Electrolux 1996 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1996 Electrolux annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Household Appliances

•

Continued investment in new markets

and upgrading of product range

•

Acquisition of majority stake in

Brazil’s second largest white-goods

company

•

Increased demand in US, but weaker

European market

•

Income for white goods improves

somewhat on basis of good perform-

ance in Brazil and substantial im-

provement in North America

Electrolux is one of the world’s largest

producers of white goods.The Group is

the market leader in Europe and the third

largest white-goods company in the US.

White goods account for the greater part

of sales in the Household Appliances busi-

ness area, and for approximately half of

total Group sales.

Electrolux is also the world’s largest

producer of floor-care products, absorp-

tion refrigerators for caravans and hotel

rooms, and compressors for refrigerators

and freezers.

White goods

Approximately 60% of sales in 1996 refer

to Europe and approximately 25% to North

America. The newly acquired Brazilian

white-goods company Refripar is included

in the accounts as of February, with sales

of SEK 4,463m.

Operating income for white goods

rose somewhat over 1995, on the basis of a

profit contribution from Refripar and sub-

stantially improved income in the North

American operation. Profitability was still

not satisfactory, however.

11

Electrolux Annual Report 1996

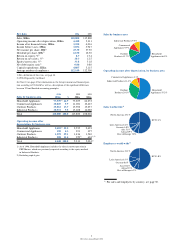

Key data 1996 1995 1994 1993 1992

Sales, SEKm 73,539 75,209 66,272 58,888 48,902

Operating income after depreciation, SEKm 2,455 2,555 2,493 785 897

Operating margin, %1) 3.3 3.4 3.8 1.3 1.8

Net assets, SEKm1) 28,743 24,484 23,553 24,972 21,186

Return on net assets, %1) 8.6 9.8 9.9 3.1 4.0

Capital expenditure, SEKm 3,633 3,579 2,772 2,394 2,414

Average number of employees 85,576 83,492 77,806 76,970 81,300

1) For a definition of this item, see page 48 1996 1995

Sales by product line SEKm % SEKm %

White goods1) 54,725 74.4 56,251 74.8

Floor-care products 7,533 10.2 8,047 10.7

Components2) 3,987 5.4 3,742 5.0

Leisure appliances 3,052 4.2 2,983 4.0

Kitchen and bathroom cabinets 1,833 2.5 1,775 2.4

Sewing machines 858 1.2 856 1.1

Other 1,551 2.1 1,555 2.0

Total 73,539 100.0 75,209 100.0

1) Including room air-conditioners

2) The compressors product line is now called components, having been combined with the operation in small

electric motors in FHP. Sales of SEK339m for the motor operation are included in 1996.

Sales, SEKm

66.9%

Share of total Group sales

9692 93 94 95

Operating income after depreciation, SEKm

96

92 93 94 95

0

15,000

30,000

45,000

60,000

75,000

0

500

1,000

1,500

2,000

2,500

1. The latest product range – “Bluprint”, in blue-grey

steel, with wooden handles.

2. AEG’s Öko Vampyr “Rosso” vacuum cleaner.

3. The new “Creation”oven consumes substantially

less energy than previous models.

4. The “Rondo” refrigerator features arched doors

and was launched in 1996.

5. Frigidaire’s new water-efficient dishwashers

feature lower noise levels than comparable US-made

products.

6. “Clario”, a new light-weight vacuum cleaner

with powerful suction.

The Group has developed a new series of fans that

offer powerful ventilation and the lowest noise levels

on the market.