E-Z-GO 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

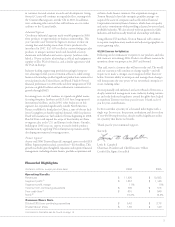

(Dollars in millions, except per share data) 2006 2005

Operating Results

Revenues $ 11,490 $ 10,043

Segment profi t(1) $ 1,267 $ 1,146

Segment profit margin 11% 11%

Income from continuing operations $ 706 $ 516

Free cash fl ow(2) $ 691 $ 546

ROIC(3) 16.8% 13.2%

Common Share Data

Diluted EPS from continuing operations $ 5.43 $ 3.78

Dividends per share $ 1.55 $ 1.40

Footnotes to this table can be found on page 18.

Financial Highlights

5

in customer-focused aviation research and development. Going

forward, Cessna will continue to expand the fl eet, starting with

the Citation Mustang now and the CJ4 in 2010. In addition,

we’re evaluating other aircraft that will welcome an ever-wider

audience to the Cessna family.

Industrial Segment

Our diverse industrial segment made notable progress in 2006,

from products to opportunities to business relationships. This

year, Greenlee used Textron Six Sigma to increase revenues in

existing lines and develop more than 30 new products to be

introduced in 2007. E-Z-GO excelled at custom-fi tting specialty

products to unique customer needs and launched a factory

showroom with full sales and service capacity. Jacobsen estab-

lished a 10-year exclusive relationship as offi cial turf equipment

supplier to The PGA of America, and a similar agreement with

the PGA in Europe.

Industry-leading engineering provided meaningful competi-

tive advantage in fuel system evolution at Kautex, while strong

business relationships yielded signifi cant production contracts for

several plants in the United States and Brazil. Fluid & Power’s

fi nancial performance in 2006 refl ected their integration of TSS

processes at global facilities and an enthusiastic commitment to

growth through R&D.

In coming years, we will continue to expand our global manu-

facturing footprint. Jacobsen and E-Z-GO have long operated

international facilities, and in 2006, other businesses in this

segment also expanded signifi cantly outside North America.

Kautex established a third plant in China, a state-of-the-art facil-

ity in Guangzhou to handle regional demand, while its plant in

Brazil will manufacture fuel tanks for Toyota beginning in 2008.

Fluid & Power will expand the scope of their facility in China

to support sales in the U.S. and Europe in the future. Greenlee,

building on 2006’s success, expects to nearly double product

introductions by applying TSS to European operations and by

developing international sourcing partners.

Finance Segment

At year-end 2006, Textron Financial’s managed assets exceeded $10

billion. Segment profi t reached a record level – $210 million. This

growth was built upon thoughtful expansion and superior fi nancial

management, including relevant fi nance portfolio acquisitions and

exclusive dealer fi nance contracts. Our acquisition strategy at

Textron Financial echoed the enterprise portfolio strategy – we

acquired the assets of companies such as Electrolux Financial

Corporation’s inventory fi nance business, which share our quality

and service commitment while providing a channel to enter related,

profi table industries. We also selected well-run partners in viable

industries and built mutually benefi cial relationships with them.

Using effi cient TSS methods, Textron Financial will continue

to tap into complementary markets and adjacent geographies to

ensure growing value.

40,000 Reasons for Optimism

Refl ecting on the enthusiastic reception to our products and valu-

able contracts won during 2006, I believe we all have reason to be

optimistic about our prospects for 2007 and beyond.

That said, ours is a journey that will never truly end. The world

and our customers will continue to change rapidly – and will

require us to make a stronger, more integrated effort than ever

before. Textron’s ability to anticipate and manage these changes

will demonstrate the true power of our networked enterprise to

create enduring value.

An exceptionally well-informed and active Board of Directors, a

deeply committed management team, industry-leading custom-

ers and truly dedicated employees around the globe have helped

to transform Textron over these past six years. I thank each of

you for your contributions.

It’s been said that a journey of a thousand miles begins with a

single step. In our case, the passion, enthusiasm and sheer talent

of our 40,000 employees has already enabled signifi cant strides

on a journey that knows no bounds.

Thank you for your continued support.

Sincerely,

Lewis B. Campbell

Chairman, President and Chief Executive Offi cer

Certifi ed Six Sigma Green Belt