Dominion Power 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012SummaryAnnualReport Dominion Resources 11

under normal weather conditions. Had

weather conditions been normal in 2012,

the company’s expected operating earn-

ings growth would have exceeded our

5– 6 percent target.

Our total shareholder return (TSR) —the

combination of one share of common

stock’s price change over a year plus its

dividend payout— ended 2012 at 1.7 per-

cent, significantly below 2011’s return of

29.4 percent. Our returns trailed those

of the major indices— the Dow Jones

Industrial Average, at 10.2 percent, and

the S&P 500, at 16.0 percent. We outper-

formed our designated TSR peer group

in the Philadelphia Stock Exchange Utility

Index (UTY), which lost 0.6 percent.

Dominion’s three- and five-year returns,

however, remain steadily ahead of the

major indices and our peers. Over the past

three years, a share of Dominion stock

has returned 51.1 percent; 35.8 percent

over five years. The S&P 500, which

represents the broader market, returned

36.3 percent and 8.6 percent over three

years and five years, respectively. The

respective three- and five-year yields for

our peers in the UTY were 25.3 percent

and 0.4 percent.

The utility sector in 2012 generally lagged

the overall market as investors feared that

high-dividend-yield stocks, such as those

of utilities, would be affected by unfavor-

able tax policy changes on Capitol Hill.

As 2013 opened, Congress voted to

extend the current dividend tax rate of

15 percent for individuals earning less

than $400,000. For those earning more,

the rate has been increased to 20 percent.

A rally for high-dividend-paying stocks

immediately followed the deal.

Last year Dominion returned $2.11 per

share in dividends to shareholders, a

7.1 percent increase over 2011. We paid

out 69 percent of operating earnings per

share, above the 60– 65 percent payout

target range set by the board in 2010.*

Safety: Always Our Top Priority

Throughout my career I have said many

times, many ways, that keeping the lights

on and the gas flowing is critical to our

nation’s economy, electronic infrastruc-

ture and defense apparatus. But there is

absolutely nothing more important than

doing that job safely, thereby protecting

our employees, our customers and

your investments.

As we tell all employees, remaining

incident-free demands more than merely

attending safety briefings and wearing

the right protective equipment. It is their

personal commitment to ensuring safety

for themselves and those around them.

Although one accident in which an

employee is injured is one too many, in

2012 we continued our downward trend

toward zero. The recordable incidence

rate— the number of reported workplace

injuries per 100 employees —dropped to

0.74, a 60 percent decline since 2006.

The lost time/restricted duty incidence

rate—the number of workplace injuries

that resulted in lost workdays or reassign-

ment of duties per 100 employees—fell

to 0.36, a six-year, 62 percent decrease

in LT/RD rates. Both are all-time

company-wide lows.

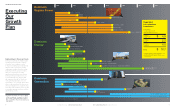

Growth Plan Moves Forward

Your company’s long-term growth plan

remained on track in 2012, with six

major projects coming online to serve

our customers.

We spent about $2.5 billion in 2012

alone on new and upgraded infrastructure

Building

Tomorrow’s

Workforce

Throughout our businesses, we rely on

craft, engineers, lawyers, accountants,

financial analysts and myriad other

individuals whose skills ensure we make

the best business decisions that support

the services we provide our customers.

We value diversity and want to attract,

hire and retain the best employees.

Part of that effort includes our innovative

Troops to Energy Jobs program,

which has hired 224 military veterans

since 2011.

* See page 22 for GAAP Reconciliation of Operating

Dividend Payout Ratio (non-GAAP) to Reported Payout

Ratio (GAAP).