Dollar General 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

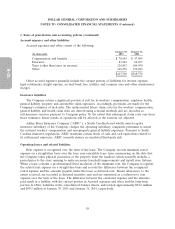

4. Income taxes (Continued)

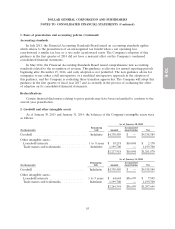

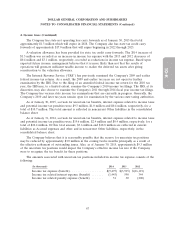

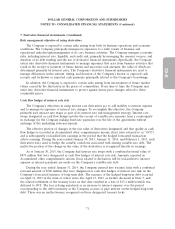

A reconciliation of the uncertain income tax positions from February 3, 2012 through January 30,

2015 is as follows:

(In thousands) 2014 2013 2012

Beginning balance .......................... $19,583 $22,237 $ 42,018

Increases—tax positions taken in the current year . . . 198 3,484 2,114

Increases—tax positions taken in prior years ....... 62 3,000 1,144

Decreases—tax positions taken in prior years ....... (8,636) (608) (22,669)

Statute expirations .......................... (1,121) (7,622) (166)

Settlements ............................... (743) (908) (204)

Ending balance ............................ $ 9,343 $19,583 $ 22,237

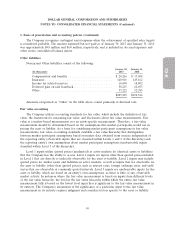

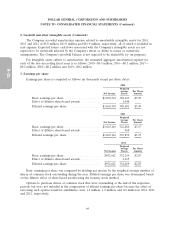

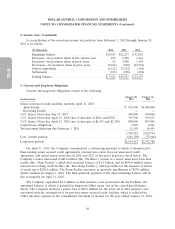

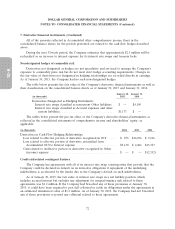

5. Current and long-term obligations

Current and long-term obligations consist of the following:

January 30, January 31,

(In thousands) 2015 2014

Senior unsecured credit facilities, maturity April 11, 2018:

Term Facility .............................................. $ 925,000 $1,000,000

Revolving Facility .......................................... — —

41⁄8% Senior Notes due July 15, 2017 .............................. 500,000 500,000

17⁄8% Senior Notes due April 15, 2018 (net of discount of $294 and $383) . . . 399,706 399,617

31⁄4% Senior Notes due April 15, 2023 (net of discount of $1,991 and $2,199) . 898,009 897,801

Capital lease obligations ....................................... 5,875 6,841

Tax increment financing due February 1, 2035 ....................... 11,995 14,495

2,740,585 2,818,754

Less: current portion ......................................... (101,158) (75,966)

Long-term portion ........................................... $2,639,427 $2,742,788

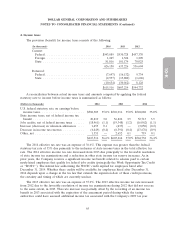

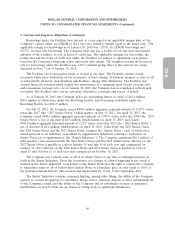

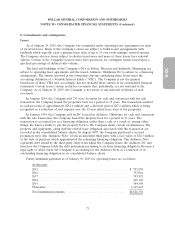

On April 11, 2013, the Company consummated a refinancing pursuant to which it terminated its

then-existing senior secured credit agreements, entered into a new five-year unsecured credit

agreement, and issued senior notes due in 2018 and 2023 as discussed in greater detail below. The

Company’s senior unsecured credit facilities (the ‘‘Facilities’’) consist of a senior unsecured term loan

facility (the ‘‘Term Facility’’), which had an initial balance of $1.0 billion, and an $850.0 million senior

unsecured revolving credit facility (the ‘‘Revolving Facility’’), which provides for the issuance of letters

of credit up to $250.0 million. The Term Facility amortizes in quarterly installments of $25.0 million,

which commenced August 1, 2014. The final quarterly payment of the then-remaining balance will be

due at maturity on April 11, 2018.

The Company capitalized $5.9 million of debt issuance costs associated with the Facilities, the

amortized balance of which is included in long-term Other assets, net in the consolidated balance

sheets. The Company incurred a pretax loss of $18.9 million for the write off of debt issuance costs

associated with the termination of its previous senior secured credit facilities, which is reflected in

Other (income) expense in the consolidated statement of income for the year ended January 31, 2014.

68