Dish Network 2001 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–28

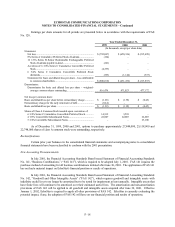

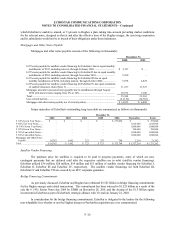

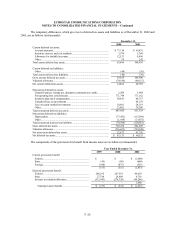

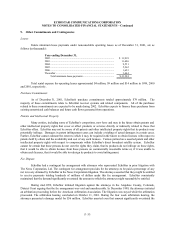

The temporary differences, which give rise to deferred tax assets and liabilities as of December 31, 2000 and

2001, are as follows (in thousands):

December 31,

2000 2001

Current deferred tax assets:

Accrued expenses................................................................................. $ 77,110 $ 95,431

Inventory reserves and cost methods...................................................... 3,974 5,369

Allowance for doubtful accounts ........................................................... 12,533 8,896

Other................................................................................................... 79 243

Total current deferred tax assets................................................................ 93,696 109,939

Current deferred tax liabilities:

Other................................................................................................... (40) (39)

Total current deferred tax liabilities........................................................... (40) (39)

Gross current deferred tax assets ............................................................... 93,656 109,900

Valuation allowance................................................................................. (79,194) (89,115)

Net current deferred tax assets .................................................................. 14,462 20,785

Noncurrent deferred tax assets:

General business, foreign tax, alternative minimum tax credits ................ 2,504 3,904

Net operating loss carryforwards ........................................................... 771,748 771,162

Incentive plan stock compensation......................................................... 38,841 44,715

Unrealized loss on investments.............................................................. –48,159

Loss on equity method investments........................................................ 10,961 24,219

Other................................................................................................... 23,802 39,200

Total noncurrent deferred tax assets .......................................................... 847,856 931,359

Noncurrent deferred tax liabilities:

Depreciation ........................................................................................ (77,452) (115,589)

Other................................................................................................... (1,108) (13,072)

Total noncurrent deferred tax liabilities ..................................................... (78,560) (128,661)

Gross deferred tax assets .......................................................................... 769,296 802,698

Valuation allowance................................................................................. (716,623) (754,948)

Net noncurrent deferred tax assets............................................................. 52,673 47,750

Net deferred tax assets.............................................................................. $ 67,135 $ 68,535

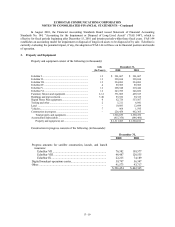

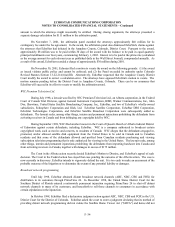

The components of the (provision for) benefit from income taxes are as follows (in thousands):

Year Ended December 31,

1999 2000 2001

Current (provision) benefit:

Federal .................................................................... $ – $ – $ (1,400)

State... ..................................................................... (45) (80) (860)

Foreign.................................................................... (108) (475) (593)

(153) (555) (2,853)

Deferred (provision) benefit:

Federal .................................................................... 286,195 247,519 44,910

State........................................................................ 27,748 28,809 4,736

Increase in valuation allowance ................................. (313,943) (276,328) (48,246)

– – 1,400

Total (provision) benefit........................................ $ (153) $ (555) $ (1,453)