Dollar General 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

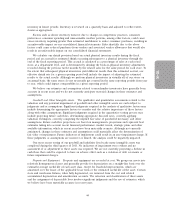

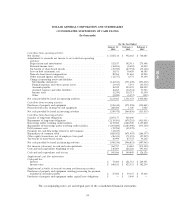

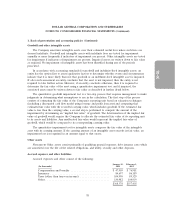

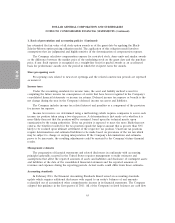

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

For the Year Ended

January 31, February 1, February 3,

2014 2013 2012

Cash flows from operating activities:

Net income ........................................... $1,025,116 $ 952,662 $ 766,685

Adjustments to reconcile net income to net cash from operating

activities:

Depreciation and amortization ............................ 332,837 302,911 275,408

Deferred income taxes ................................. (36,851) (2,605) 10,232

Tax benefit of share-based awards .......................... (30,990) (87,752) (33,102)

Loss on debt retirement, net ............................. 18,871 30,620 60,303

Noncash share-based compensation ......................... 20,961 21,664 15,250

Other noncash (gains) and losses .......................... (12,747) 6,774 54,190

Change in operating assets and liabilities:

Merchandise inventories ............................... (144,943) (391,409) (291,492)

Prepaid expenses and other current assets ................... (4,947) 5,553 (34,554)

Accounts payable ................................... 36,942 194,035 104,442

Accrued expenses and other liabilities ...................... 16,265 (36,741) 71,763

Income taxes ...................................... (5,249) 138,711 51,550

Other ........................................... (2,200) (3,071) (195)

Net cash provided by (used in) operating activities ................ 1,213,065 1,131,352 1,050,480

Cash flows from investing activities:

Purchases of property and equipment ......................... (538,444) (571,596) (514,861)

Proceeds from sales of property and equipment .................. 288,466 1,760 1,026

Net cash provided by (used in) investing activities ................ (249,978) (569,836) (513,835)

Cash flows from financing activities:

Issuance of long-term obligations ............................ 2,297,177 500,000 —

Repayments of long-term obligations ......................... (2,119,991) (478,255) (911,951)

Borrowings under revolving credit facilities ..................... 1,172,900 2,286,700 1,157,800

Repayments of borrowings under revolving credit facilities ........... (1,303,800) (2,184,900) (973,100)

Debt issuance costs ..................................... (15,996) (15,278) —

Payments for cash flow hedge related to debt issuance ............. (13,217) — —

Repurchases of common stock .............................. (620,052) (671,459) (186,597)

Other equity transactions, net of employee taxes paid .............. (26,341) (71,393) (27,219)

Tax benefit of share-based awards ........................... 30,990 87,752 33,102

Net cash provided by (used in) financing activities ................ (598,330) (546,833) (907,965)

Net increase (decrease) in cash and cash equivalents ............... 364,757 14,683 (371,320)

Cash and cash equivalents, beginning of year .................... 140,809 126,126 497,446

Cash and cash equivalents, end of year ........................ $ 505,566 $ 140,809 $ 126,126

Supplemental cash flow information:

Cash paid for:

Interest ............................................ $ 73,464 $ 121,712 $ 209,351

Income taxes ........................................ $ 646,811 $ 422,333 $ 382,294

Supplemental schedule of noncash investing and financing activities:

Purchases of property and equipment awaiting processing for payment,

included in Accounts payable ............................. $ 27,082 $ 39,147 $ 35,662

Purchases of property and equipment under capital lease obligations .... $ — $ 3,440 $ —

The accompanying notes are an integral part of the consolidated financial statements.

54

10-K