net sales Operating income Margin, % Income after financial items Net income Net income per share, SEK Dividend per share, SEK Return on equity, % Return on net assets, % Value creation Net debt/equity ratio Operating cash flow Capital expenditure Average number of employees 1) Key data... -

Page 34

... over last year and was positive. The market for floor-care products in Europe showed good growth in volume, particularly in the lower price segments. Sales for the Group's European operation declined somewhat. Operating income improved, mainly as a result of a better product mix and implemented... -

Page 35

... by the Board of Directors for 2003 Operations by business area Net sales SEKm 2003 Change, % 2002 Change, % 2001 Consumer Durables Europe North America Rest of the world Total Consumer Durables Professional Products Indoor Outdoor Total Professional Products Other Total 47,312 45,063 12,646... -

Page 36

... 4.7 Net assets at year-end corresponded to 23.6% of annualized net sales in 2003, as against 23.1% in 2002. Working capital Working capital at year-end amounted to SEK 4,068m (2,216), corresponding to 3.6% (1.8) of annualized net sales. The increase refers mainly to accounts payable. Inventories... -

Page 37

... Other provisions Financial liabilities Long-term loans Short-term loans Operating liabilities Accounts payable Tax liabilities Other liabilities Accrued expenses and prepaid income Total equity and liabilities Contingent liabilities Note 26 Note 18 Note 25 Electrolux Annual Report 2003 35 -

Page 38

...), mainly as a result of the divestment of the 50% shareholding in Vestfrost A/S, a Danish producer of refrigerators and freezers, and the acquisition of all outstanding shares in Electrolux Home Appliances Co. Ltd in China. Equity and return on equity Group equity as of December 31, 2003, amounted... -

Page 39

... Policy. The Financial Policy also describes the management of risks relating to pension funds assets. Management of ï¬nancial risks has largely been centralized to Group Treasury in Stockholm. Local ï¬nancial issues are managed by four regional treasury centers located in Europe, North America... -

Page 40

...high accounts payable. Higher taxes paid, higher utilization of restructuring provisions, as well as changes in exchange rates also had a negative impact on operating cash ï¬,ow. Cash ï¬,ow SEKm 2003 2002 2001 refrigeration, dishwashing and washing product areas in Europe. Projects in North America... -

Page 41

... 27 Machinery, buildings, land, construction in progress, etc. Capitalization of product development and software Other Cash ï¬,ow from investments Total cash ï¬,ow from operations and investments Financing Change in short-term loans Change in long-term loans Dividend Repurchase of shares Cash ï¬,ow... -

Page 42

...of net income for the year. For more information on dividend payment, see page 71. Proposed redemption of shares On the basis of the Group's strong balance sheet, and in order to contribute to increased shareholder value, the Board of Directors has decided to propose that the Annual General Meeting... -

Page 43

... Group over a three-year period. It supports the Electrolux principles of "pay-for-performance" and is an integral part of the total compensation plan for Electrolux management. Depending on the outcome of value creation, the proposed program would distribute a variable number of Electrolux B-shares... -

Page 44

... number of employees Net sales per employee, SEKm The average number of employees decreased to 77,140 in 2003, mainly as a result of divestments and structural changes. Environmental activities Electrolux operates 97 manufacturing facilities in 25 countries. Manufacturing operations comprise... -

Page 45

...were held in 2003. Special consideration was given to a proposal for a new long-term incentive program. Audit Committee The main task of the Audit Committee is to assist the Board in monitoring processes and internal controls for accounting and ï¬nancial reporting, including related disclosures, as... -

Page 46

...of net assets in foreign subsidiaries at year-end rates. Group contributions in 2003 amounted to SEK 1,139m. Group contributions net after taxes in the amount of SEK 820m is reported in retained earnings. See change in equity on the next page. For information on the number of employees, salaries and... -

Page 47

... Change in inventories Change in accounts receivable Change in current intra-Group balances Change in other current assets Change in current liabilities and provisions Cash ï¬,ow from operations Investments Change in shares and participations Machinery, buildings, land, construction in progress, etc... -

Page 48

... the acquisition value to the Group. Any differences between the acquisition price and the market value of the acquired net assets are reported as goodwill or negative goodwill. The consolidated income for the Group includes the income statements for the Parent Company and its direct and indirect... -

Page 49

... White Consolidated Industries, American Yard Products and Email. These acquisitions have given Electrolux major market shares in Europe, North America and Australia as well as a leading global position. The industry in which the Group operates is relatively stable, and large market shares are a key... -

Page 50

... and accounting pension costs and pension liabilities differ from country to country. The companies report according to local rules, and the reported ï¬gures are included in the consolidated accounts of the Group. Borrowings Borrowings are initially recognized at proceeds received, net of... -

Page 51

... • Commodity price risk affecting the expenditure on raw material and components for goods produced • Credit risk relating to ï¬nancial and commercial activities The Board of Directors of Electrolux has approved a ï¬nancial policy for the Group to manage and control these risks. Each business... -

Page 52

... decision levels and management of bad debts. The Board of Directors sets customer credit limits that exceed SEK 300m. There is a concentration of credit exposures on a number of customers in, primarily, USA and Europe. For more information, see Note 17 on page 56. 50 Electrolux Annual Report 2003 -

Page 53

... year. Professional Outdoor Products comprise mainly high-performance chainsaws and professional lawn and garden equipment, as well as power cutters and diamond tools. Within Consumer Durables, the white goods operation is managed regionally while ï¬,oor-care products and consumer outdoor products... -

Page 54

...The Group's business segments operate mainly in three geographical areas of the world; Europe, North America, Rest of the world. Sales by market are presented below and show the Group's consolidated sales by geographical market, regardless of where the goods were produced. Sales, by market 2003 2002... -

Page 55

...). Premiums on forward contracts intended as hedges for foreign net investments have been amortized as interest in the amount of SEK -43m (114). Note 10 Taxes Group 2003 2002 2001 2003 Parent Company 2002 2001 Current taxes Deferred taxes Group share of taxes in associated companies Total -1,945... -

Page 56

... Weighted average number of shares outstanding during the year, after repurchase of own Note 13 Intangible assets Group Product Goodwill development Software Other Total Parent Company Brands, etc. Acquisition costs Closing balance Dec. 31, 2001 Acquired during the year Development Fully amortized... -

Page 57

... operations was impaired. Discount rates of 13 - 35% were used when calculating value in use. Note 14 Tangible ï¬xed assets Group Acquisition costs Closing balance Dec. 31, 2001 Acquired during the year Corporate acquisitions Corporate divestments Transfer of work in progress and advances Sales... -

Page 58

.... The book value of accounts receivable is considered to represent fair value. The total provision for bad debts at year-end was SEK 1,012m (1,459). Electrolux has a signiï¬cant concentration on a number of major customers primarily in the US and Europe. Receivables concentrated to customers... -

Page 59

...term, days Effective yield, % (average per annum) months. Sweden at the parent company level. Given the strong liquidity, Electrolux does not currently maintain any committed credit facilities for short-term borrowings, other than as back-up facility for the European commercial paper program, which... -

Page 60

...balance sheet. The Group's customer ï¬nancing activities are performed in order to provide sales support and are directed mainly to independent retailers in the US and in Scandinavia. The majority of the ï¬nancing is shorter than 12 months. There is no major concentration of credit risk related to... -

Page 61

...,000 10,000,000 328,712,580 - - - -14,612,580 - - 10,000,000 314,100,000 As of December 31, 2003, Electrolux had repurchased 17,000,000 B-shares, with a total par value of SEK 85m. The average number of shares during the year has been 313,270,489 (327,093,373). Electrolux Annual Report 2003 59 -

Page 62

...general, the local practices. The Group's major deï¬ned beneï¬t plans cover employees in the US, UK, Switzerland, Germany and Sweden. The German plan is unfunded and the plans in the US, UK, Switzerland and Sweden are funded. The methods for calculating and accounting for pension costs and pension... -

Page 63

... any contractual guarantees. Electrolux has, jointly with the state-owned company AB Swedecarrier, issued letters of support for loans and leasing agreements totaling SEK 1,492m in the associated company Nordwaggon AB. Note 27 Acquired and divested operations Group 2003 2002 2001 The assets and... -

Page 64

...managers and other employees, by geographical area 2003 Boards and senior managers Other employees 2002 Boards and senior managers Other employees 2001 Boards and senior managers Other employees Sweden Parent Company Other Total Sweden EU, excluding Sweden Rest of Europe North America Latin America... -

Page 65

... inherent in employee stock option programs. The President and CEO received 60,000 options and members of Group Management 30,000 options each. 4) Refers to holdings in the beginning of the year by the members of Group Management as of December 31, 2003. Electrolux Annual Report 2003 63 -

Page 66

... and 2003 option programs In 2001, a new program for employee stock options was introduced for less than 200 senior managers. The options can be used to purchase Electrolux B-shares at a strike price, which is 10% above the average closing price of the Electrolux B-shares on the Stockholm Exchange... -

Page 67

... AB, Sweden Sidème S.A., France Viking Financial Services, USA Diamant Boart S.A., Argentina A/O Khimki Husqvarna, Russia Diamant Boart Inc., The Philippines e2 Home AB, Sweden Manson Tools AB, Sweden Saudi Refrigerators Manufacturing Company Ltd, Saudi-Arabia Holding, % Book value, equity... -

Page 68

... Laundry Systems Sweden AB Electrolux Hemprodukter AB Electrolux Professional AB Electrolux Floor Care and Light Appliances AB Electrolux Holding AG A+T Hausgeräte AG Electrolux Plc Electrolux Outdoor Products Ltd Electrolux Professional Ltd Electrolux Home Products Inc. Electrolux North America... -

Page 69

... the Electrolux trademark in North America. The goodwill and the intangible assets with assigned indeï¬nite lives have been tested for impairment in accordance with the methods prescribed in SFAS 142. Prior to the adoption of SFAS 142, the Group applied the discounted approach under APB 17 in order... -

Page 70

... 2003 and 2002 divestments are accounted for as discontinued operations: Vestfrost, the compressor operation, Zanussi Metallurgica, the European motor operation, the Mexican compressor plant, the European home comfort operation and the remainder of the leisure appliance product line. Accordingly... -

Page 71

... more at the time of acquisition in liquid assets; SFAS 95 requires that changes in long-term accounts receivable are included in cash ï¬,ows from operating activities, whereas Electrolux includes these changes as investments. SFAS 95 requires changes in long-term loans to be reported gross showing... -

Page 72

... of US GAAP would have on consolidated net income, equity and the balance sheet. Consolidated net income Net income as reported in the consolidated income statement Adjustments before taxes Acquisitions Goodwill and other intangible assets Development costs Restructuring and other provisions... -

Page 73

... report To the Annual General Meeting of the shareholders of AB Electrolux (Corporate identity No. 556009-4178) We have audited the annual accounts, the consolidated accounts, the accounting records and the administration of the Board of Directors and the President of AB Electrolux for the year 2003... -

Page 74

... Total assets Net assets 3) Working capital Accounts receivable Inventories Accounts payable Equity Interest-bearing liabilities Data per share, SEK 4) 5) Net income 1) Net income according to US GAAP 6) Equity Dividend 7) Trading price of B-shares at year-end Key ratios Value creation Return on... -

Page 75

...,470 19,431 55,400 3.5 7.1 39.3 17.8 16.1 1.49 1.28 2.7 114,700 18,691 65,700 -4.9 -1.5 3.6 -3.9 -0.9 -0.8 7) 2003: Proposed by the Board. In addition, the Board has proposed a redemption of shares totaling approximately SEK 3,000m. 8) Net sales are annualized. Electrolux Annual Report 2003 73 -

Page 76

...11.10 313.3 327.1 340.1 3,449 3,461 262 Operating income Income after ï¬nancial items Net income per share, SEK Average number of shares, million Value creation 1) Exclusive of items affecting comparability, 2003: SEK -463m, 2002: SEK -434m, 2001: SEK -141m. 74 Electrolux Annual Report 2003 -

Page 77

Quarterly ï¬gures Net sales, by business area Consumer Durables Europe 2003 2002 2001 2003 2002 2001 2003 2002 2001 2003 2002 2001 Q1 11,987 11,241 10,901 12,028 13,284 12,308 2,908 3,437 3,233 26,923 27,962 26,442 Q2 ... -

Page 78

....5 1,508 14.2 1,313 13.9 2,132 11.2 2,261 10.5 2,383 9.0 -744 -683 -590 -463 -434 -141 7,175 5.8 7,731 5.8 6,281 4.6 Outdoor Total Professional Products Common Group costs, etc. Items affecting comparability Total Group, including items affecting comparability 76 Electrolux Annual Report 2003 -

Page 79

...higher return on net assets than the weighted average cost of capital implies that the Group or the unit creates value. Electrolux Value Creation model Net sales - Cost of goods sold - Marketing and administration costs = Operating income, EBIT 1) - WACC x Average net assets 1) = Value creation EBIT... -

Page 80

...Employees Public sector Credit institutions Shareholders Value added represents the contribution made by a company's production, i.e., the increase in value arising from manufacture, handling, etc., within the company. It is deï¬ned as sales revenues less the costs of purchased goods and services... -

Page 81

... Internal Audit Board of Directors CEO and Group Management Risk Management Board Treasury Board Audit Board IT Board Tax Board Brand Leadership Group Global Product Councils Purchasing Board Human Resource Executive Board Business Sector Boards Shareholder structure According to the share... -

Page 82

...to assist the Board of Directors in monitoring processes and internal controls for accounting and ï¬nancial reporting, including related disclosures, as well as the audits of the ï¬nancial statements. Working procedures for the Audit Committee were established early in 2003. The Board of Directors... -

Page 83

..., branding, product creation, demand ï¬,ow, and business support. The President and CEO and two members of Group Management form a special working group with the task of addressing Compensation for the Chairman and Board members is paid in accordance with the resolution adopted by the Annual General... -

Page 84

...internal control and risk-management process includes ï¬ve key activities, i.e., assess risk, develop control strategy, monitor, improve, and inform and communicate. Assessing risks Assessing risks includes identifying, sourcing and measuring business risks, i.e., strategic, operational, commercial... -

Page 85

...of Electrolux operations and a business opportunity, as well as a central component of the Group's brand strategy. Environmental impact and risk during manufacturing Electrolux shows an above average environmental and social performance in comparison with the durable goods manufacturing industry as... -

Page 86

...average % 100 95 90 85 80 75 70 Refrigerators Freezers Combined refrigerators/freezers Chest freezers Washing machines Dishwashers 1999 2000 2001 2002 2003 Reduction in energy consumption for products sold in Europe, with energy index set at 100% in the year 1998. 84 Electrolux Annual Report 2003 -

Page 87

...and 18% of gross proï¬t. Since a large part of environmental impact depends on the volume of production, some indicators are calculated in relation to added value, which is deï¬ned as the difference between total production cost and the cost for direct material. Electrolux Annual Report 2003 85 -

Page 88

...advantage through product development and effective management. Individual producer responsibility, as opposed to a system of shared ï¬nancial responsibility, means that Group investments in product design aimed at lowering end-of-life disposal costs will directly beneï¬t Electrolux. Electrolux is... -

Page 89

...are in line with the Electrolux Workplace Code of Conduct. Electrolux is also engaged in a network of Nordic companies that meets regularly to share experiences and discuss issues of mutual interest related to the Global Compact and Corporate Social Responsibility. Electrolux Annual Report 2003 87 -

Page 90

...operation in food-service equipment. Elected 1998. Holdings in AB Electrolux: 500,000 A-shares and 500,000 B-shares through a company. Hans Stråberg President and CEO Born 1957, M. Eng. President and CEO of Electrolux, 2002. Board Member: The Association of Swedish Engineering Industries Board, AB... -

Page 91

Rune Andersson Louis R. Hughes Thomas Halvorsen Karel Vuursteen Ola Bertilsson Peggy Bruzelius Mats Ekblad Bert Gustafsson Annika Ã-gren Hans StrÃ¥berg Michael Treschow Barbara R. Thoralfsson Malin Björnberg Ulf Carlsson Jacob Wallenberg Electrolux Annual Report 2003 89 -

Page 92

..., AB Electrolux, 2002. Head of Consumer Outdoor Products outside North America, 2001-2003. Board Member: First Swedish National Pension Fund, The Bank of Sweden Tercentenary Foundation. Holdings: 2,024 B-shares, 157,600 options. Magnus Yngen Head of Floor Care Products and Small Appliances Born... -

Page 93

... Hans Stråberg Lilian Fossum Magnus Yngen Nina Linander Fredrik Rystedt Bengt Andersson Wolfgang König Keith R. McLoughlin Lars Göran Johansson For more information about the Group's organization and structure, see page 81. Johan Bygge Electrolux Annual Report 2003 91 -

Page 94

...April 30, 2003. Effective yield The effective yield indicates the actual proï¬tability of an investment in shares, and comprises dividends received plus change in trading price. The compounded annual effective yield on an investment in Electrolux shares was 14.2% over the past ten years, including... -

Page 95

...to the trading price of the Electrolux B-share. Sweden USA UK Other 64.3 20.0 4.4 11.3 Source: SIS Ägarservice as of December 31, 2003. As of December 31, 2003, about 36% of the total share capital was owned by foreign investors. Major shareholders in AB Electrolux Number of A-shares Number of... -

Page 96

... by the Board. 4) Plus 1/2 share in Gränges for every Electrolux share. 5) As % of net income. 6) Excluding items affecting comparability. 7) Dividend per share divided by trading price at year-end. 8) Cash ï¬,ow from operations less capital expenditures divided by average number of shares after... -

Page 97

... by mail to AB Electrolux, Dept. C-J, SE-105 45 Stockholm, Sweden, by fax at +46 8 738 63 35, or by telephone at +46 8 738 64 10. Notice can also be given at: www.electrolux.com/agm Notice should include the shareholder's name, registration number, if any, address and telephone number. Shareholders... -

Page 98

...printed on Galerie Art Gloss, a paper that meets the criteria of the Nordic Environmental Label. Cover 300 g, inside pages 150 g. Production: Electrolux Investor Relations and Intellecta Communication AB. Printing: Tryckindustri Information AB, Solna, Sweden, 2004. 96 Electrolux Annual Report 2003