Dominion Power 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

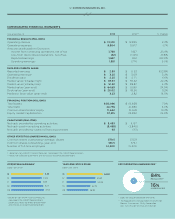

Our total shareholder return — the

combination of one share of common stock’s

price change over a year plus its dividend

payout — ended 2013 at 29.7 percent,

which barely beat that of the Dow Jones

Industrial Average at 29.6 percent and

was slightly less than that of the S&P 500,

which returned 32.4 percent. The total

shareholder return of our peers in the

Philadelphia Stock Exchange Index (UTY)

was 11.0 percent. In 2013, Dominion’s total

return ranked second among that of the

20 utilities that are part of the UTY.

Last year Dominion returned $2.25

per share in dividends to shareholders,

a 6.6 percent increase from 2012. We paid

out 69 percent of operating earnings per

share, within the 65 percent to 70 percent

payout target range set by the company’s

board of directors in December 2012.*

SAFETY METRICS IMPROVE

Our growth opportunities arise from our

base of operations — vibrant communities

and savvy customers requiring state-of-

the-art facilities, wires and pipes that can

move electricity and natural gas seamlessly,

without interruption.

Yet we cannot achieve targeted growth

rates and meet market demand without the

hard work, faithfulness and integrity of our

14,500 employees.

Whenever meeting with investors or

potential investors in our company, I discuss

Dominion’s four core values— safety, ethics,

excellence and One Dominion, our term

for teamwork.

We expect everyone at Dominion

to live these values each and every day.

Indeed, an ethical company whose

employees do their jobs safely and well

not only is a less risky proposition for your

hard-earned money but also bolsters our

relationships with lawmakers, regulators,

customers and other stakeholders.

Safety is the most important value.

We want all employees to return home after

a day on the job without incident. Every

employee must take personal responsibility

for safety to ensure that no one is harmed.

Internally, we call this a drive to zero.

Companywide in 2013, Dominion recorded

all-time bests for OSHA recordable and

“

SAFETY IS THE MOST

IMPORTANT VALUE.

WE WANT ALL EMPLOYEES

TO RETURN HOME AFTER A

DAY ON THE JOB WITHOUT

INCIDENT. EVERY EMPLOYEE

MUST TAKE PERSONAL

RESPONSIBILITY FOR

SAFETY TO ENSURE THAT

NO ONE IS HARMED.

”

10 DOMINION RESOURCES, INC.

* See page 22 for GAAP Reconciliation

of Operating Dividend Payout Ratio

(non-GAAP) to Reported Payout Ratio

(GAAP).

lost time/restricted duty rates, reducing

2012 rates by 10 percent and 6 percent,

respectively. Dominion East Ohio had its best

safety performance in its 115-year history.

And Dominion Virginia Power’s rate of lost-day

incidents and serious injuries dropped to its

lowest-ever level.

This performance, while outstanding,

provides room for improvement in our

drive to zero.

STRATEGIC HIGHLIGHTS

Your company’s attributes include its

desirable location and its dedicated

employees. Achieving desired results also

includes a vision, a path forward — our

multibillion-dollar, energy infrastructure

growth plan.

Our desired results? Customer satisfaction

and service reliability. Earnings-per-share

growth. Dividend increases. Solid returns

for you, our shareholders.

Dominion’s promise is an operating

earnings mix consisting of 80 percent to

90 percent from businesses such as our

electric and gas utilities and our natural gas

interstate pipeline and storage system.

In 2013, 84 percent of your company’s

primary operating segment earnings were

derived from businesses such as those.

Our sale of two merchant coal-fired power

stations and our 50 percent ownership stake

in a gas-fired facility helped us achieve that

goal. The sale reduced commodity risk,

and the company will use the proceeds —

about $650 million after taxes, including

cash tax benefits from the sale — to

finance further growth in our regulated

and contracted enterprises.

In 2013, your company also took steps to

provide more transparency and clarity in our

regulated gas businesses—gas transmission

pipeline and storage assets and natural

gas distribution companies— by creating

Dominion Gas Holdings, LLC, a subsidiary

that, like Virginia Power, will have the ability

to issue debt to finance maintenance and

growth. Because the new entity will be filing

financial information with the U.S. Securities

and Exchange Commission, investors will be

presented a clearer picture of the overall

financial performance of these operations.