Dollar General 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

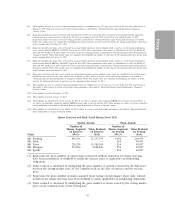

Pre-2012 Equity Awards. Mr. Dreiling and Mr. Flanigan are the only named executive officers

who continue to have options outstanding that were granted prior to 2012. All options granted to

Mr. Dreiling prior to 2012 are fully vested and generally may be exercised by him (or by his survivor in

the case of death) for a period of 1 year from service termination.

If Mr. Flanigan’s employment with us terminates due to death or disability:

• The portion of outstanding performance-based options granted prior to 2012 that would

have become exercisable in respect of the fiscal year in which his employment terminates if

he had remained employed with us through that date will remain outstanding through the

date we determine whether the applicable performance targets are met for that fiscal year.

If such performance targets are met, such portion of the performance-based options will

become exercisable on such performance-vesting determination date. Otherwise, such

portion will be forfeited.

• The portion of outstanding time-based options granted prior to 2012 that would have

become exercisable on the next scheduled vesting date if he had remained employed with

us through that date will become vested and exercisable.

• All otherwise unvested options granted prior to 2012 will be forfeited, and vested options

granted prior to 2012 generally may be exercised (by his survivor in the case of death) for

a period of 1 year from service termination.

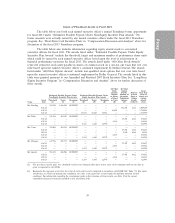

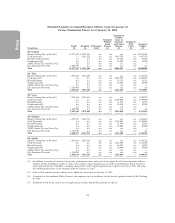

Other Payments. In the event of death, each named executive officer’s beneficiary will receive

payments under our group life insurance program in an amount, up to a maximum of $3 million, equal

to 2.5 times the named executive officer’s annual base salary, rounded to the next highest $1,000. We

have excluded from the tables below amounts that the named executive officer would receive under our

disability insurance program since the same benefit level is provided to all of our salaried employees.

The named executive officer’s CDP/SERP Plan benefit also becomes fully vested (to the extent not

already vested) upon his death and is payable in a lump sum within 60 days after the end of the

calendar quarter in which the death occurs. In the event Mr. Dreiling’s employment terminates due to

death, he will also be entitled to receive payment for any unused vacation accrued but unpaid as of his

termination date.

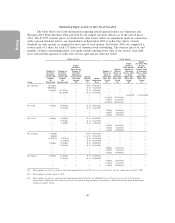

In the event of disability, each named executive officer’s CDP/SERP Plan benefit becomes fully

vested (to the extent not already vested) and is payable in a lump sum within 60 days after the end of

the calendar quarter in which the disability occurs, provided that we may delay payment until as soon

as reasonably practicable after receipt of the disability determination by the Social Security

Administration.

In the event Mr. Dreiling’s employment terminates due to disability, he will also be entitled to

receive any incentive bonus earned for any of our previously completed fiscal years but unpaid as of his

termination date and payment for any unused vacation accrued but unpaid as of his termination date,

as well as a lump sum cash payment, payable at the time annual bonuses are paid to our other

executives, equal to a pro rata portion of his annual incentive bonus, if any, that he would have been

entitled to receive, if such termination had not occurred, for the fiscal year in which his termination

occurred.

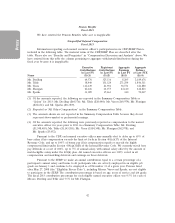

‘‘Disability’’ Definitions. For purposes of the named executive officers’ employment

agreements, other than Mr. Dreiling’s, ‘‘disability’’ means (1) disabled for purposes of our long-term

disability insurance plan or (2) an inability to perform the duties under the agreement in accordance

with our expectations because of a medically determinable physical or mental impairment that (x) can

reasonably be expected to result in death or (y) has lasted or can reasonably be expected to last longer

than 90 consecutive days. For purposes of Mr. Dreiling’s employment agreement, ‘‘disability’’ means

(1) disabled for purposes of our long-term disability insurance plan or for purposes of his portable

long-term disability insurance policy, or (2) if no such plan or policy is in effect or in the case of the

45

Proxy