Dollar General 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

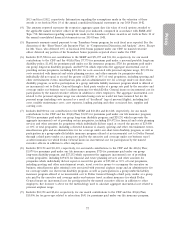

performance share units from such awards that would have become vested had

such officer remained employed through the 2nd anniversary of the grant date

(one-third of earned performance share units) would have or shall become vested

and nonforfeitable, as applicable, and would have been or shall be paid, as

applicable, on the retirement date. For the 2012 PSUs, the 2013 PSUs and the

2014 PSUs, if such retirement had occurred or occurs, as applicable, after the

2nd anniversary of the grant date but prior to the 3rd anniversary of the grant date,

the remaining portion of any earned but unvested performance share units from

such awards that would have become vested had such officer remained employed

through the 3rd anniversary of the grant date (one-third of earned performance

share units) would have or shall become vested and nonforfeitable, as applicable,

and would have or shall be paid, as applicable, on the retirement date. Otherwise,

any earned but unvested performance share units from such awards shall be

forfeited and cancelled on the retirement date.

• Restricted Stock Units. The one-third of the outstanding restricted stock units that would

have become vested and nonforfeitable on the next immediately following vesting date if

such officer had remained employed through such date will become vested and

nonforfeitable upon such retirement (provided that if the retirement occurs on a vesting

date no accelerated vesting will occur, but rather the officer shall be entitled only to the

portion of the restricted stock units that were scheduled to vest on such vesting date) and

will be paid 6 months and 1 day following the retirement date.

Payments Upon Voluntary Termination

The payments to be made to a named executive officer upon voluntary termination vary

depending upon whether he resigns with or without ‘‘good reason’’ (as defined in the applicable

employment agreement) or after our failure to offer to renew, extend or replace his employment

agreement under certain circumstances.

Voluntary Termination with Good Reason or After Failure to Renew the Employment Agreement.

If any named executive officer resigns with good reason, he will forfeit all then unvested equity awards.

Such officer generally may exercise any vested options that were granted after 2011 up to 90 days

following the resignation date and generally may exercise any vested options that were granted prior to

2012 for 180 days following the resignation date.

In the event any named executive officer (other than Mr. Dreiling) resigns under the

circumstances described in (2) below, or in the event we failed to extend the term of Mr. Dreiling’s

employment as provided in (3) below, the relevant named executive officer’s equity will be treated as

described under ‘‘Voluntary Termination without Good Reason’’ below.

Additionally, (1) if the named executive officer resigns with good reason, or (2) if the named

executive officer, other than Mr. Dreiling, resigns within 60 days of our failure to offer to renew,

extend or replace his employment agreement before, at or within 6 months after the end of the

agreement’s term (unless we enter into a mutually acceptable severance arrangement or the resignation

is a result of the named executive officer’s voluntary retirement or termination), or (3) if we had

elected not to extend Mr. Dreiling’s term of employment by providing 60 days prior written notice

before the applicable extension date, then in each case the named executive officer will receive or

would have received (in Mr. Dreiling’s case) the following benefits generally on or beginning on the

60th day after termination of employment but contingent upon the execution and effectiveness of a

46