Dominion Power 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dominion Resources 2012 Summary Annual Report12

for Dominion Virginia Power, Dominion

Transmission and Dominion East Ohio.

In Virginia, the $1.8 billion coal- and

biomass-fired Virginia City Hybrid Energy

Center — which we believe to be one of

the nation’s cleanest coal-burning power

stations— began producing electricity

for Dominion Virginia Power customers.

Located in Southwest Virginia, a region in

which most counties have unemployment

rates above 8 percent, the 600-mega-

watt facility has about 125 permanent

employees onsite, and employed nearly

2,400 during the peak of construction.

It is expected to contribute between

$6 million and $7 million per year to Wise

County’s tax base. In addition, a major

electric transmission project, Hayes to

Yorktown, was energized. We invested

$79 million in this electric transmission

infrastructure, serving a high-load,

constrained population center in the

Peninsula of Virginia.

In gas-rich Appalachia, four transmis-

sion, gathering and processing projects—

Appalachian Gateway, Gathering

Enhancement, Northeast Expansion and

Ellisburg to Craigs— entered service to

help producers deliver natural gas to

markets in the Northeast and mid-Atlantic.

All told, they represent nearly $1 billion

in investment and encompass an area that

includes West Virginia, Ohio, Pennsylvania

and New York. The projects include more

than 800,000 dekatherms per day of firm

transportation and pipeline capacity,

new compression at 14 stations and

additional processing— the removal of

heavy hydrocarbons and natural gas

liquids (NGL) from the gas stream and

separation of those products into propane,

butane, isobutane and natural gasoline—

at the Hastings Extraction Plant and two

other new plants in West Virginia.

Moreover, to stimulate growth in mid-

stream services to natural gas producers

operating in the Utica Shale in eastern

Ohio and western Pennsylvania, in late

December we formed a joint venture

with Dallas-based Caiman Energy II, LLC,

an energy company focused on midstream

gas assets, particularly in the Utica region.

The $1.5 billion joint venture— Blue

Racer Midstream, LLC— will use our

assets and midstream expertise along

with Caiman’s midstream expertise and

equity funding to focus on “wet” gas

gathering, processing, fractionation and

NGL transportation and marketing, and,

perhaps, dry gas and oil gathering in the

area. It should solidify and enhance our

position in the Utica Shale.

We also expect Blue Racer to support

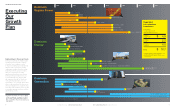

our 5– 6 percent earnings per share

growth target and provide flexibility

to spend Dominion capital on other

gas-related growth projects.

Business Model Refinement:

Reducing Merchant Exposure

Your company took additional steps in

2012 to prepare to meet future 5– 6 percent

earnings per share growth. Recognizing

depressed merchant power markets and

declining spreads in the Midwest and among

merchant coal-fired stations nearly every-

where, Dominion decided to pursue the sale

of two coal-fired stations —Kincaid in Illinois

and Brayton Point in Massachusetts—and

our 50 percent ownership interest in

Elwood, a gas-fired facility also in Illinois.

These three plants have a generating

capacity of nearly 3,400 megawatts. This

action follows the announced retirements

and sale of two coal-fired facilities, Salem

Harbor in Massachusetts and State Line

in Indiana, principally because of environ-

mental reasons.

The proposed sales of these assets

advance our transition to a more regulated

earnings mix — 80– 90 percent regulated

in 2013 and beyond. And they are the best

path forward, allowing us to further reduce

risk, redeploy capital to regulated busi-

nesses and lessen equity needs for 2013.

You may recall that in 2011, Dominion

announced its intention to sell the Kewaunee

nuclear station in Wisconsin because

it no longer fit strategically with our mer-

chant portfolio. We were unable to find a

buyer for the facility and expect to begin