Dish Network 2001 Annual Report Download - page 73

Download and view the complete annual report

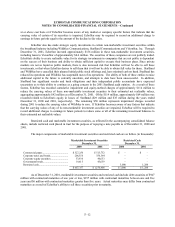

Please find page 73 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F–8

1. Organization and Business Activities

Principal Business

The operations of EchoStar Communications Corporation (“ECC,” and together with its subsidiaries, or

referring to particular subsidiaries in certain circumstances, “EchoStar” or the “Company”) include two interrelated

business units:

• The DISH Network - a direct broadcast satellite (“DBS”) subscription television service in the United States.

and

• EchoStar Technologies Corporation (“ETC”) - engaged in the design, development, distribution and sale of

DBS set-top boxes, antennae and other digital equipment for the DISH Network (“EchoStar receiver

systems”) and the design, development and distribution of similar equipment for international satellite

service providers.

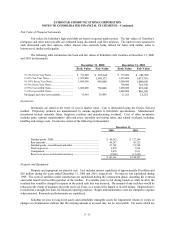

Since 1994, EchoStar has deployed substantial resources to develop the “EchoStar DBS System.” The

EchoStar DBS System consists of EchoStar’s FCC-allocated DBS spectrum, seven DBS satellites (“EchoStar I”

through “EchoStar VII”), EchoStar receiver systems, digital broadcast operations centers, customer service facilities,

and other assets utilized in its operations. EchoStar's principal business strategy is to continue developing its

subscription television service in the United States to provide consumers with a fully competitive alternative to cable

television service.

Recent Developments

On October 28, 2001, EchoStar signed definitive agreements with Hughes Electronics Corporation

(“Hughes”), and General Motors (“GM”), which is Hughes’ parent corporation, relating to EchoStar’s merger with

Hughes in a stock-for-stock transaction.

The surviving corporation in the merger will carry EchoStar’s name and will provide DBS services in the

United States and Latin America, primarily under the DIRECTV brand name, global fixed satellite services and

other broadband communication services. The merger is subject to the prior separation of Hughes from GM by way

of a recapitalization of Hughes and split-off of Hughes from GM and other conditions and risks. EchoStar expects

the merger with Hughes and related transactions to require at least $7.025 billion of cash.

Consummation of the Hughes merger and related transactions will require at least $7.025 billion of cash.

At the time of signing of the merger agreement, EchoStar had approximately $1.5 billion of available cash on hand,

and obtained $5.525 billion in bridge financing commitments for the Hughes merger and related transactions. These

commitments have been reduced to $3.325 billion as a result of the sale of $700 million of 9 1/8% senior notes by

EDBS and $1.5 billion of our series D preferred stock to Vivendi. Any other financings EchoStar completes prior to

closing of the Hughes merger will generally further reduce the bridge financing commitments dollar-for-dollar. The

remaining approximately $3.325 billion of required cash, is expected to come from new cash raised by EchoStar,

Hughes or a subsidiary of Hughes on or prior to the closing of the merger through public or private debt or equity

offerings, bank debt or a combination thereof. The amount of such cash that could be raised by EchoStar prior to

completion of the Hughes merger is severely restricted. EchoStar’s agreements with GM and Hughes prohibit it

from raising any additional equity capital beyond the $1.5 billion Vivendi investment. The prohibition will likely

continue for two years following completion of the Hughes merger, absent possible favorable IRS rulings or

termination of the Hughes merger. Further, EchoStar’s agreements with GM and Hughes place substantial

restrictions on EchoStar’s ability to raise additional debt prior to the closing of the Hughes merger.

If Hughes cannot complete the merger with EchoStar, EchoStar may be required to purchase Hughes’ 81%

interest in PanAmSat, merge with PanAmSat or make a tender offer for all of PanAmSat’s shares and may also be

required to pay a $600 million termination fee to Hughes. If EchoStar purchases the Hughes interest in PanAmSat