Dollar General 2010 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued)

At January 28, 2011, 53,434 Rollover Options were outstanding, all of which were exercisable. The

aggregate intrinsic value of these outstanding Rollover Options was $1.4 million with a weighted

average remaining contractual term of 4.3 years, and a weighted average exercise price of $2.1875.

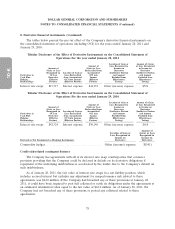

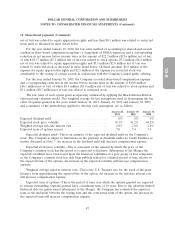

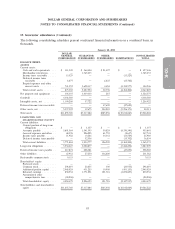

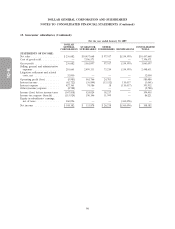

A summary of Time Options activity during the period ended January 28, 2011 is as follows:

Remaining

Options Average Contractual Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Exercise Price Term in Years Value

Balance, January 29, 2010 .................... 6,123,052 $ 8.68

Granted ................................ 348,784 27.39

Exercised ................................ (342,293) 8.15

Canceled ................................ (351,412) 10.53

Balance, January 28, 2011 .................... 5,778,131 $ 9.73 7.3 $108,104

Vested or expected to vest at January 28, 2011 ..... 5,491,477 $ 9.55 7.2 $103,695

Exercisable at January 28, 2011 ................ 2,773,235 $ 8.31 7.0 $ 55,706

The weighted average grant date fair value of Time Options granted during 2010, 2009 and 2008

was $12.61, $6.73 and $4.17, respectively.

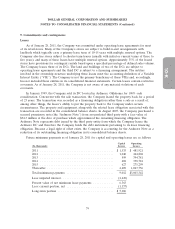

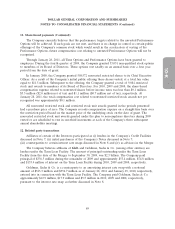

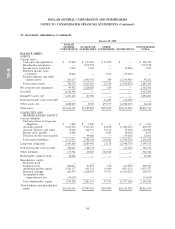

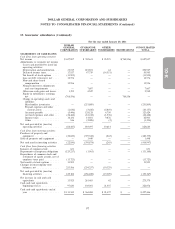

A summary of Performance Options activity during the period ended January 28, 2011 is as

follows:

Remaining

Options Average Contractual Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Exercise Price Term in Years Value

Balance, January 29, 2010 .................... 6,251,623 $ 8.67

Granted ................................ 348,784 27.39

Exercised ................................ (777,249) 8.13

Canceled ................................ (326,134) 10.58

Balance, January 28, 2011 .................... 5,497,024 $ 9.82 7.3 $102,369

Vested or expected to vest at January 28, 2011 ..... 5,198,923 $ 9.62 7.3 $ 97,838

Exercisable at January 28, 2011 ................ 3,426,809 $ 8.68 7.0 $ 67,597

The weighted average grant date fair value of Performance Options granted was $12.61, $6.73 and

$4.17 during 2010, 2009 and 2008, respectively.

In April 2010, the Company granted 100,000 options to its Chief Executive Officer with an exercise

price of $29.38 and a vesting period of one year from the date of grant.

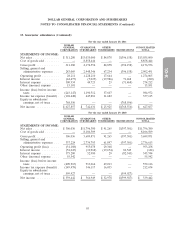

The total intrinsic value of all stock options repurchased by the Company under terms of the

management stockholders’ agreements during 2010, 2009 and 2008 was $0.1 million, $0.8 million and

$2.5 million, respectively.

At January 28, 2011, the total unrecognized compensation cost related to non-vested stock options

was $30.8 million with an expected weighted average expense recognition period of 2.8 years.

88