DuPont 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 DuPont annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Part II

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, continued

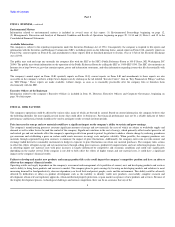

2010 versus 2009 The table below shows a regional breakdown of 2010 consolidated net sales based on location of customers and percentage variances

from 2009:

Percent Change Due to:

(Dollars in billions) 2010

Net Sales Percent

Change vs.

2009

Local

Price Currency

Effect Volume Portfolio

Worldwide $ 31.5 21 5 — 17 (1)

U.S. & Canada 12.4 17 5 1 12 (1)

EMEA 8.1 14 4 (3) 13 —

Asia Pacific 7.3 40 6 2 33 (1)

Latin America 3.7 17 4 2 13 (2)

Sales increased 21 percent, due principally to higher volume as demand recovered in most markets from prior-year levels that were depressed from a global

economic recession. Volume was higher across all segments, with the largest dollar increases in Performance Materials, Performance Chemicals, and

Electronics & Communications. Volume grew double digits in all regions, led by a rebound in demand in the Asia Pacific region. Sales in developing markets

of $10.2 billion improved 27 percent from 2009, and the percentage of total company sales in these markets increased to 32 percent from 31 percent in 2009.

(Dollars in millions) 2011 2010 2009

OTHER INCOME, NET $ 758 $ 1,228 $ 1,219

2011 versus 2010 The $470 million decrease was largely attributable to a $201 million reduction of Cozaar®/Hyzaar ® income, an increase of $150 million

in net pre-tax exchange losses, the absence of a benefit of $59 million recorded in 2010 related to accrued interest associated with settlements of income tax

contingencies related to prior years, the absence of $41 million in insurance recoveries and a $37 million decrease in net gains on sales of assets.

2010 versus 2009 Other income, net, was essentially flat compared to 2009, despite a decrease of $549 million of Cozaar® /Hyzaar® income due to the

expiration of certain patents. Offsetting the reduction of Cozaar® /Hyzaar® income was a decrease in net pre-tax exchange losses of $192 million combined

with higher income from equity affiliates of $93 million, an increase in net gains on sales of assets of $64 million, a benefit of $59 million in 2010 related to

accrued interest associated with settlements of income tax contingencies related to prior years, an increase in insurance recoveries of $41 million and a

$31 million combined benefit from an acquisition and an early termination of a supply agreement.

Additional information related to the company's other income, net is included in Note 3 to the Consolidated Financial Statements.

(Dollars in millions) 2011 2010 2009

COST OF GOODS SOLD AND OTHER OPERATING CHARGES $ 27,814 $ 23,146 $ 19,708

As a percent of net sales 73% 73% 75%

2011 versus 2010 Cost of goods sold and other operating charges (COGS) increased 20 percent. COGS as a percentage of net sales was 73 percent,

unchanged from prior year, as selling price increases of $3.6 billion were offset by $2.0 billion of inflation in raw material, energy and freight costs, and $0.7

billion of higher plant operating costs, including capacity expansions. 2011 COGS also included $175 million of additional costs related to the fair value step-

up of inventory acquired from Danisco, $85 million of Danisco transaction related fees and $175 million for charges related to Imprelis® herbicide claims.

2010 versus 2009 COGS increased 17 percent, while COGS as a percent of net sales decreased 2 percentage points from 2009. The improvement principally

reflects increased manufacturing utilization and higher selling prices that more than offset increases in raw material costs. Higher selling prices increased sales

$1.3 billion, while raw material, energy and freight costs, adjusted for volume and currency, were up 6 percent, or $0.7 billion.

18