Dollar General 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

Pension Benefits

Fiscal 2014

We have omitted the Pension Benefits table because it is inapplicable.

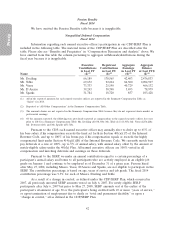

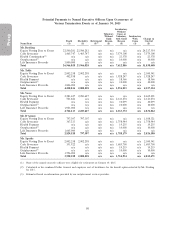

Nonqualified Deferred Compensation

Fiscal 2014

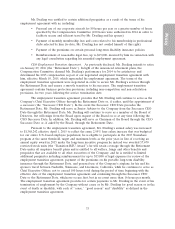

Information regarding each named executive officer’s participation in our CDP/SERP Plan is

included in the following table. The material terms of the CDP/SERP Plan are described after the

table. Please also see ‘‘Benefits and Perquisites’’ in ‘‘Compensation Discussion and Analysis’’ above. We

have omitted from this table the column pertaining to aggregate withdrawals/distributions during the

fiscal year because it is inapplicable.

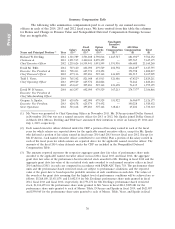

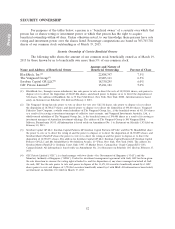

Executive Registrant Aggregate Aggregate

Contributions Contributions Earnings Balance

in Last FY in Last FY in Last FY at Last FYE

Name ($)(1) ($)(2) ($)(3) ($)(4)

Mr. Dreiling 66,189 178,565 42,403 2,476,833

Mr. Tehle 69,672 92,224 86,300 2,094,507

Mr. Vasos 73,333 25,190 40,729 466,132

Mr. D’Arezzo 39,243 30,390 3,493 78,979

Mr. Sparks 31,784 18,720 857 103,428

(1) All of the reported amounts for each named executive officer are reported in the Summary Compensation Table as

‘‘Salary’’ for 2014.

(2) Reported as ‘‘All Other Compensation’’ in the Summary Compensation Table.

(3) The amounts shown are not reported in the Summary Compensation Table because they do not represent above-market or

preferential earnings.

(4) Of the amounts reported, the following were previously reported as compensation to the named executive officer for years

prior to 2014 in a Summary Compensation Table: Mr. Dreiling ($1,938,330); Mr. Tehle ($1,313,345); Mr. Vasos ($276,228);

Mr. D’Arezzo ($0); and Mr. Sparks ($51,724).

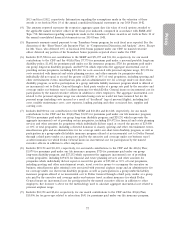

Pursuant to the CDP, each named executive officer may annually elect to defer up to 65% of

his base salary if his compensation exceeds the limit set forth in Section 401(a)(17) of the Internal

Revenue Code, and up to 100% of his bonus pay if his compensation equals or exceeds the highly

compensated limit under Section 414(q)(1)(B) of the Internal Revenue Code. We currently match base

pay deferrals at a rate of 100%, up to 5% of annual salary, with annual salary offset by the amount of

match-eligible salary under the 401(k) Plan. All named executive officers are 100% vested in all

compensation and matching deferrals and earnings on those deferrals.

Pursuant to the SERP, we make an annual contribution equal to a certain percentage of a

participant’s annual salary and bonus to all participants who are actively employed in an eligible job

grade on January 1 and continue to be employed as of December 31 of a given year. Persons hired

after May 27, 2008, including Messrs. Vasos, D’Arezzo and Sparks, are not eligible to participate in the

SERP. The contribution percentage is based on age, years of service and job grade. The fiscal 2014

contribution percentage was 9.5% for each of Messrs. Dreiling and Tehle.

As a result of a change in control, as defined under the CDP/SERP Plan, which occurred in

2007, all previously unvested SERP amounts vested on July 6, 2007. For newly eligible SERP

participants after July 6, 2007 but prior to May 27, 2008, SERP amounts vest at the earlier of the

participant’s attainment of age 50 or the participant’s being credited with 10 or more ‘‘years of service,’’

or upon termination of employment due to death or ‘‘total and permanent disability’’ or upon a

‘‘change in control,’’ all as defined in the CDP/SERP Plan.

42