Electrolux 1996 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1996 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

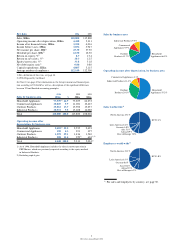

Household Appliances

Operations in Europe

The market for core appliances in Western

Europe fell by about 2% in volume. The

decline refers mainly to the last two quar-

ters of the year. Virtually all countries

showed a downturn, the largest being in

Italy, France, Sweden and Denmark. The

German market also declined in volume in

the built-in appliances segment, which is

important for the Group.

The total European market for core

appliances in 1996 is estimated at 44.0

(44.9) million units.

Operating income for the Group’s

European operation declined as a result of

lower sales volume and a less favorable

product mix.

Continued organizational changes

The process of changing the European

organization to achieve higher internal

efficiency and improved customer service

continued during the year. A number of

pan-European functions were established in

such areas as logistics, IT, product planning

and brand positioning. Goals include creat-

ing a framework for more efficient, more

market-driven product development, and

strengthening the profiles of the pan-Euro-

pean brands in relation to local and regional

brands.

Operations in the US

The American white-goods market grew by

3.5% in volume in 1996. All product areas

except freezers and gas cookers showed

growth, with the largest increases being in

dishwashers and electric cookers.

The market for core appliances in the

US, i.e. deliveries from domestic producers

plus imports, amounted to 32.3 (31.2) mil-

lion units in 1996.

The Frigidaire brand increased its

market share somewhat from the previous

year. The Group’s total market share

decreased slightly, however, mainly due to

lower deliveries to private brands. Operat-

ing income for the American operation

showed a marked improvement on the

basis of increased sales of new high-end

products with better margins, and lower

production costs.

Frigidaire Home Products

As of 1997, the operation in the Frigidaire

Company has been merged with the US

outdoor-product subsidiaries American

Yard Products and Poulan/Weed Eater in a

single company, Frigidaire Home Products.

Like the changes in the European operation,

the merger will enable improved customer

service and lower costs in such areas as

administration, logistics, purchasing and IT.

Acquisition of Refripar in Brazil

In recent years the Group has devoted large

investments to creation of a white-goods

operation in new growth markets outside

Western Europe and North America. A

number of acquisitions and joint ventures

have been implemented in Eastern Europe,

China and India. Substantial market invest-

ments have also been made in the ASEAN

countries, i.e. The Philippines, Indonesia,

Malaysia, Singapore and Thailand.

The largest acquisition in 1996 com-

prised a majority stake in Refripar, the sec-

ond largest white-goods company in Brazil,

with sales of BRL 800 million (approxi-

mately SEK 5,300m) in 1996 and about

12

Electrolux Annual Report 1996

An AEG hob based on the induction-heating

principle. Benefits include shorter heating-time

and more precise temperature control than in

conventional products.

The new Frigidaire Gallery Tumble Action Washer

features extra large capacity and better washing

performance. It consumes substantially less water

and energy than conventional American models.

In 1996 Electrolux acquired a majority stake in

Refripar, the second largest white-goods company

in Brazil, with annual sales of approximately

SEK 5,300m. The company has strong market

positions for refrigerators and freezers.